Written by Steven Hansen

Written by Steven Hansen

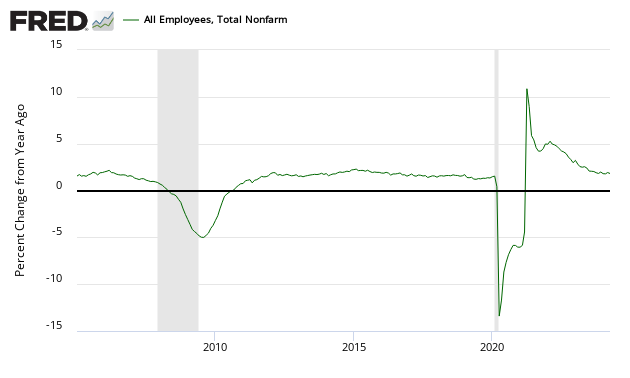

The BLS jobs report headlines from the establishment survey were strong and above expectations. The unadjusted data shows relatively strong jobs growth. The household survey continues to tell a different story – and consider that the unadjusted data from the establishment survey was about average for growth seen in times of economic expansion. The rate of jobs growth continues to accelerate.

- The rate of growth for employment continues to accelerate (red line on graph below).

Unadjusted Non-Farm Private Employment – Year-over-Year Change (blue bars – left axis) and Year-over-Year Growth Acceleration / Deceleration (red line – right axis)

z bls2.png

- The unadjusted jobs added month-over-month was strong and better than last year (year-over-year comparisons).

- economic intuitive sectors of employment were strong.

- This month’s report internals (comparing household to establishment data sets) AGAIN were fairly inconsistent with the household survey showing seasonally adjusted employment growing 96,000 vs the headline establishment number of growing 295,000. The point here is that part of the headlines are from the household survey (such as the unemployment rate) and part is from the establishment survey (job growth). From a survey control point of view – the common element is jobs growth – and if they do not match, your confidence in either survey is diminished. [note that the household survey includes ALL jobs growth, not just non-farm).

- The household survey removed 178,000 people from the workforce – this the main reason that the unemployment rate fell.

- The monthly comment from the National Federation of Independent Business (NFIB) on jobs growth is below.

A summary of the employment situation:

- BLS reported: 257K (non-farm) and 267K (non-farm private). Unemployment marginally worsened from 5.6% to 5.7%.

- ADP reported: 212K (non-farm private)

- In Econintersect’s February 2015 economic forecast released in late January, we estimated non-farm payroll growth at 200,000 (unadjusted based on economic potential) and 275,000 (fudged based on current overrun of economic potential).

- The market expected:

| Seasonally Adjusted Data | Consensus Range | Consensus | Actual |

| Nonfarm Payrolls – M/M change | 215,000 to 252,000 | 230,000 | 295,000 |

| Unemployment Rate – Level | 5.5 % to 5.7 % | 5.6 % | 5.5 % |

| Private Payrolls – M/M change | 202,000 to 245,000 | 225,000 | 288,000 |

| Average Hourly Earnings – M/M change | 0.2 % to 0.3 % | 0.2 % | +0.1 % |

| Av Workweek – All Employees | 34.5 hrs to 34.8 hrs | 34.6 hrs | 34.6 hrs |

The BLS reports seasonally adjusted data – manipulated with multiple seasonal adjustment factors, and Econintersect believes the unadjusted data gives a clearer picture of the jobs situation.

Non-seasonally adjusted non-farm payrolls improved 467,000 – an average improvement for February employment in the 21st century.

Historical Unadjusted Private Non-Farm Jobs Growth Between Januarys and Februarys (Table B-1, data in thousands) – unadjusted (blue line) vs seasonally adjusted (red line)

bls non-adjusted change.PNG

Last month’s seasonally adjusted employment was revised down.

Change in Seasonally Adjusted Non-Farm Payrolls Between Originally Reported (blue bars) and Current Estimates (red bars)

z bls1.png

Most of the analysis below uses unadjusted data, and presents an alternative view to the headline data.

