Written by Steven Hansen

The ISM non-manufacturing (aka ISM Services) index continues its growth cycle, but declined marginally from 56.9 to 56.5 (above 50 signals expansion). Important internals mixed but still remained in expansion. On the other hand, Market PMI Services Index was released this morning and says the opposite.

The ISM non-manufacturing (aka ISM Services) index continues its growth cycle, but declined marginally from 56.9 to 56.5 (above 50 signals expansion). Important internals mixed but still remained in expansion. On the other hand, Market PMI Services Index was released this morning and says the opposite.

This was within the range of market forecasts of 46.5 to 58.5 (consensus 56.7).

For comparison, the Market PMI Services Index was released this morning also – and it strengthened instead of weakening. Here is the analysis from Bloomberg:

Released On 4/6/2015 9:45:00 AM For Mar, 2015

Prior Consensus Consensus Range Actual Level 57.1 58.4 57.5 to 58.6 59.2 Highlights

With exports on the decline due to weak foreign demand and the high value of the dollar, the service sector is increasingly the key to US economic health. And right now conditions look very solid with the PMI services index jumping to 59.2 in final March, up more than 1/2 point from the March flash reading and up more than 2 points from the final reading for February. The final reading for March is the strongest since August last year.New orders, backlog orders, business activity and employment are all accelerating with inflation readings remaining dormant. One weakness, however, is a tangible easing in the business outlook, the result perhaps of troubles underway in the manufacturing sector and a factor that could slow future hiring.

Still, today’s report is very strong and points to economic momentum going into the second quarter. Coming up at 10:00 a.m. ET is the non-manufacturing report from the ISM which, including the non-service sectors of construction and mining, both of which are soft, has been running less hot that the PMI services report.

There are two sub-indexes in the NMI which have good correlations to the economy – the Business Activity Index and the New Orders Index – and both have good track records in spotting an incipient recession. The Business Activity Index declined and the New Orders Index marginally improved – with both remaining in territories associated with moderate expansion.

This index and its associated sub-indices are fairly volatile – and one needs to step back from the data and view this index over longer periods than a single month.

The Business Activity sub-index declined 1.9 points and now is at 57.5.

ISM Services – Business Activity Sub-Index

The New Orders Index improved 1.1 and is currently at 57.8.

ISM Services – New Orders Sub-Index

The complete ISM manufacturing and non-manufacturing survey table is below.

Econintersect does give serious consideration to this survey as the service sector accounts for 80% of the economy and 90% of employment. However, this an opinion survey and is not hard data.

From the ISM report:

Economic activity in the non-manufacturing sector grew in March for the 62nd consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The NMI® registered 56.5 percent in March, 0.4 percentage point lower than the February reading of 56.9 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 57.5 percent, which is 1.9 percentage points lower than the February reading of 59.4 percent, reflecting growth for the 68th consecutive month at a slower rate. The New Orders Index registered 57.8 percent, 1.1 percentage points higher than the reading of 56.7 percent registered in February. The Employment Index increased 0.2 percentage point to 56.6 percent from the February reading of 56.4 percent and indicates growth for the 13th consecutive month. The Prices Index increased 2.7 percentage points from the February reading of 49.7 percent to 52.4 percent, indicating prices increased in March after three consecutive months of decreasing. According to the NMI®, 14 non-manufacturing industries reported growth in March. The majority of respondents’ comments reflect stability and are mostly positive about business conditions and the overall economy.

INDUSTRY PERFORMANCE

The 14 non-manufacturing industries reporting growth in March — listed in order — are: Management of Companies & Support Services; Real Estate, Rental & Leasing; Accommodation & Food Services; Transportation & Warehousing; Agriculture, Forestry, Fishing & Hunting; Arts, Entertainment & Recreation; Retail Trade; Finance & Insurance; Public Administration; Information; Wholesale Trade; Professional, Scientific & Technical Services; Health Care & Social Assistance; and Construction. The four industries reporting contraction in March are: Mining; Educational Services; Other Services; and Utilities.

Caveats on the use of ISM Non-Manufacturing Index:

This is a survey, a quantification of opinion. However, as pointed out above, certain elements of this survey have good to excellent correlation to the economy for as long as it has been in existence. Surveys lead hard data by weeks to months, and can provide early insight into changing conditions.

The main ISM non-manufacturing index (NMI) is so new that it does not have enough data history to have reliable certainty about how it correlates to the economy. Again, two sub-indices (business activity and new orders) do have good correlation for the limited history available.

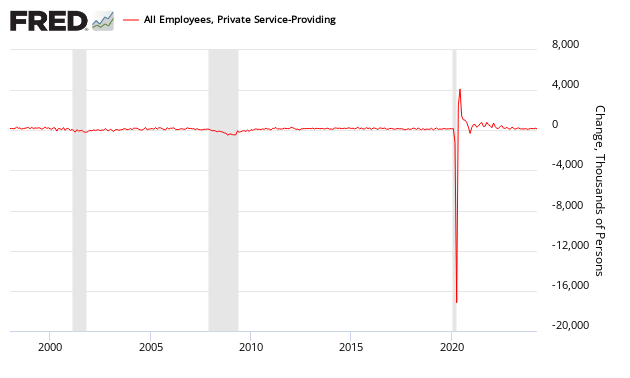

No survey is accurate in projecting employment – and the ISM Non-Manufacturing Employment Index is no exception. Although there are some general correlation in trends if you stand far enough back from this graph, month-to-month movements have not correlated well with the BLS Service Sector Employment data.

ISM Services Employment Sub-Index vs BLS Non-Farm Services Employment

Related Posts:

Old Analysis Blog | New Analysis Blog |

| All Articles on Institute of Supply Management Surveys | All Articles on Institute of Supply Management Surveys |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>