Written by Steven Hansen

The ISM Manufacturing survey continues to indicate manufacturing growth expansion – but again marginally declined this month. The key internal new orders declined but remains in expansion. Backlog of orders contraction improved over the contraction the previous month..

The ISM Manufacturing survey continues to indicate manufacturing growth expansion – but again marginally declined this month. The key internal new orders declined but remains in expansion. Backlog of orders contraction improved over the contraction the previous month..

The ISM Manufacturing survey index (PMI) marginally declined from 52.7 to 51.1 (50 separates manufacturing contraction and expansion). This was slightly below expectations which were 51.5 to 54.0 (consensus 52.8).

Earlier today, the PMI Manufacturing Index was released – from Bloomberg:

Released On 9/1/2015 9:45:00 AM For Aug, 2015

Prior Consensus Consensus Range Actual Level 53.8 53.0 52.7 to 54.0 53.0 Highlights

Growth in Markit’s manufacturing sample is as slow as it’s been since October 2013, at a composite 53.0 in August which is right at the Econoday consensus. Growth in new orders slowed while growth in backlog orders was marginal. Export orders, hurt by the strong dollar, contracted for the fourth time in five months with August’s drop the deepest of the run. Growth in output is the slowest since January 2014 while growth in employment is the slowest since July 2014.Inventory data are positive, showing the first decline this year for finished goods and the slowest build for pre-production in just over a year, a combination which may ease concern that inventories in the sector are heavy. Price readings are quiet.

This is the 32nd month of expansion. The regional Fed manufacturing surveys indicated little growth or contraction in August, and now the ISM indicates manufacturing shows weak expansion.

Relatively deep penetration of this index below 50 has normally resulted in a recession.

The noisy Backlog of Orders contraction improved. Backlog growth should be an indicator of improving conditions; a number below 50 indicates contraction. Backlog accuracy does not have a high correlation against actual data.

Excepts from the ISM release:

The August PMI® registered 51.1 percent, a decrease of 1.6 percentage points from the July reading of 52.7 percent. The New Orders Index registered 51.7 percent, a decrease of 4.8 percentage points from the reading of 56.5 percent in July. The Production Index registered 53.6 percent, 2.4 percentage points below the July reading of 56 percent. The Employment Index registered 51.2 percent, 1.5 percentage points below the July reading of 52.7 percent. Inventories of raw materials registered 48.5 percent, a decrease of 1 percentage point from the July reading of 49.5 percent. The Prices Index registered 39 percent, down 5 percentage points from the July reading of 44 percent, indicating lower raw materials prices for the 10th consecutive month. The New Export Orders Index registered 46.5 percent, down 1.5 percentage points from the July reading of 48 percent. Comments from the panel reflect a mix of modest to strong growth depending upon the specific industry, the positive impact of lower raw materials prices, but also a continuing concern over export growth.

Of the 18 manufacturing industries, 10 are reporting growth in August in the following order: Textile Mills; Furniture & Related Products; Paper Products; Nonmetallic Mineral Products; Chemical Products; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing; Fabricated Metal Products; Plastics & Rubber Products; and Machinery. The six industries reporting contraction in August — listed in order — are: Apparel, Leather & Allied Products; Primary Metals; Electrical Equipment, Appliances & Components; Petroleum & Coal Products; Computer & Electronic Products; and Transportation Equipment.

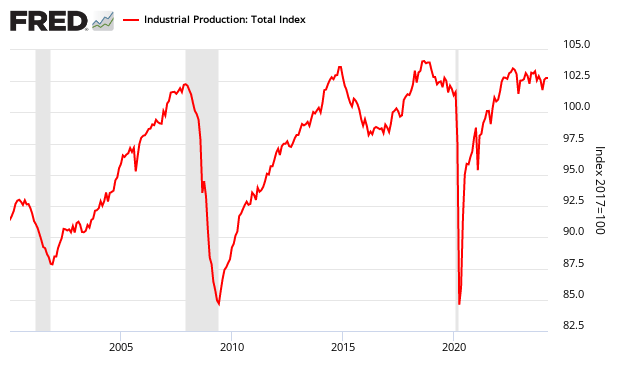

It is interesting to note that ISM Manufacturing represents less than 10% of USA employment, and approximately 20% of the business economy. Historically, it could be argued that the production portion of ISM Manufacturing leads the Fed’s Industrial Production index – however the correlation is not strong when looking at trends.

New orders have direct economic consequences – and degraded from 56.5 to 51.7. Expanding new orders is a relatively reliable sign a recession is NOT imminent. However, New Orders contraction have given false recession warnings twice since 2000.

However, holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (blue bar) and US Census manufacturing shipments (red bar) to the ISM Manufacturing Survey (purple bar).

Comparing Surveys to Hard Data

z survey1.png

Caveats on the use of ISM Manufacturing Index:

This is a survey, a quantification of opinion – not facts and data. However, as pointed out above, certain elements of this survey have good to excellent correlation to the economy. Surveys lead hard data by weeks to months, and can provide early insight into changing conditions.

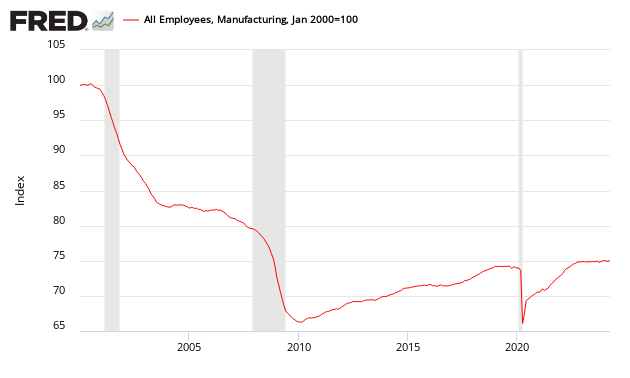

Many use ISM manufacturing for guidance in estimating manufacturing employment growth. Econintersect has run correlation coefficients for the ISM manufacturing employment and the BLS manufacturing employment data series above going back to 1988, using quarterly data. The coincident correlations are actually negative, but poor (r = -0.2 to -0.4 for various time periods examined). See here for definitions.

Before 2000 the ISM employment data had a weak positive correlation to the BLS data 4 to 7 quarters later (r values above 0.6). Since 2000 the correlations for ISM manufacturing employment as a leading indicator for the BLS manufacturing employment have been between 0 and 0.3 for r (correlation coefficient). These values define correlations as none to poor.

In other words, ISM employment index is not useful in understanding manufacturing jobsgrowth. The graph below shows BLS manufacturing employment month-over-month gains against the ISM Manufacturing employment index.

Indexed to Jan 2000 – Comparison of the ISM Manufacturing Employment Subindex (blue line) to BLS Manufacturing Employment (red line) – all data seasonally adjusted

The ISM employment index appears useful in predicting turning points which can lead the BLS data up to one year.

Related Posts:

Old Analysis Blog | New Analysis Blog |

| Institute of Supply Management Surveys | Institute of Supply Management Surveys |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>