Unemployment

The BLS reported U-3 (headline) unemployment marginally improved 0.2% to 5.5% with the U-6 “all in” unemployment rate (including those working part time who want a full time job) improved 0.3 % to 11.0%. These numbers are volatile as they are created from the household survey.

BLS U-3 Headline Unemployment (red line, left axis), U-6 All In Unemployment (blue line, left axis), and Median Duration of Unemployment (green line, right axis)

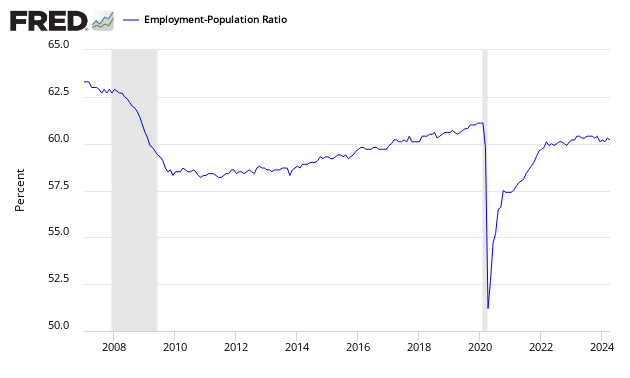

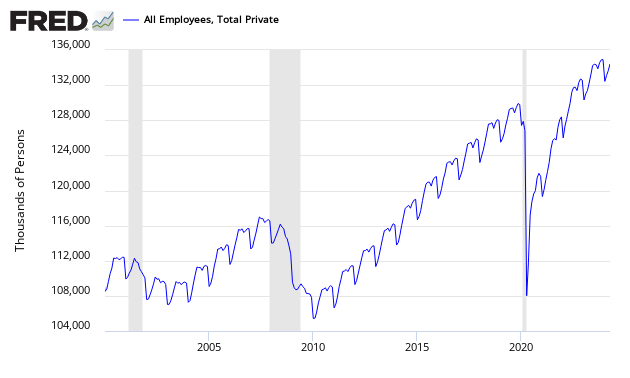

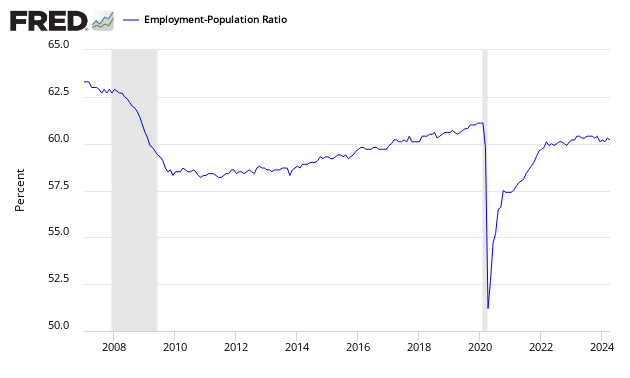

Econintersect has an interpretation of employment supply slack using the BLS unadjusted data base, demonstrated by the graph below. The employment-population ratio was unchanged at 59.3.

Employment-Population Ratio

The jobs picture – when the employment / population as a whole – has been on an uptrend since mid-2011. This ratio is determined by household survey.

- Econintersect uses employment-populations ratios to monitor the jobless situation. The headline unemployment number requires the BLS to guess at the size of the workforce, then guess again who is employed or not employed. In employment – population ratios, the population is a given and the guess is who is employed.

- In this latest BLS report employment-population ratio is unchanged at 59.3 – this ratio has been in a general uptrend since the beginning of 2014. The employment-population ratio tells you the percent of the population with a job. Each 0.1% increment represents approximately 300,000 jobs. [Note: these are seasonally adjusted numbers – and we are relying on the BLS to get this seasonal adjustment factor correct]. An unchanged ratio would be telling you that jobs growth was around 150,000 – as this is approximately the new entries to the labor market caused by population growth.

