Written by Steven Hansen

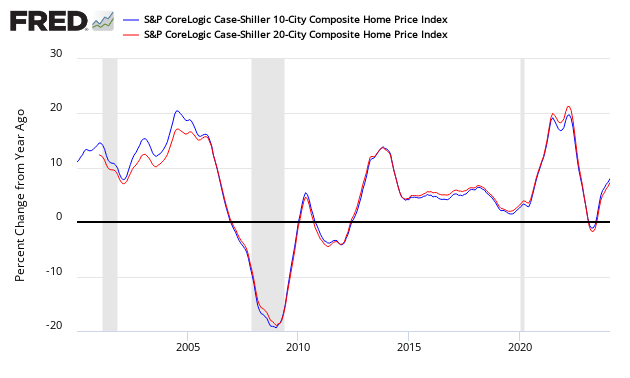

The non-seasonally adjusted Case-Shiller home price index (20 cities) year-over-year rate of home price growth was unchanged from last month’s 5.7% (last month revised downward from 5.8%). Still, the authors of the index say “continued increases in prices of existing homes, as shown in the S&P/Case-Shiiller Home Price Indices, should encourage further activity in new construction.“

- 20 city unadjusted home price rate of growth accelerated 0.0 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in rate of growth]

- Note that Case-Shiller index is an average of the last three months of data.

- The market expected:

| Consensus Range | Consensus | Actual | |

| 20-city, SA – M/M | 0.7 % to 1.2 % | 0.8 % | +0.8 % |

| 20-city, NSA – M/M | 0.1 % to 0.4 % | 0.2 % | +0.0 % |

| 20-city, NSA – Yr/Yr | 5.7 % to 6.2 % | 5.9 % | +5.7 % |

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing all the home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index – and no index is perfect. The National Association of Realtors normally shows exaggerated movements which likely is due to inclusion of more higher value homes.

Comparison of Home Price Indices – Case-Shiller 3 Month Average (blue line, left axis), CoreLogic (green line, left axis) and National Association of Realtors 3 Month Average (red line, right axis)

z existing3.PNG

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to be stabilizing (rate of growth not rising or falling).

Year-over-Year Price Change Home Price Indices – Case-Shiller 3 Month Average (blue bar), CoreLogic (yellow bar) and National Association of Realtors 3 Month Average (red bar)

z existing5.PNG

There are some differences between the indices on the rate of “recovery” of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller’s David M. Blitzer, Chairman of the Index Committee at S&P Indices:

While home prices continue to rise, the pace is slowing a bit. Seasonally adjusted, Miami had lower prices this month than last and 10 other cities saw smaller increases than last month. Year-over-year, seven cities saw the rate of price increases wane. Even with some moderation, home prices in all but one city are rising faster than the 2.2% year-over-year increase in the CPI core rate of inflation.

Sparked by the stock market’s turmoil since the beginning of the year, some are concerned that the current economic expansion is aging quite rapidly. The recovery is six years old, but recoveries do not typically die of old age. Housing construction, like much of the economy, got off to a slow start in 2009-2010 and is only now beginning to show some serious strength. Continued increases in prices of existing homes, as shown in the S&P/Case-Shiiller Home Price Indices, should encourage further activity in new construction. Total housing starts have stayed above an annual rate of one million starts per year since last March and single family home have been higher than 700,000 units at annual rates since June. Housing investment continues its positive contribution to GDP growth.

CoreLogic believes low inventories are spurring rising home prices (November Data). Per Dr Frank Nothaft, chief economist for CoreLogic and Anand Nallathambi, president and CEO of CoreLogic stated:

Nationally, home prices have been rising at a 5 to 6 percent annual rate for more than a year. However, local-market growth can vary substantially from that. Some metropolitan areas have had double-digit appreciation, such as Denver and Naples, Florida, while others have had price declines, like New Orleans and Rochester, New York.

Higher property valuations appear to be driving up single-family construction as we head into the spring. Additional housing stock, especially in urban centers on the coasts such as San Francisco, could help to temper home price growth in the longer term. In the short and medium term, local markets with strong employment growth are likely to experience a continued rise in home sales and price growth well above the U.S. average.

The National Association of Realtors says home sales prices have moderated (December 2015 data): [note that the NAR will release its January 2016 data later today].

Lawrence Yun, NAR chief economist, says December’s robust bounce back caps off the best year of existing sales (5.26 million) since 2006 (6.48 million). “While the carryover of November’s delayed transactions into December contributed greatly to the sharp increase, the overall pace taken together indicates sales these last two months maintained the healthy level of activity seen in most of 2015. Additionally, the prospect of higher mortgage rates in coming months and warm November and December weather allowed more homes to close before the end of the year.”

“Although some growth is expected, the housing market will struggle in 2016 to replicate last year’s 7 percent increase in sales,” adds Yun. “In addition to insufficient supply levels, the overall pace of sales this year will be constricted by tepid economic expansion, rising mortgage rates and decreasing demand for buying in oil-producing metro areas.”

“First-time buyers were for the most part held back once again in 2015 by rising rents and home prices, competition from vacation and investment buyers and supply shortages,” says Yun. “While these headwinds show little signs of abating, the cumulative effect of strong job growth in recent years and young renters’ overwhelming interest to own a home5 should lead to a modest uptick in first-time buyer activity in 2016.”

“December’s rebound in sales is reason for cautious optimism that the work to prepare for Know Before You Owe is paying off,” says NAR President Tom Salomone. “However, our data is still showing longer closing timeframes, which is a reminder that the near-term challenges we anticipated are still prevalent. NAR advised members to extend the time horizon on their purchase contracts to address this concern, and we’ll continue to work with our industry partners to ensure 2016 is a success for consumers, homeowners and Realtors® alike.”

Black Knight Financial Services (formerly known as Lender Processing Services) November 2015 home price index Up 0.1 Percent for the Month; Up 5.5 Percent Year-Over-Year (unchanged from the previous month).

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code – and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined almost 60%.

Each home price index uses a different methodology – and this creates slightly different answers. There is some evidence in various home price indices that home prices are beginning to stabilize – the evidence is also in this post. Please see the post Economic Headwinds from Real Estate Moderate.

The most broadly based index is the US Federal Housing Finance Agency’s House Price Index (HPI) – a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales – a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner’s equity (OEHRENWBSHNO) which has been included on the graph below.

Comparing Various Home Price Indices to Owner’s Equity (blue line)

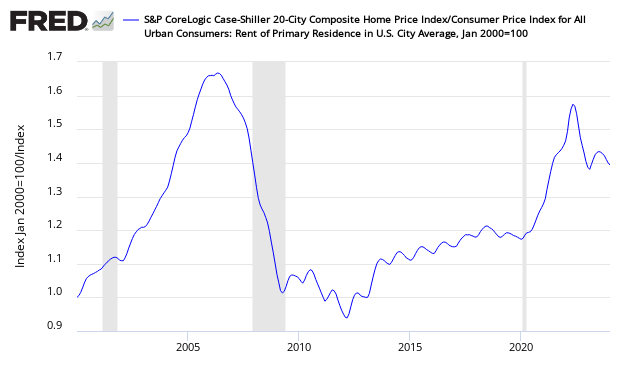

With rents increasing and home prices declining – the affordability factor favoring rental vs owning is reversing. Rising rents are shifting the balance.

Price to Rent Ratio – Indexed on January 2000 – Based on Case-Shiller 20 cities index ratio to CPI Rent Index

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>