Written by Steven Hansen

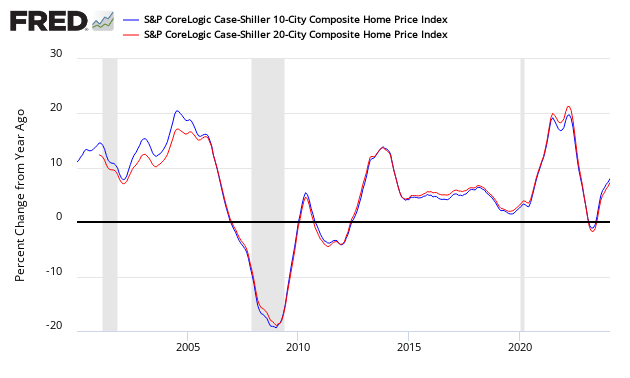

The non-seasonally adjusted Case-Shiller home price index (20 cities) for November 2014 (released today) year-over-year rate of home price growth slowed from 4.5% (reported as 4.5% last month) to 4.3%.

- 20 city unadjusted home price rate of growth decelerated 0.2% month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in rate of growth]

- Case-Shiller no longer shows the highest year-over-year home price gains of any home price index – this “honor” goes to CoreLogic.

- The market expected:

| Consensus Range | Consensus | Actual | |

| 20-city, SA – M/M | 0.3 % to 0.9 % | 0.6 % | +0.7% |

| 20-city, NSA – M/M | -0.2 % to 0.0 % | -0.2 % | -0.2% |

| 20-city, NSA – Yr/Yr | 4.2 % to 4.7 % | 4.3 % | 4.3% |

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing all the home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index – and no index is perfect. The National Association of Realtors normally shows exaggerated movements which likely is due to inclusion of more higher value homes.

Comparison of Home Price Indices – Case-Shiller 3 Month Average (blue line, left axis), CoreLogic (green line, left axis) and National Association of Realtors 3 Month Average (red line, right axis)

z existing3.PNG

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to be stabilizing (rate of growth not rising or falling).

Year-over-Year Price Change Home Price Indices – Case-Shiller 3 Month Average (blue bar), CoreLogic (yellow bar) and National Association of Realtors 3 Month Average (red bar)

z existing5.PNG

There are some differences between the indices on the rate of “recovery” of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller’s David M. Blitzer, Chairman of the Index Committee at S&P Indices:

With the spring home buying season, and spring training, still a month or two away, the housing recovery is barely on first base . Prospects for a home run in 2015 aren’t good. Strong price gains are limited to California, Florida, the Pacific Northwest, Denver, and Dallas. Most of the rest of the country is lagging the national index gains. Moreover, these price patterns have been in place since last spring. Existing home sales were lower in 2014 than 2013, confirming these trends.

Difficulties facing the housing recovery include continued low inventory levels and stiff mortgage qualification standards. Distressed sales and investor purchases for buy-to-rent declined somewhat in the fourth quarter. The best hope for housing is the rest of the economy where the news is better. 2014 was a good year for job creation and weekly unemployment claims – good short term indicators – which continue to provide upbeat reports. Consumer confidence, helped by cheap gasoline prices, is strong, and a good GDP number is expected this week.

CoreLogic believes home price growth has pockets of weakness (November Data). Per Sam Khater, deputy chief economist at CoreLogic and Anand Nallathambi, president and CEO of CoreLogic:

After decelerating for most of the year, home price growth has been holding firm between a 5-percent and 6-percent growth rate for the last four months. However, pockets of weakness are clear in Baltimore and Washington D.C., and three of the top four states with the highest price appreciation are energy intensive and had been benefiting from the energy boom which is currently receding as oil prices trend downward. These states-Texas, Colorado and North Dakota, may see some downward pressure on prices in 2015.

The pace of home price gains have slowed as we exit 2014 but this is probably only a temporary lull. While the CoreLogic HPI Forecast shows a slight dip in prices next month, we believe that prices will be up a year from now as continued economic growth fuels buyer confidence and their willingness to purchase a home and invest in their future.

The National Association of Realtors says home sales growth is improving (December 2014 data):

Lawrence Yun, NAR chief economist, says sales picked up in December to close a 2014 that got off to a sluggish start but showed encouraging signs of activity the second half of the year. “Home sales improved over the summer once inventory increased, prices moderated and economic growth accelerated,” he said. “Sales were measurably better in the second half – up 8 percent compared to the first six months of the year.”

“A drop in housing supply in December raises some affordability concerns in the months ahead as minimal selection and the potential for faster price appreciation could offset the demand from buyers encouraged by a stronger economy and sub-4 percent interest rates,” says Yun. “Housing costs – both rents and home prices – continue to outpace wages and are burdensome for potential buyers trying to save for a downpayment while looking for available homes in their price range.”

NAR President Chris Polychron, says Realtors® are optimistic the Federal Housing Administration’s plan to reduce annual mortgage insurance premiums will have a positive impact on first-time buyers once it goes into effect on January 26. “NAR is a strong supporter of the FHA and its vital role in the mortgage marketplace for homebuyers,” he said. “Realtors® support responsible lending to qualified borrowers and the move to lower premiums will enable more buyers to enter the market while continuing to protect taxpayers from the risky lending practices that led to the housing crash.”

Black Knight Financial Services (formerly known as Lender Processing Services) November 2014 home price index up 0.1% for the Month; Up 4.5% Year-over-Year.

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code – and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined almost 60%.

Each home price index uses a different methodology – and this creates slightly different answers. There is some evidence in various home price indices that home prices are beginning to stabilize – the evidence is also in this post. Please see the post Economic Headwinds from Real Estate Moderate.

The most broadly based index is the US Federal Housing Finance Agency’s House Price Index (HPI) – a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales – a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner’s equity (OEHRENWBSHNO) which has been included on the graph below.

Comparing Various Home Price Indices to Owner’s Equity (blue line)

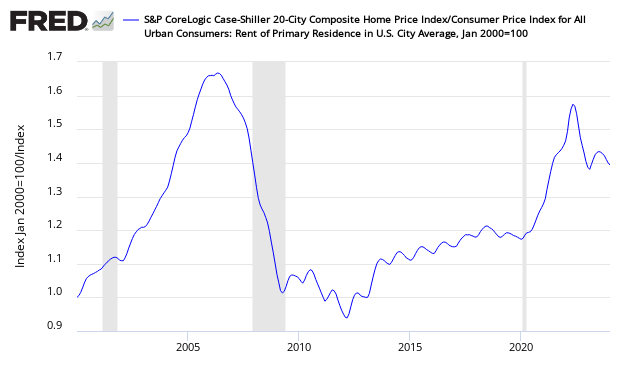

With rents increasing and home prices declining – the affordability factor favoring rental vs owning is reversing. Rising rents are shifting the balance.

Price to Rent Ratio – Indexed on January 2000 – Based on Case-Shiller 20 cities index ratio to CPI Rent Index

Related Articles

Old Analysis Blog | New Analysis Blog |

| Housing Sales and Prices | Housing Sales and Prices |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>