Employment Metrics

The 3 month rolling average growth trend in the establishment survey’s non-farm payroll improved, and have been trending up since the beginning of 2014.

Unadjusted Non-Farm Payrolls Year-over-Year Growth

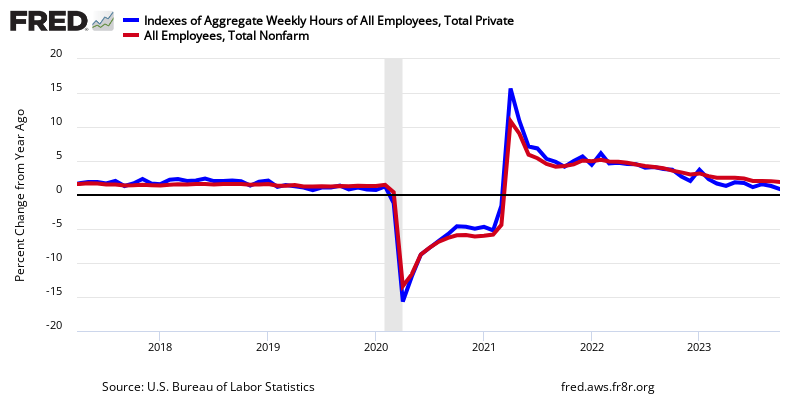

Another way to view employment is to watch the total hours worked which has been within a narrow range for the last 4 years is now showing some growth.

Percent Change Year-over-Year Non-Farm Private Weekly Hours Worked

The bullets below use seasonally adjusted data from the establishment survey except where indicated:

- Average hours worked (table B-2) was unchanged at 34.6. A rising number normally indicates an expanding economy .

- Government employment was up 7K (7,000) with the Federal Government unchanged, state governments up 3K and local governments up 4K.

- The big contributor to employment growth this month was food services (58.7K), education and health (54k), professional and business services (51K), and retail trade (32K).

- There were no major headwinds this month to employment.

- Manufacturing was up 8K, while construction was up 29K.

- The unemployment rate (from household survey) for people between 20 and 24 (Table A-10) degraded from 9.8% to 10.0%. This number is produced by survey and is very volatile.

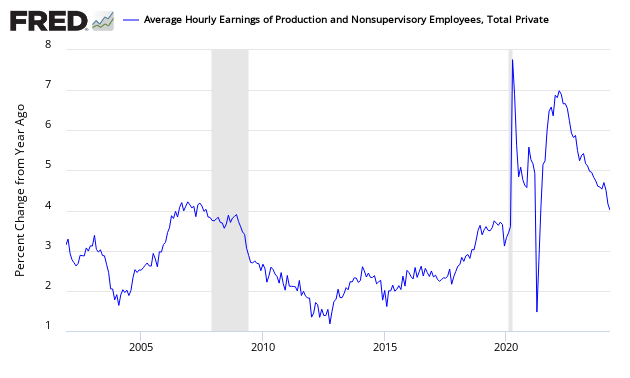

- Average hourly earnings (Table B-3) was was up $0.3 to $24.78.

Private Employment: Average Hourly Earnings

Economic Metrics

Economic markers used to benchmark economic growth (all from the establishment survey) were positive and well away from recessionary levels.

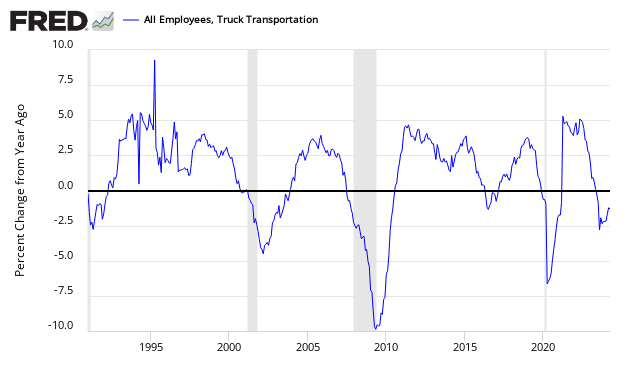

The truck employment was up 2.6K. Year-over-year improvement is well into expansion territory, with an improving short term trend.

