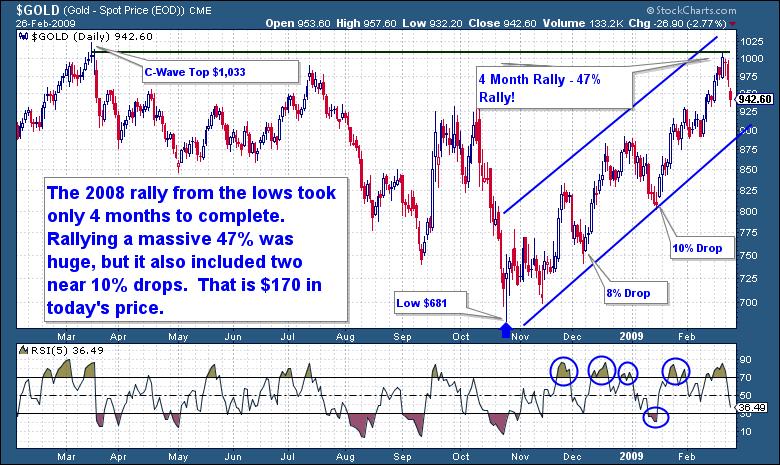

Investor Tip – Always prepare yourself mentally and emotionally for what may be lying ahead in any given trading situation. Understanding the possible scenarios and their likely impact on your investments will prepare you to emotionally handle the real-time action. Many investors can accurately forecast a coming move; unfortunately it’s their lack of emotional and mental preparation and control that fails them during the panic filled capitulation sell-offs.

Investor Tip – Always prepare yourself mentally and emotionally for what may be lying ahead in any given trading situation. Understanding the possible scenarios and their likely impact on your investments will prepare you to emotionally handle the real-time action. Many investors can accurately forecast a coming move; unfortunately it’s their lack of emotional and mental preparation and control that fails them during the panic filled capitulation sell-offs.

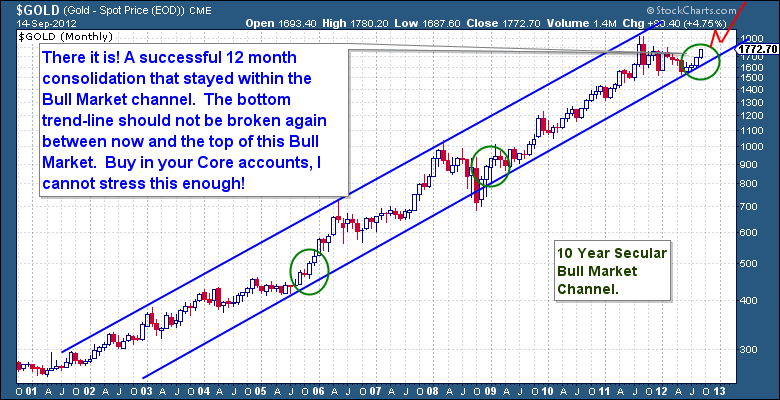

Let me again (as I often do) remind you of the end goal here. We’re investing in a generational Bull Market here, so let’s keep an eye on our prize and walk away from this Bull Market wealthy beyond any expectation. As they say, “there is no fever like Gold Fever”. By the time this Bull Market blows-off, our positions would have multiplied many times over.

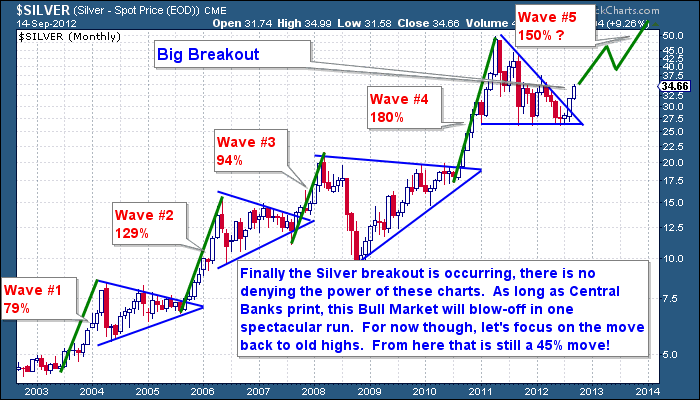

Let’s also not forget our shiny Silver friend in this equation. As you know the Long Wealth Portfolio is loaded with Silver exposure and I’ve been trying to convince you to buy it since the multiple bounces off the $26 area. Members, Silver Wave #5 is going to happen, and to think that Wave #5 does not begin until we get back to $45-$50. Between now and then, we still have a solid 45% move left in Silver just to get back to the prior highs. This is exciting and you need to ensure you are adequately and correctly exposed to Silver.

