Written by Gary

U.S. stocks rose Thursday morning after solid retail sales for May indicated consumers have increased spending.

Markets then came off session highs today after the International Monetary Fund quit bailout talks with Greece, saying ‘major differences’ remained over an agreement to save the country from bankruptcy.

The current green market status remains to be seen if it can remain positive. Some analysts believe the markets will seek flat to negative status before today’s close.

Here is the current market situation from CNN Money | |

| North and South American markets are mixed today. The S&P 500 is up 0.24% while the IPC gains 0.08%. The Bovespa is off 0.72%. |

Traders Corner – Health of the Market

| Index | Description | Current Value |

| Investors.com Members Sentiment: | % Bullish (the balance is Bearish) | 47% |

| CNN’s Fear & Greed Index | Above 50 = greed, below 50 = fear | 43% |

| Investors Intelligence sets the breath | Above 50 bullish | 55.5% |

| StockChart.com Overbought / Oversold Index ($NYMO) | anything below -30 / -40 is a concern of going deeper. Oversold conditions on the NYSE McClellan Oscillator usually bounce back at anything over -50 and reverse after reaching +40 oversold. | -29.25 |

| StockChart.com NYSE % of stocks above 200 DMA Index ($NYA200R) | $NYA200R chart below is the percentage of stocks above the 200 DMA and is always a good statistic to follow. It can depict a trend of declining equities which is always troubling, especially when it drops below 60% – 55%. Dropping below 40%-35% signals serious continuing weakness and falling averages. | 51.96% |

| StockChart.com NYSE Bullish Percent Index ($BPNYA) | Next stop down is ~57, then ~44, below that is where we will most likely see the markets crash. | 61.37% |

| StockChart.com S&P 500 Bullish Percent Index ($BPSPX) | In support zone and rising. ~62, ~57, ~45 at which the markets are in a full-blown correction. | 62.40% |

| StockChart.com 10 Year Treasury Note Yield Index ($TNX) | ten year note index value | 24.26 |

| StockChart.com Consumer Discretionary ETF (XLY) | As long as the consumer discretionary holds above [66.88], all things being equal, it is a good sign for stocks and the U.S. economy | 77.00 |

| StockChart.com NYSE Composite (Liquidity) Index ($NYA) | Markets move inverse to institutional selling and this NYA Index is followed by Institutional Investors | 11,072 |

What Is Moving the Markets

| Here are the headlines moving the markets. | |

| Wall St off session highs as IMF quits Greece talks (Reuters) – U.S. stocks came off session highs on Thursday after the International Monetary Fund quit bailout talks with Greece, saying ‘major differences’ remained over an agreement to save the country from bankruptcy. |

| Wheels: Technology to Prevent Drunken Driving Could Soon Come in New Cars Touch pads that detect alcohol in blood vessels beneath the skin and sensors that analyze normal breaths could be in vehicles by the end of the decade. |