Truck Transport Employment – Year-over-Year Change

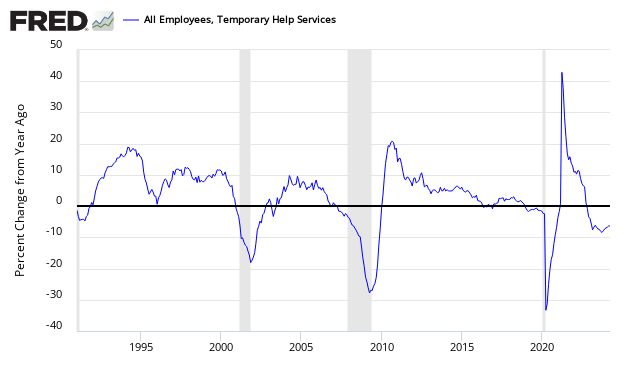

Temporary help declined (7.8K). Note that many believe, that Obamacare is creating a shift from permanent to temporary jobs. If this is the case, this metric would be inoperative.

Temporary Help Employment – Year-over-Year Change

Econintersect believes the transport sector is a forward indicator. Others look at temporary help as a forward indicator.

Food for Thought

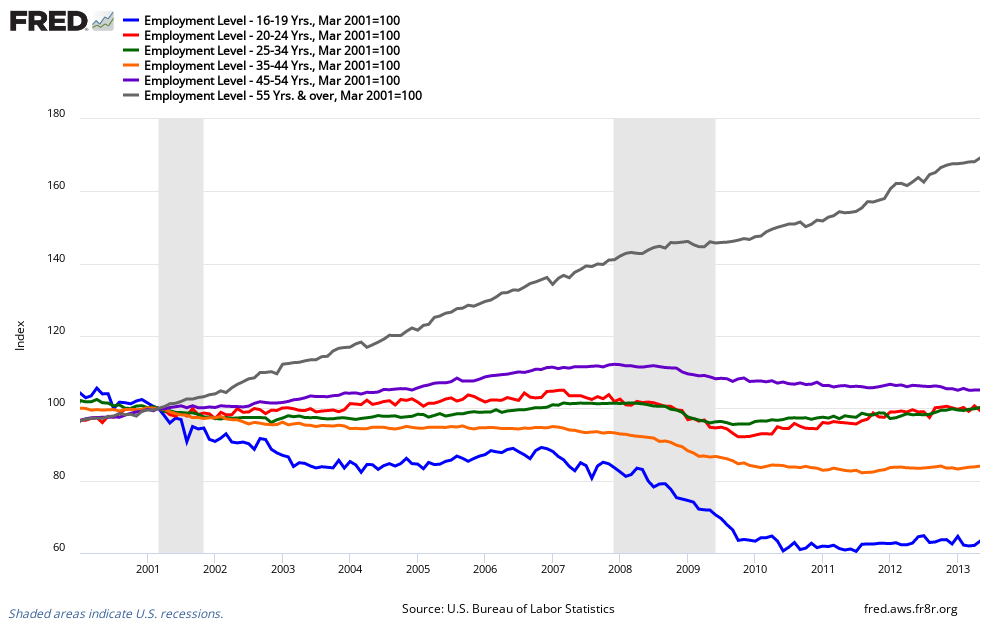

Who are the victims in this mediocre employment situation. It is not people over 55.

Index of Employment Levels – 55 and up (dark grey line), 45 to 54 (purple line), 35 to 44 (orange line), 25 to 34 (green line), 20 to 24 (red line), and 16 to 19 (blue line)

Women are doing better than men.