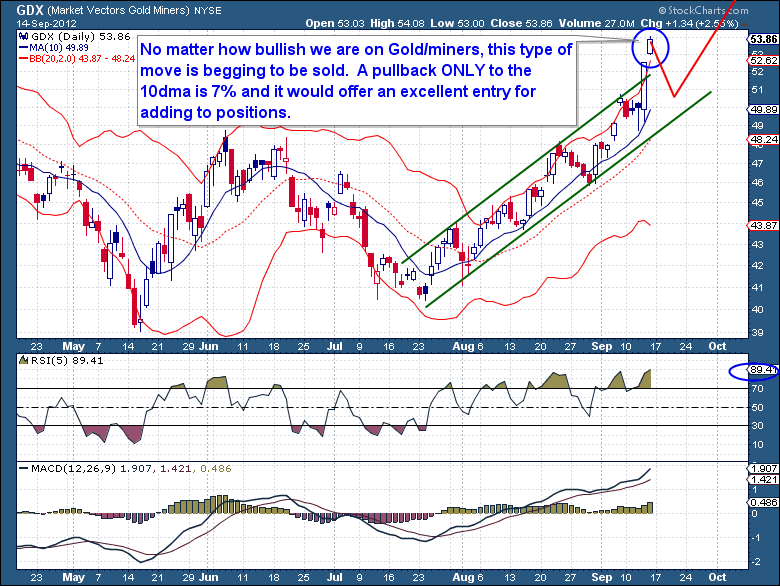

Moving along to miners, I’ve got to admit I have neglected them in preference to metals in this early move, and it has been somewhat of a mistake. The reasoning has simply been that the metal generally needs to make its sustained move before the mining sector follows suit. Without a strong supporting bullion price, the miners are not going anywhere in a hurry. GDX and the mining complex in general has seen a very powerful move here, one that has been beyond impressive considering the relative infancy of this latest Gold move. For me this gives me confidence and is simply just more confirmation that the Bull Market in Gold is squarely back on the table and about to enter mainstream.

Since the successful retest of the May lows, GDX has gone on to rally 30% off these lows. Just like Gold, this move has “plenty of legs” for the long haul, but in the short term it has gotten slightly ahead of itself here. The latest spike on Friday pushed GDX fully above the upper and stretched Bollinger Bands, well clear of its defined channel, and a full 7% above just its 10dma. Such an extreme move is only ever sustainable in the final stages of any blow-off move, so I fully expect that by early next week we see at least the start of a sideways retracement. But we must realistically (and hope for the Bull’s sake) expect to see at least a 5% drop back to the 10dma before the move could reset itself again. Even a $5 drop over 2 weeks to the middle of the band would be beneficial for the miners; it would set the scene for another strong surging rally.

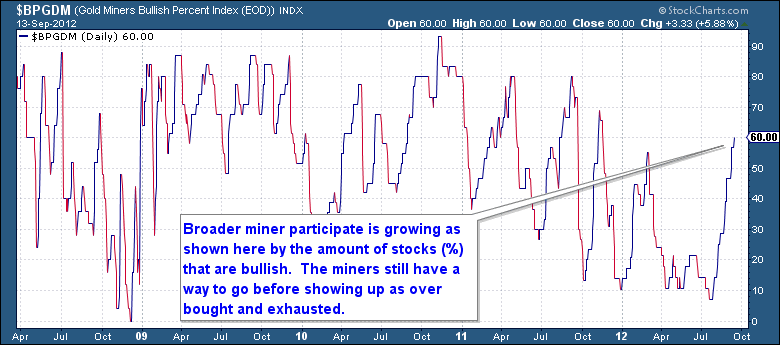

From an exhaustion standpoint, this rally still has plenty of sidelined miners who have yet to join in. Although the rally is broadening, only 60% of miners are in a bullish up trending pattern, suggesting that after a quick pullback, the miners could go on to repeat yet another 30% rally!

