Written by Steven Hansen

The BLS Job Openings and Labor Turnover Survey (JOLTS) can be used as a predictor of future jobs growth, and the predictive elements show that the year-over-year unadjusted private non-farm job opening growth rate declined modestly. The jobs growth rate predicted remains above average for times of expansion. The problem with this data series is the backward revisions which makes real time analysis problematic.

The market was expecting 5.150 M to 5.165 M seasonally adjusted jobs openings (consensus 5.158) versus 4.994 M actual. Last month’s data was revised up insignificantly. The trend lines now are flat to downward.

- the number of unadjusted PRIVATE jobs openings – which is the most predictive of future employment growth of the JOLTS elements – shows the year-over-year growth rate declined from a upwardly revised 25.4% (February) to 18.0% (March). The year-over-year growth of the unadjusted non-farm private jobs opening rate (percent of job openings compared to size of workforce) improved from 20.0% to 12.5%. Overall, the data is now suggesting slower employment growth.

- The graph below looks at rate of growth for job openings. The rate of growth is quite high, and is continuing on an upward growth trend.

- Seasonally adjusted jobs openings in February were 5.133 million – and has been revised to million 5,144.

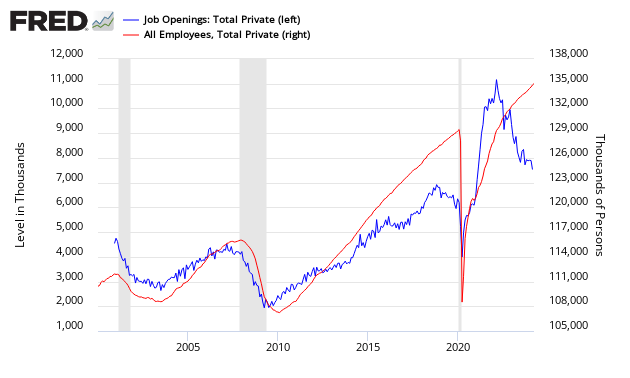

The relevance of JOLTS to future employment is obvious from the graphic below which shows JOLTS Job Openings leading or coincident to private non-farm employment. JOLTS job openings are a good predictor of jobs growth turning points.

Seasonally Adjusted Private Jobs Openings from JOLTS (blue line, left axis) compared to BLS Non-farm Private (red line, right axis)

The graph below uses year-over year growth comparisons of non-seasonally adjusted non-farm private BLS data versus JOLTS Job Openings – and then compare trend lines. JOLTS is showing a long term trend improvement.

Year-over-Year Change – Seasonally Jobs Openings from JOLTS (blue line, left axis) compared to Unadjusted BLS Non-farm Private (red line, right axis)

- The JOLTS Unadjusted Private hires rate (percent of hires compared to size of workforce) and the separations rate (percent of separations compared to size of workforce – separations are the workforce which quit or was laid off) are not predictive.

Seasonally Adjusted Hires (blue line) and Seasonally Adjusted Separation Levels (red line) – Non-Farm Private

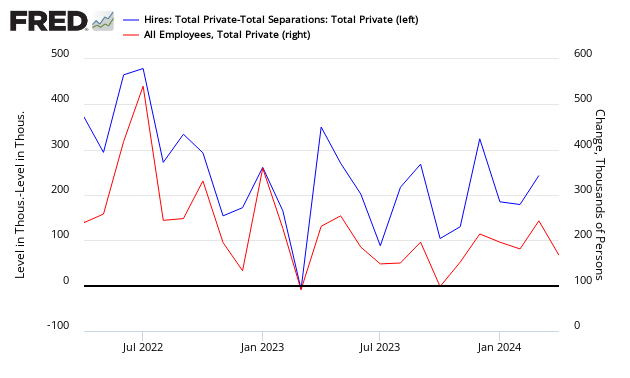

Please note that Econintersect has not been able use the hire rate or the separation rate (or a combination thereof) to help in understanding future jobs growth. A Philly Fed study agrees with Econintersect’s assessment. JOLTS is issued a month later than the jobs data – and correlates against one month old data. The data in the below chart shows that the JOLTS data is turning at the same points – but the JOLTS data is released one month later making this a lagging indicator.

Hires less Separation Rate (blue line, left axis) compared to Non-Farm Private BLS Non-farm Private (red line, right axis)

Caveats on the Use of JOLTS

This data series historically is very noisy which likely is a result of data gathering issues and/or seasonal adjustments. Therefore this series must be trended to provide any understanding of the dynamics. One of two months of good or bad data are not predictive.

Related Posts:

Old Analysis Blog | New Analysis Blog |

| All employment articles | All employment articles |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>