Index of Employment Levels – Men (blue line) vs Women (red line)

Mom and Pop employment is below recessionary levels.

The less education one has, the less chance of finding a job.

Index of Employment Levels – University graduate (blue line), Some college or AA degree (orange line), high school graduates (green line), and high school dropouts (red line)

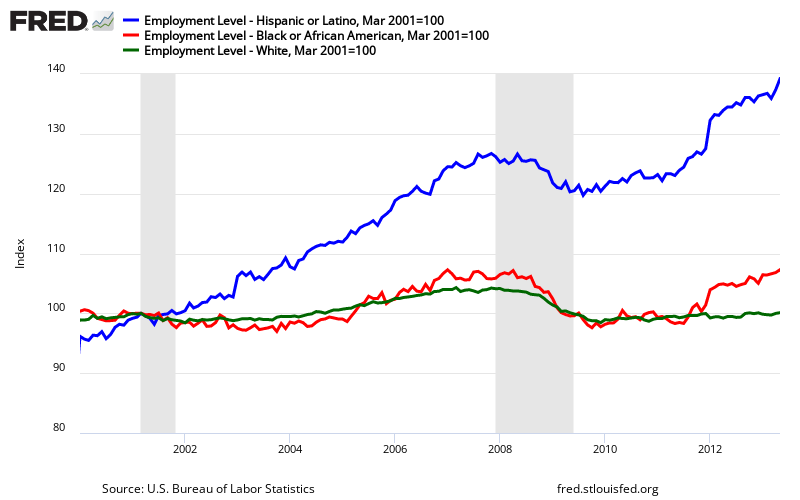

And being white is not helpful for employment. FRED does not have data series for Asians, but the BLS does – and indexed Asian employment levels are similar to Hispanic.

Index of Employment Levels (from the BLS Establishment Survey) – Hispanic (blue line), African American (red line), and White (green line)

However, keep in mind that population growth is different for each group. Here is a look at employment to population ratios which clearly shows NO group has recovered from the Great Recession:

Employment / Population Ratios (from the BLS Household Survey) – Hispanic (blue line), African American (red line), and White (green line)

According William C. Dunkelberg, Chief economist for the National Federation of Independent Business (NFIB), small business hiring was soft in January:

The percent of owners reporting an increase in employment fell 1 percentage points to a net 4 percent of owners, a solid number. The percent of owners cutting jobs rose 3 points to 11 percent while the percent increasing employment gained 2 points to 15 percent. This suggests that initial claims for unemployment might run a bit higher but the jobs numbers will also improve. Overall, the average increase in workers per firm was 0.16 workers per firm, unchanged from January’s solid reading. Those increasing employment added an average of 3.4 workers while those reducing their workforce cut an average of 2.9 positions. Fifty-three percent reported hiring or trying to hire (up 5 points), but 47 percent reported few or no qualified applicants for the positions they were trying to fill. Twelve percent reported using temporary workers, down 2 points.

Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 3 points and the highest reading since March 2006. This strong of a reading anticipates a further reduction in the unemployment rate. A net 12 percent are planning to create new jobs, down 2 points but a solid reading.

The net percent of owners planning to create new jobs (hire more than the let go) gave up 1 point from December’s excellent reading, providing evidence that the December number was not a fluke. A net 14 percent planning to create new jobs is a strong reading. Not seasonally adjusted, 20 percent plan to increase employment at their firm (up 2 points), and 5 percent plan reductions (down 3 points). With weaker top line sales for large firms (due to the strong dollar and lower exports), employment gains may be shifting to the small business sector.

GDP growth in 2014 Q4 was revised down to 2.2 percent from the initial estimate of 2.6 percent. This is a substantial slowdown from the mid-2014 pace. Consumer spending was still fairly solid in Q4 but has shown little strength so far this year. Even so, the labor market indicators are showing very solid strength. The job openings figure is one of the highest in 40 years and this suggests that labor markets are tightening and that there will be more pressure on compensation in the coming months. The monthly job report has been significantly revised each month recently and the revisions have been positive. But winter east of the Mississippi has not been conducive to growth and increased employment. All this considered, the NFIB data anticiipate a solid number but short of the 300,000 average of the past few months.

