Written by Steven Hansen

The headlines say seasonally adjusted Industrial Production (IP) declined (the manufacturing portion of this index was also down month-over-month). Consider this a soft data point that was expected. It is beginning to look like industrial production is in a recession.

- Headline seasonally adjusted Industrial Production (IP) decreased 0.2 % month-over-month and up 0.4 % year-over-year.

- Econintersect‘s analysis using the unadjusted data is that IP growth decelerated 1.2 % month-over-month, and is up 0.2 % year-over-year.

- The unadjusted year-over-year rate of growth decelerated 0.4 % from last month using a three month rolling average, and is up 1.1 % year-over-year.

- The market was expecting (from Bloomberg):

| Headline Seasonally Adjusted | Consensus Range | Consensus | Actual |

| IP (month over month change) | -0.6 % to 0.3 % | -0.3 % | -0.2% |

| Capacity Utilization | 77.2 % to 77.9 % | 77.4 % | 77.5 % |

| IP Subindex Manufacturing (month over month change) | -0.4 % to 0.5 % | -0.2 % | -0.1 % |

IP headline index has three parts – manufacturing, mining and utilities – manufacturing was down 0.1 this month (up 1.4 % year-over-year), mining down 2.0% (down 5.7 % year-over-year), and utilities were up 1.3 % (up 1.0 % year-over-year). Note that utilities are 9.8% of the industrial production index, whilst mining is 15.9%.

Comparing Seasonally Adjusted Year-over-Year Change of the Industrial Production Index (blue line) with Components Manufacturing (red line), Utilities (green line), and Mining (orange line)

Unadjusted Industrial Production year-over-year growth for the past 2 years has been between 2% and 4% – it is currently 0.4 %. It is interesting that the unadjusted data is giving a smooth trend line.

Year-over-Year Change Total Industrial Production – Unadjusted (blue line) and the Unadjusted 3 month rolling average (red line)

z ip3.PNG

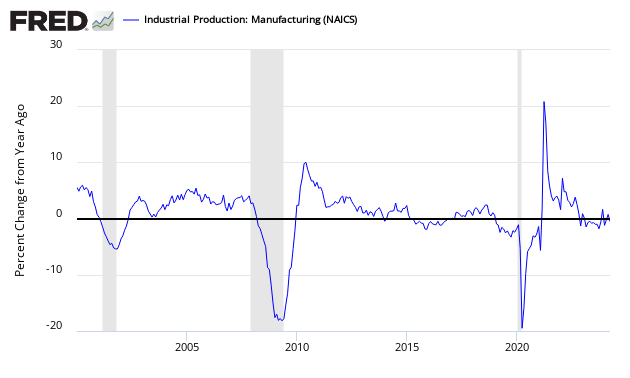

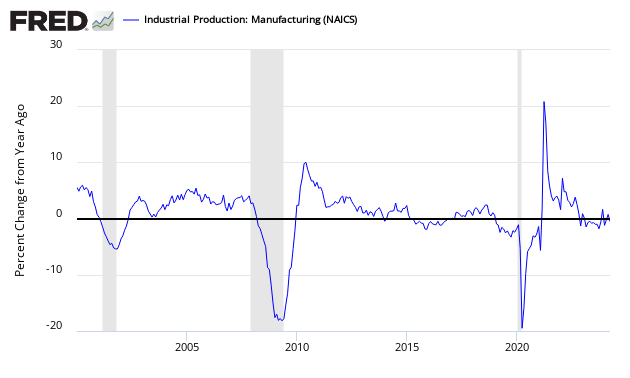

Economic downturns have been signaled by only watching the manufacturing portion of Industrial Production. Historically manufacturing year-over-year growth has been negative when a recession is imminent. This index is not indicating a recession is imminent.

Seasonally Adjusted Manufacturing Index of Industrial Production – Year-over-Year Growth

Seasonally Adjusted Capacity Utilization – Year-over-Year Change – Seasonally Adjusted – Total Industry (blue line) and Manufacturing Only (red line)

Econintersect uses unadjusted data and graphs the data YoY in monthly groups.

Total Industrial Production – Unadjusted

z ip1.PNG

The industrial portion of the USA economy is now technically in a recession.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

z dallas_man.PNG

Philly Fed (hyperlink to reports):

z philly fed1.PNG

New York Fed (hyperlink to reports):

z empire1.PNG

Federal Reserve Industrial Production – Actual Data (hyperlink to report):

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

Comparing Surveys to Hard Data:

z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats in the Use of Industrial Production Index

Industrial Production is a non-monetary index – and therefore inflation or other monetary adjustments are not necessary. The monthly index values are normally revised many months after initial release and are subject to annual revision. The following graphic is an example of the variance between the original released value – and the current value of the index. If the current values are better than the original values – this is normally a sign of an improving economy.

Total Industrial Production – Unadjusted – Original Headline Index Value (blue line) and Current Index Value (red line)

/images/z ip2.PNG

This index is somewhat distorted by including utility production which is noisy, based primarily on weather variations. There is some variance between the manufacturing component of industrial production which monitors production, and the US Census reported Manufacturing Sales. While it is true that these are slightly different pulse points (inventory not accounted in shipments) – they should not have different trends for long periods of time.

Comparing Year-over-Year Change – Manufacturing Industrial Production (blue line) to Inflation Adjusted Manufacturers Shipments (green line)

Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but New Normal effects and the Great Recession distort historical data).

Old Analysis Blog | New Analysis Blog |

| All Posts on Manufacturing | All Posts on Manufacturing |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>