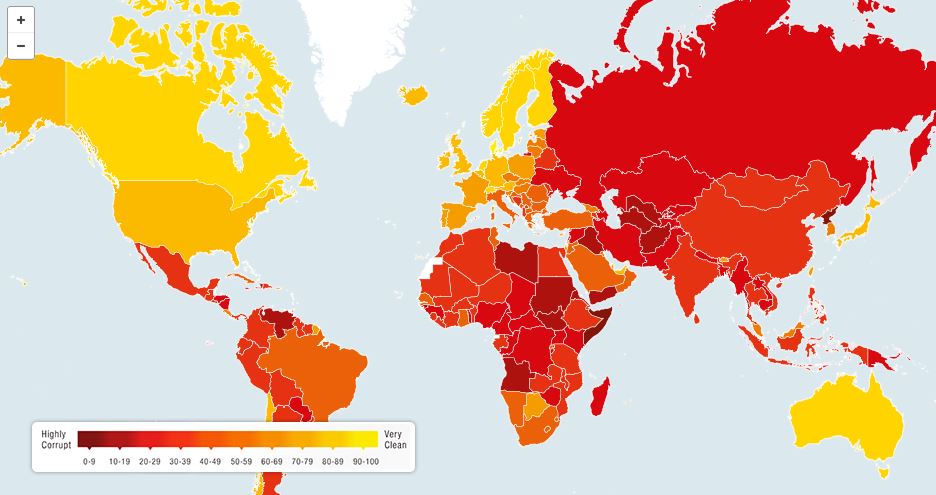

| Fighting Cronyism With The Corruption ETFSubmitted by Daniel Drew via Dark-Bid.com, It seems like there’s an ETF for everything nowadays. From global warming ETFs to fertilizer ETFs, Wall Street has neatly packaged nearly every type of investment to attract your cash. One thing they forgot to package was corruption. Considering how they are already overflowing in it, perhaps they just took it for granted. However, for many investors, corruption is worth taking a second look. It all started with a question: Does corruption hurt stock performance? To answer this, I looked at a list of country ETFs. Then I looked at the Corruption Perceptions Index provided by Transparency International. Corruption Perceptions Heat Map Countries with high rankings have less corruption, and countries with low rankings have higher corruption. I took the countries with a ranking of 80 or higher and placed them in a basket called the “Low Corruption Index.” (Note: Neither the U.S. or the U.K. made the cut.) Then I took the countries with a ranking of 40 or lower and placed them in a basket called the “High Corruption Ind … |

| Indian Silver Demand Explodes to US Silver Owners’ DelightIndian Silver Demand Explodes to US Silver Owners’ Delight – India may absorb as much as one third of total global silver production this year

This would represent almost one third of total annual mine supply globally. Worldwide mine supply was 877 million troy ounces (27,277 metric tonnes). It would represent a 27% increase in India’s 2014 silver imports of 7063 tonnes which itself was a 13% increase on the 2013 figure showing a steadily growing demand for physical silver in India with each passing year. According to srsroccoreport.com, who compiled the data, it is Indian citizens who are the driving force behind the record demand for silver in India. We would speculate that India’s commitment to solar power may also be a factor. Back in 2009, the Indian government set a target of 20GW of solar power generation by 2020. However, in January of this year the government d … |

| IMF quits Greek talks; EU tells Tsipras: stop gambling WASHINGTON/BRUSSELS (Reuters) – The International Monetary Fund dramatically raised the stakes in Greece’s stalled debt talks on Thursday, announcing that its delegation had broken off negotiations in Brussels and flown home because of major differences with Athens. |

| Crime Cam: Filming Police Legality Explained

Videos of police violence across the U.S. are a frequent feature in the world’s headlines. With everyone carrying camera-phones these days, passers-by are able to capture officers’ misdemeanors and share them with everyone. But it could be a crime to film them as RT’s Marina Portnaya explains. |

| Rupert Murdoch preparing to step down as Fox CEO: reports (Reuters) – Rupert Murdoch, the 84-year-old chief executive of Twenty-First Century Fox Inc, is preparing to step down and name his son James as successor at the entertainment conglomerate behind Fox News and the studio that makes “X-Men” movies, CNBC and Bloomberg reported on Thursday. |

| Boeing revises up jet demand forecast PARIS (Reuters) – Boeing Co boosted its 20-year forecast for aircraft demand by 3.5 percent on Thursday, predicting “strong and resilient” growth as two out of every five newly built jets feed Asia’s booming travel market. |

| As Japan Battles Deflation, a Bitter Legacy LoomsKorekiyo Takahashi steered Japan out of the Great Depression but was criticized for the soaring inflation that ensued. Now, Prime Minister Shinzo Abe faces the difficult question of how far to follow Mr. Takahashi’s policies. |

| The Two Things Every Investor Needs to Know About The Fed’s War on CashFor six years straight, the Fed has been trying to “trash” cash. First it cut interest rates to zero… making it so that savings deposits produced almost nothing in the way of interest income. Consider that at current rates, a retiree with $1 million in savings earns a measly $2,500 per year in interest income. The Fed’s hope was that by making it painful for savers to sit in cash, said savers would move into risk assets such as bonds and stocks. This has worked in that stocks are now in one of, if not THE biggest bubbles in history… while bonds are trading at yields never before seen outside of wartime. However, the Fed overlooked two outlets for investors who didn’t want to be forced into risk. They are: Gold bullion and physical cash. Bullion and Cash represent two of the best means of “getting your money” out of the system. They are a way of saying “no” to Central Banking madness (at least unless hyperinflation sets in). How is this?Warren Buffett once noted, Gold doesn’t do anything “but look at you.” It doesn’t pay a dividend or produce cash flow. However, the fact of the matter is that Gold has dramatically outperformed the stock market for the better part of 40 years. I say 40 years because there is no point comparing Gold to stocks during periods in which Gold was pegged to world currencies. Most of the analysis I see comparing the benefits of owning Gold to stocks goes back to the early 20th century. However Gold was pegged to global currencies up until 1967. Stocks weren’t. Comparing the two during this time period is just bad analysis. And once the Gold peg officially ended with France dropp … |

