Gold Cycles Analysis

by @tradepoly, The Financial Tap

Gold is moving almost vertically now, the pent up energy of a year worth of consolidating is finally starting to lift this asset out of its trading range. The  clear realization that the world’s central banks are going to attack their economic problems via monetary expansion and cheap liquidity has ignited Gold again. It has always been the catalyst for this Bull Market since Day 1. But as the central bank stakes are significantly raised, so will fiat money rush into the relatively thinly traded markets of Gold and Silver, guaranteeing that this Bull ends like all others, with a final, massive, and speculative blow off top.

clear realization that the world’s central banks are going to attack their economic problems via monetary expansion and cheap liquidity has ignited Gold again. It has always been the catalyst for this Bull Market since Day 1. But as the central bank stakes are significantly raised, so will fiat money rush into the relatively thinly traded markets of Gold and Silver, guaranteeing that this Bull ends like all others, with a final, massive, and speculative blow off top.

GOLD – Cycle Counts

Cycle | Count | Observation | Outlook |

Daily | Day 10 | Range 24-28 Days | Neutral |

Investor | Week 18 | Range 18-22 Weeks–4th Daily Cycle | Neutral |

8Yr | Month 47 | Range 90-100 Months | Bullish |

Secular | Bull | Gold in a secular Bull Market | Bullish |

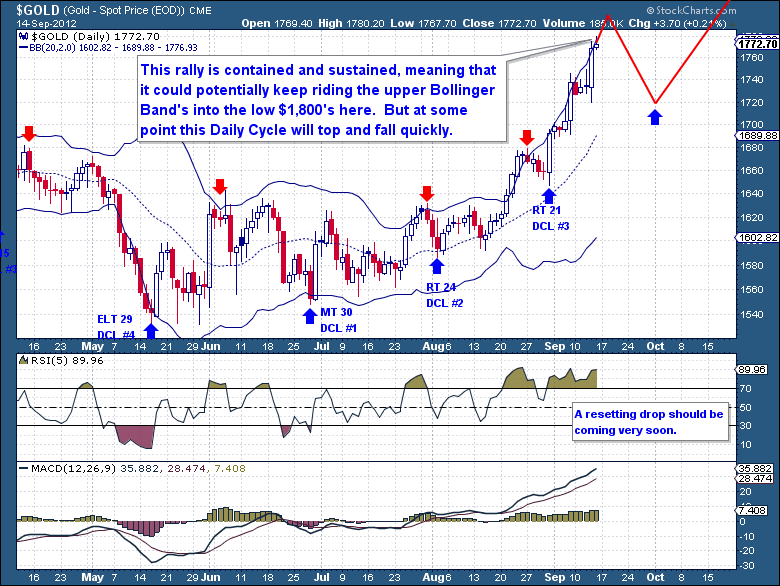

Obviously well before that point though, we need to contend with the immediate price action of Gold. With 17 of 22 winning trading days and a solid $170 surge, the move has been convincing and all confirming. If there was any lingering doubt regarding the future of this Bull Market, then this Gold surge should remove that doubt. But like all significant rallies, we must content and be prepared for the sharp pullbacks too. Although the Daily Cycle (See TERMINOLOGY end of document) is relatively young, it has stretched well above its short term moving averages, is truly overbought in the short term, and is attracting a significant amount of speculative interest. These are short term risks that eventually do have an impact on price. As the Dollar is so severely oversold and due to rebound out of a major Cycle Low, I caution all those who have taken late and much leveraged positions. This type of euphoric move is certainly sustainable, but generally only with a series of short term drops and draw downs along the way. In an uptrend these are welcomed drops and should not be feared (see trading strategy for current plan).

Click on any chart for larger image.

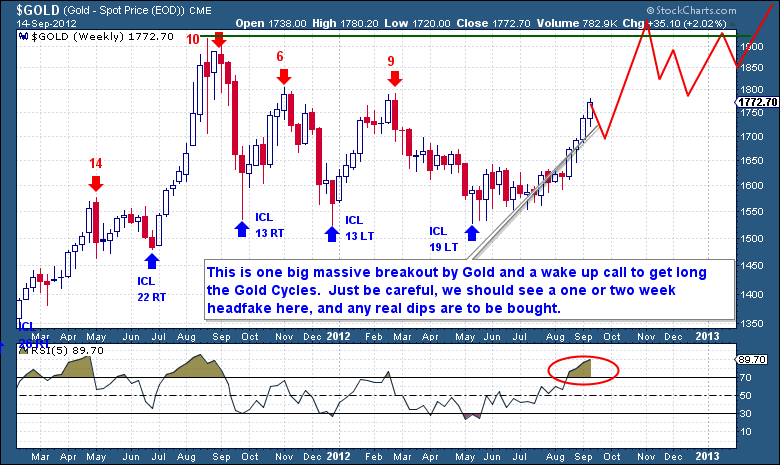

But we’re not necessarily day trading Gold here, we’re trying to catch a significant portion of this Bull Market while avoiding as much of the declines as possible. The Cycle to profit most from is the Investor Cycle and it’s on this chart that the bullish breakout is certainly most visible and inspiring. When we look at the weekly chart, it’s pretty much all open air above from this point. All of the speculative and longer term excess of last years blow-off has been washed away with that fairly demoralizing yearlong consolidation. There was a point not long ago when everybody was predicting sub $1,500 gold, even many of the ardent Gold bugs were running scared and talking about a deeper contraction. This has only served to create the necessary foundation for the next rally.

So with 4 solid winning weeks behind this Cycle, it’s more than clear gold has convincingly broken out. The Aug 2011 blow-off top collapsed and eventually found its D-Wave low at the end of December. The ensuing rally over Jan/Feb was the powerful A-Wave advance and it took most people by surprise. Like all Bull Markets, speculators with still relatively fresh and fond memories of the Aug blow-off were quickly fooled into thinking that was the real deal move. But the move back down (B-Wave) in May to test and hold the D-wave lows was the ultimate insult, serving the purpose of completely washing away all remaining speculative and greed based elements from the asset. In its wake it left behind those wise enough to build themselves core positions in preparation for the next move.

So the coming moves are obvious to me, just like all past C-Wave moves of this Bull Market, Gold is going to first spend the next few months getting back to and likely above its prior highs. Although short term sentiment has risen very sharply, Gold has relatively no trapped longs to contend with and should now be equipped with a loyal and solid base of investors. This foundation will serve as the platform from where gold assaults the prior highs and most likely attempt to crack the $2,000 level.

But just like the Daily Cycle warning earlier, we need to be prepared. In any environment, even one as bullish as this, there are always pullbacks. The greater the rally, the sharper and faster the pullbacks will come. This is a natural reaction in any sustained and powerful rally; in powerful moves you see lock-out like gains interrupted by brief periods of stampeding panic for the exits. Don’t forget that out of the 2008 lows the FED pumped in $1T via QE1, the effect on gold was immediate and massive (see chart below). The ensuing 47% rally was simply breathtaking but difficult to ride, but it too was not a straight ride up. So be prepared and do not be surprised with any 5 day, $100 drops. I bring this up not to keep you from getting into positions here, but to prepare psychologically and emotionally. The last thing you need is to panic and sell a strong hand right before a significant turn; rather you should be conditioned to instead buy the dip aggressively.