Manufacturing activity in the central Atlantic region pulled back in October after improving somewhat last month, according to the Richmond Fed’s latest survey. The seasonally adjusted index of overall activity was pushed lower as all broad indicators of activity—shipments, new orders and employment—were in negative territory. Other indicators also suggested additional softness.

Capacity utilization turned negative, while backlogs remained negative but improved from its September reading. Moreover, the gauge for delivery times changed little, while raw materials inventories grew at a slightly quicker pace, and growth in finished goods edged lower.

Looking forward, assessments of business prospects for the next six months were less optimistic in October. Contacts at more firms anticipated that new orders, backlogs, capacity utilization, and vendor lead-times will grow more slowly than anticipated a month ago.

Survey assessments of current prices revealed that growth in both raw materials and finished goods prices grew at a somewhat quicker rate than a month ago. Over the next six months, respondents expected growth in both raw materials and finished goods prices to grow at a somewhat faster pace than they had anticipated a month earlier.

Current Activity

In October, the seasonally adjusted composite index of manufacturing activity—our broadest measure of manufacturing—lost eleven points to -7 from September’s reading of 4. Among the index’s components, shipments fell eighteen points to -9, new orders moved down thirteen points to finish at -6, and the jobs index held steady at -5.

Most other indicators also suggested weaker activity. The index for capacity utilization turned negative, losing seven points to -4, and the backlogs of orders gained six points to end at -3.

Additionally, the delivery times index subtracted one point to -2, while our gauges for inventories were mixed in October. The raw materials inventory index rose six points to finish at 23, while the finished goods index fell three points to 15.

Read entire source document from Richmond Fed

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

/images/z richmond_man.PNG

Kansas Fed (hyperlink to reports):

/images/z kansas_man.PNG

Dallas Fed (hyperlink to reports):

/images/z dallas_man.PNG

Philly Fed (hyperlink to reports):

/images/z philly fed1.PNG

New York Fed (hyperlink to reports):

/images/z empire1.PNG

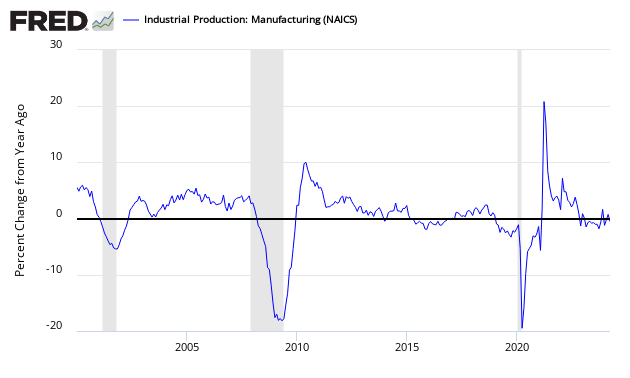

Federal Reserve Industrial Production – Actual Data (hyperlink to report)

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Empire State Survey (green bar).

Comparing Surveys to Hard Data

![]()

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.