| IMF Crushes Greek Deal Hopes, Says “No Progress Made”, Halts Talks After Major Differences RemainAnd just like that we are back to the rumor drawing board. IMF’S RICE SAYS NO PROGRESS MADE TOWARD DEAL WITH GREECE IMF HAS MAJOR DIFFERENCES WITH GREECE IN KEY AREAS: SPOKESMAN IMF’S TECHNICAL TEAM ON GREECE HAS LEFT BRUSSELS, RICE SAYS The WSJ has more details:

But “two Bloomberg sources”, an organization which like Reuters, makes money from collecting commissions from trading and loves a surge in volatility, said yesterday a deal was assured. What gives? Perhaps the fact that just as we said, this is a tried and true pattern of drawing the sheep in just so the big boys can dump to novices, Chinese grandmothers and of course, Virtu’s vacuum tubes. |

| Strong U.S. retail sales boost growth outlook WASHINGTON (Reuters) – U.S. retail sales surged in May as households boosted purchases of automobiles and a range of other goods even as they paid a bit more for gasoline, the latest sign economic growth is finally gathering steam. |

| April 2015 Business Inventories and Sales Very SoftWritten by Steven Hansen Econintersect’s analysis of final business sales data (retail plus wholesale plus manufacturing) shows unadjusted sales declined compared to the previous month. Even with inflation adjustments, business sales is in contraction. The inventory-to-sales ratios remain at recessionary levels. |

| 14 Reasons Why Jamie Dimon “Understands The Global Banking System”According to the afterword to her book “A Fighting Change” Elizabeth Warren recounts a visit by jamie Dimon to her office shortly after she was sworn in. She said that when Dimon complained about stiffening regulation she warned him CFPB rules might take effect that would spell trouble for the bank. Warren said Dimon “leaned back and slowly smiled,” and then replied, “So hit me with a fine. We can afford it.” Afford it he can, over $30 billion and counting… or rather JPM’s shareholders can – the same shareholders who would have been wiped out had they not been bailed out by the same government that is now punishing JPM for years of market rigging and manipulation, and yet is terrified of throwing anyone in prison. Which is also why Dimon is not only richer than you, but richer than almost everyone else now that he is a billionaire. He also carries a grudge. According to Bloomberg, during a speech on Wednesday at an event in Chicago, when talking about Elizabeth Warren Dimon said: “I don’t know if she fully understands the global banking system.” Perhaps his comment is in response to Warren’s recent statement that “the finance guys argue that if you’re never in the club, you can’t understand it, but I think they have it backward. Not being in the club means not drinking the Kool-Aid.” She added that such bankers are smart, but no smarter than people in many other professions, she said. When their mistakes led to the financial crisis, they “took care of themselves and their bonuses while millions of people lost everything.” “The problem was never that I didn’t understand … |

| Founder Chip Wilson looking at sale of entire Lululemon stake TORONTO (Reuters) – Chip Wilson, who founded Lululemon Athletica Inc and left its board earlier this year after disagreements with fellow directors, is now looking to potentially sell his family’s estimated $1.3 billion stake in the yogawear maker. |

| Business Inventories Jump Most In 11 Months, Push Sales-Ratio Into Recessionary EnvironmentBusiness inventories-to-sales ratios remain in the flahing red recessionary environment as inventories surge more than expected in April. The biggest “field of dreams” appears to be Clothing and Building Materials. The 0.4% rise (against 0.2% expectations) of business inventories is the highest since May 2014. Motor Vehicles saw a 1.2% rise MoM in inventories (and 5.9% YoY) leading the surge in the “if we build it, credit will enable everyone to buy it” economy.

Charts: Bloomberg |

| Fashion brand Bally back on growth path, says CEO MONACO (Reuters) – Bally, the long-struggling Swiss leather goods maker, is back in growth mode after years of stagnant sales, buoyed by more contemporary designs and solid demand from Japanese and U.S. buyers, its chief executive said. |

Earnings Summary for Today

leading Stock Positions

Current Commodity Prices

Commodities are powered by Investing.com

Current Currency Crosses

The Forex Quotes are powered by Investing.com.

To contact me with questions, comments or constructive criticism is always encouraged and appreciated: