Written by Steven Hansen

Written by Steven Hansen

The Philly Fed Business Outlook Survey remains in contraction. Key elements are likewise in contraction.

This is a very noisy index which readers should be reminded is sentiment based. The Philly Fed historically is one of the more negative of all the Fed manufacturing surveys but has been more positive then the others recently.

The index improved from -6.0 to -4.5. Positive numbers indicate market expansion, negative numbers indicate contraction. The market expected (from Bloomberg) -4.0 to 3.0 (consensus -1.0).

Manufacturing conditions in the region continued to weaken in October, according to firms responding to this month’s Manufacturing Business Outlook Survey. The indicator for general activity remained negative, while the new orders and shipments indexes turned negative this month. Labor market indicators also weakened. The survey’s indicators for prices of inputs and for firms’ own products suggest near-steady prices this month. Although the survey’s future indicators decreased this month, a minority of firms expect a continued downturn in business activity over the next six months.

Indicators Are Weaker in October

The diffusion index for current activity remained negative for the second consecutive month, although it edged slightly higher from -6.0 in September to -4.5. The indexes for current new orders and shipments showed notable deterioration this month, with both indexes falling below zero, marking the first negative reading for the new orders index since May 2013. Indicators for delivery times and unfilled orders were also negative. Thirty percent of the firms reported a decline in inventories this month, and the current inventories index declined 15 points.

The survey’s indicators for labor market conditions suggest slightly weaker employment. The percentage of firms reporting declines in employment (15 percent) was slightly greater than the percentage reporting increases (13 percent). The employment index declined nearly 12 points, from 10.2 to -1.7. Firms also reported overall declines in average work hours in October, and the workweek index was negative for the first time since May.

z philly fed1.PNG

Econintersect believes the important elements of this survey are new orders and unfilled orders . Unfilled orders declined and remains in contraction, while new orders significantly declined and now is deep in contraction..

This index has many false recession warnings.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

z dallas_man.PNG

Philly Fed (hyperlink to reports):

z philly fed1.PNG

New York Fed (hyperlink to reports):

z empire1.PNG

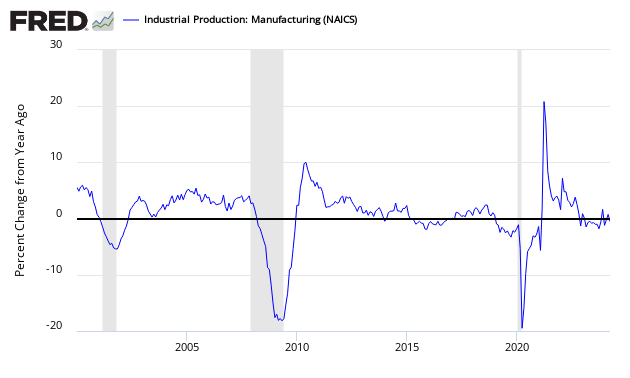

Federal Reserve Industrial Production – Actual Data (hyperlink to report):

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Philly Fed survey (yellow bar).

Comparing Surveys to Hard Data:

z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats on the use of Philly Fed Business Outlook Survey:

This is a survey, a quantification of opinion – not facts and data. Surveys lead hard data by weeks to months, and can provide early insight into changing conditions. Econintersect finds they do not necessarily end up being consistent compared to hard economic data that comes later, and can miss economic turning points.

This survey is very noisy – and recently showed recessionary conditions. And it is understood from 3Q2011 GDP that the economy was expanding even though this index was in contraction territory. On the positive side, it hit the start and finish of the 2007 recession exactly.

No survey is accurate in projecting employment – and the Philly Fed Business Outlook Survey is no exception. Although there are some general correlation in trends, month-to-month movements have not correlated with the BLS Service Sector Employment data.

Over time, there is a general correlation with real business data – but month-to-month conflicts are frequent.

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>