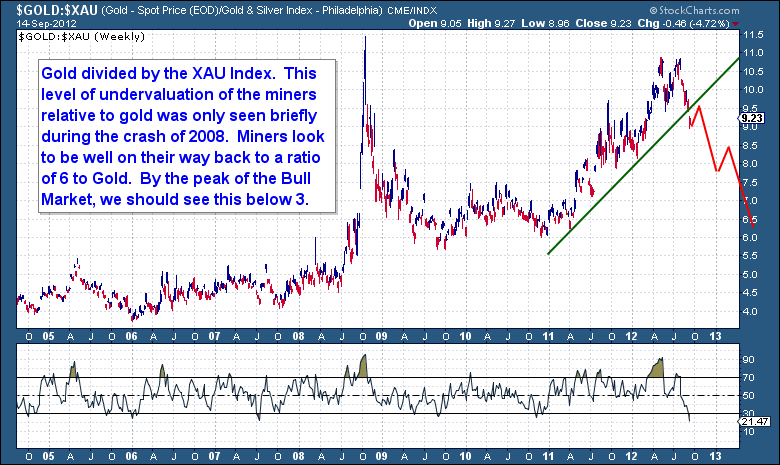

In terms of rotation, it looks as if the miners may have turned the corner here. Essentially ever since the last real run in the miners ended in 2010, they have spent a solid 18 months greatly underperforming the metal. The ratio of Gold to the XAU index basically doubled, clearly illustrating that the miners have spent more than 18 months consolidating in preparation for this new move higher. As the ratio begins to fall, the miners will be increasing in price at an accelerated ratio compared to Gold. The argument for rebalancing the Investor Portfolio weighting between the metals versus the miners is certainly going to be something we will be addressing (See trading section).

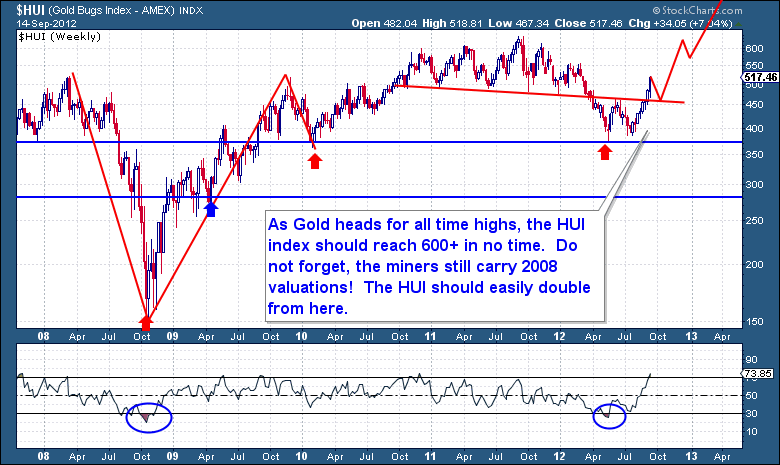

From a longer term perspective, the under-performance of the miners is glaring. With prices still no higher than where they were 4 years ago, the potential for massive gains in the near future can easily be seen through the below chart. With a clean and decisive break of the 18 month consolidating trend-line firmly behind us, there remains the potential for one last drawn down to kiss the trend-line before exploding higher. But even from this point, a move back to the prior highs is still a 20% gain. Once gold begins to make new all-time highs the miners should be well on their way to outright doubling in price.

I hope by now you have realized just how difficult it is to trades big bull markets. Getting in and out of positions is not going to be easy. Sometimes we will nail the exact low and highs of a given Cycle, but then at times it will completely run away from us. That is the nature of “trading”, it’s not easy and not for everybody. Until we get back into clean and predictable C-Wave Cycles, do not underestimate the power of buying and holding positions here.

Editor’s note: Read here and here to learn more about The Financial Tap subscription services.

Hat tip to Jeff Pierce.