Caveat on the use of BLS Jobs Data

The monthly headline data ends up being significantly revised for months after the initial release – and is subject also to annual revisions. The question remains how seriously can you take the data when first released.

The above graphic (updated through October 2011) is the month-over-month change in employment based on the original headline non-farm employment level and the current stated employment levels at month end. You will note some pretty drastic backward revision for a major economic release the market reacts to in real time.

Econintersect Contributor Jeff Miller has the following description of BLS methodology:

- An initial report of a survey of establishments. Even if the survey sample was perfect (and we all know that it is not) and the response rate was 100% (which it is not) the sampling error alone for a 90% confidence interval is +/- 100K jobs.

- The report is revised to reflect additional responses over the next two months.

- There is an adjustment to account for job creation — much maligned and misunderstood by nearly everyone.

- The final data are benchmarked against the state employment data every year. This usually shows that the overall process was very good, but it led to major downward adjustments at the time of the recession. More recently, the BLS estimates have been too low.

Econintersect has repeatedly pointed out questions about how the seasonal adjustment algorithms and data gathering methodology used by the BLS introduce uncertainty into interpretation of month to month changes in employment.

Econintersect believes the simplistic sampling extrapolation technique of ADP yields a far better picture of the employment situation than the complicated, convoluted Bureau of Labor Statistics (BLS) methodology. However, ADP is using a new methodology beginning with the October 2012 data – and only time will tell if their new approach was as good as their old one.

ADP (blue line) versus BLS (red line) – Monthly Jobs Growth Comparison

Because of the differences in methodology, many pundits ignore the ADP numbers – while waiting for the BLS numbers. Although there can be a low correlation in a particular month, the different methodologies tend to balance out, and the correlations are excellent outside of the data turning points. We are now 16 months past the post recession turning point in employment.

However, there is some discussion that neither the ADP nor BLS numbers are correct – as both are derived by a sampling methodology. The answer could be that there is no correct answer in real time – and that it is best to look at the trends. As has been noted, all eventually end up correlating.

The BLS uses seasonal adjusted data for its headline numbers. The seasonally adjusted employment data is produced by an algorithm. The following graph which shows unadjusted job growth – seasonal adjustments spread employment growth over the entire year. Employment does not really grow in the second half of the year and always falls significantly in January.

Non-Seasonally Adjusted Employment – Private Sector

There is the proverbial question on what is minimal jobs growth each month required to allow for new entrants to the market. Depending on mindset, this answer varies. According to Investopdia, the number is between 100,000 and 150,000. The Wall Street Journal is citing 125K. Mark Zandi said 150K. Econintersect is going with Mark Zandi’s number:

- In Econintersect‘s June 2014 economic forecast released in late May, we estimated non-farm payroll growth at 160,000 (unadjusted based on economic potential) and 229,000 (fudged based on current overrun of economic potential).

- If Econintersect uses employment – population ratios, the correct number would be the number where this ratio improved. Using the graph below, the ratio began to improve starting a little after mid-year. This corresponds to the period where the 12 month rolling average of job gains hit 150,000.

Employment to Population Ratio

Note: The ratio could be fine tuned by adjusting to the ratio of employment to working age population rather than the total population. However, this would not change the big picture that an increase of somewhere around 150,000 (+/-) is needed for the growing population numbers. We have estimated 140k – 160k. The number might possibly be within the range 125k – 175k. Econintersect cannot find reason to support the estimates below 125k.

The question of how changing demographics impact the employment numbers is at the margins of analysis. Econintersect will publish more on this fine tuning going forward, both in-house research and the work of others.

Related Posts:

Old Analysis Blog | New Analysis Blog |

| All Employment Articles | All Employment Articles |

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>