The rate of growth of the US Coincident Index was unchanged in April 2015 data. A comparison of US Coincident Index, Aruoba-Diebold-Scotti business conditions index, Conference Board’s Coincident Index, ECRI’s USCI (U.S. Coincident Index), and Chicago Fed National Activity Index (CFNAI) coincident indicators follows. In general, most coincident indices are showing slower growth.

Economic indicators that coincide with economic movements are coincident indicators. Coincident indicators by definition do not provide a forward economic view. However, trends are valid until they are no longer valid, making the trend lines on the coincident indicators a forward forecasting tool. Econintersect‘s analysis of the coincident indices is that:

- There is general agreement that the economy is expanding – but most show the rate of growth is flat (not speeding up or slowing down) or decelerating.

- You cannot take most of these coincident indices to the bank – as they are subject to backward revision.

- The economy is expanding at main street level.

Excerpt from Philly Fed Report for the United States Coincident Index

[click graph below to enlarge]The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2015. In the past month, the indexes increased in 40 states, decreased in six, and remained stable in four, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in April and 0.6 percent over the past three months.

z philly coincident.PNG

| Philly Fed Coincident | 1 month change | 3 month change | 1 year change |

| January 2015 | 0.3% | 0.9% | 3.4% |

| February 2015 | 0.3% | 0.8% | 3.5% |

| March 2015 | 0.2% | 0.6% | 3.4% |

| April 2015 | 0.2% | 0.6% | 3.4% |

The Philly Fed produces this real time coincident indictor report based on six underlying indicators:

- Weekly initial jobless claims

- Monthly payroll employment

- Industrial production

- Personal income less transfer payments

- Manufacturing and trade sales

- Quarterly real GDP

Aruoba-Diebold-Scotti Business Conditions Index

Per the Philly Fed:

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. Its underlying (seasonally adjusted) economic indicators (weekly initial jobless claims; monthly payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales; and quarterly real GDP) blend high- and low-frequency information and stock and flow data. Both the ADS index and this web page are updated as data on the index’s underlying components are released.

The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. The ADS index may be used to compare business conditions at different times. A value of -3.0, for example, would indicate business conditions significantly worse than at any time in either the 1990-91 or the 2001 recession, during which the ADS index never dropped below -2.0.

The vertical lines on the figure provide information as to which indicators are available for which dates. For dates to the left of the left line, the ADS index is based on observed data for all six underlying indicators. For dates between the left and right lines, the ADS index is based on at least two monthly indicators (typically employment and industrial production) and initial jobless claims. For dates to the right of the right line, the ADS index is based on initial jobless claims and possibly one monthly indicator.

The Aruoba-Diebold-Scotti business conditions index is currently showing worse than average business conditions.

Conference Board’s Coincident Index (red line):

z conference.png

Per the Conference Board:

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased 0.2 percent in April to 112.0 (2010 = 100), following a 0.1 percent decline in March, and a 0.2 percent increase in February.

ECRI’s USCI (U.S. Coincident Index):

ECRi’s Coincident Index’s rate of growth has been declining for three months.

z ecri_coin.png

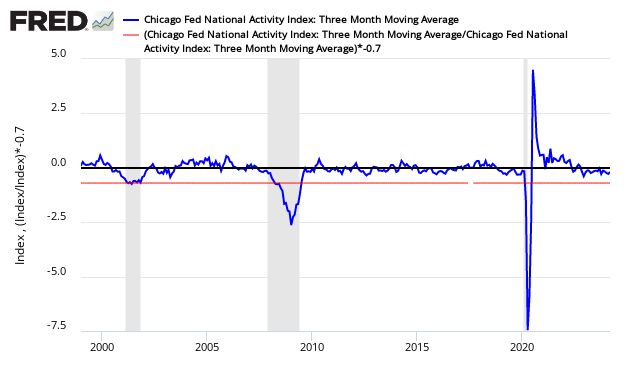

Chicago Fed National Activity Index (CFNAI)

On the above graph, the CFNAI rate of growth continues to trend down – and economic expansion is now below the trend rate of growth (zero line) – but far from recession territory (red line).

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>