Written by rjs, MarketWatch 666

This is a feature at Global Economic Intersection every Monday evening or Tuesday morning.

Please share this article – Go to very top of page, right hand side, for social media buttons.

Oil hits 32 mo high; refineries running at post pandemic high, gasoline output at 15 mo high; DUC backlog at 8.4 months

- Oil prices hit 32 month high

- Natural gas price hits 7 month high

- Refinery utilization at a 17 month high

- Refinery throughput at a 16 month high

- Gasoline production at a 15 month high

- Post pandemic record jump in combined fuel demand

- Distillates exports at a 37 week high

- DUC backlog at 8.4 months

Oil prices rose to a 31 month high for the fourth straight week on rising demand and falling supplies early this week, before fading going into the weekend on fears of a tighter monetary policy…after rising 1.9% to a 31 month high of $70.91 a barrel last week on forecasts from the EIA and IEA for higher fuel demand in the second half of 2021, the contract price of US light sweet crude for July delivery opened lower on Monday due to the expected extension of virus restrictions in the U.K, but then moved more than 1% higher, boosted by renewed confidence in the economic revival and an associated jump in oil demand, before sliding back to end down 3 cents at $70.88 a barrel, on traders’ concern over gasoline demand and the potential for new oil supply from Iran….but oil opened higher on Tuesday and shot up nearly 2%, buoyed by expectations demand would recover rapidly in the second half of 2021. and settled $1.24 higher at $72.12 a barrel, the highest in more than two and a half years, getting a further boost from expectations of higher energy demand ahead of an EIA report that was expected to show a fourth-straight weekly decline in crude inventories…oil prices extended their gains in after hours trading Tuesday evening after the American Petroleum Institute reported the biggest draw from crude inventories in more than 5 months and hence opened 33 cents higher on Wednesday, and then headed to $73 oil after the EIA also reported a big crude draw, along with a pickup in fuel demand, before again fading at the close to finish just 3 cents higher at yet another 32 month high of $72.15 a barrel, pulled lower after Fed officials suggested they expected two interest rate increases by the end of 2023…oil prices slumped in Thursday’s trading as a rising dollar pushed traders who had bought oil as an inflation hedge to dump the commodity, and July crude settled $1.11 lower at $71.04 a barrel as demand worries resurfaced after new coronavirus cases jumped in Britain, while supply concerns over the return of Iranian barrels also weighed on the market…after falling for a second day in Asian trading on a surging dollar, oil prices rebounded in thin holiday trading in the US on Friday after OPEC sources said the producer group expected limited U.S. oil output growth this year, despite rising prices, and finished 60 cents higher at $71.64 a barrel, thus ending up 1.0% on the week and posting a fourth straight weekly gain, as signs of a global demand recovery and supply discipline among producers encouraged traders…

Natural gas prices finished lower for just the second time in eleven weeks, as utilities switched to cheaper coal and cooler weather was forecast to follow this week’s heatwave …after rising 6.4% to a seven month high at $3.296 per mmBTU last week after a major eastern pipeline announced pressure and volume restrictions, the contract price of natural gas for July delivery opened nearly 5 cents higher Monday amid blistering summer heat and a recovery in LNG exports, and extended those gains to close 5.6 cents higher at another seven month high of $3.352 per mmBTU….but gas prices were down twice that much Tuesday, settling at $3.240 per mmBTU, after Monday’s high gas prices prompted power generators to switch to coal to keep air conditioning running…natural gas futures retreated more than 5 cents in early trading Wednesday as analysts pointed to technical factors, rather than fundamentals, that were moving prices, before recovering to close 1.1 cents higher at $3.251 per mmBTU as new data showed production declined, exports climbed and weather forecasts pointed to strong cooling demand in the weeks ahead…natural gas prices were little changed on Thursday, closing up 0.2 cents at $3.251 per mmBTU, as a smaller than expected storage build offset forecasts for less hot weather over the two weeks following this week’s record breaking heatwaves…but natural gas prices slid 3.8 cents to finish the week down 2.5% at $3.215 per mmBTU on Friday, as weather forecasts for the week ahead shifted cooler and a storm in the Gulf of Mexico threatened to curb demand…

The natural gas storage report from the EIA for the week ending June 11th indicated that the amount of natural gas held in underground storage in the US rose by 16 billion cubic feet to 2,427 billion cubic feet by the end of the week, which thus left our gas supplies 453 billion cubic feet, or 15.7% below the 2,880 billion cubic feet that were in storage on June 11th of last year, and 126 billion cubic feet, or 4.9% below the five-year average of 2,553 billion cubic feet of natural gas that have been in storage as of the 11th of June in recent years…however, this week’s storage data was skewed by a record one-time adjustment of 51 billion cubic feet of gas, shifted from working storage to cushion gas by Pacific Gas and Electric, that resulted in a steep decrease in reported working gas supplies in the Pacific region;…absent that ‘on paper’ reclassification, injections of natural gas into storage were actually at 67 billion cubic feet during the cited week… nonetheless, the 16 billion cubic feet increase in US natural gas officially in storage this week was therefore far below the average forecast of a 78 billion cubic foot addition from an S&P Global Platts survey of analysts, and was also way below the average addition of 87 billion cubic feet of natural gas that have typically been injected into natural gas storage during the second week of June over the past 5 years, as well as far below the 86 billion cubic feet that were added to natural gas storage during the corresponding week of 2020…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending June 11th showed that because of a big increase in our oil exports and another increase in our refinery throughput, we again needed to withdraw oil from our stored commercial crude supplies for the sixth time in the past seven weeks and for the 20th time in the past thirty-one weeks….our imports of crude oil rose by an average of 108,000 barrels per day to an average of 6,746,000 barrels per day, after rising by an average of 1,007,000 barrels per day during the prior week, while our exports of crude oil rose by an average of 953,000 barrels per day to an average of 3,884,000 barrels per day during the week, which meant that our effective trade in oil worked out to a net import average of 2,862,000 barrels of per day during the week ending June 11th, 845,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, the production of crude oil from US wells reportedly rose by 200,000 barrels per day to 11,200,000 barrels per day, and hence our daily US oil refineries reported they were processing 16,337,000 barrels of crude per day during the week ending June 11th, 412,000 more barrels per day than the amount of oil they used during the prior week, while over the same period the EIA’s surveys indicated that a net of 1.178,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US….so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from net imports, from storage, and from oilfield production was 1,097,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just plugged a (+1,097,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet to make the reported data for the daily supply of oil and the consumption of it balance out, essentially a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been a error or errors of that magnitude in this week’s oil supply & demand figures that we have just transcribed…..furthermore, since last week’s EIA fudge factor was at (+276,000) barrels per day, that means there was a 820,000 barrel per day balance sheet difference in the unaccounted for crude oil figure from a week ago, thus rendering the week over week supply and demand changes we have just transcribed meaningless…. however, since most everyone treats these weekly EIA reports as gospel and since these figures often drive oil pricing and hence decisions to drill or complete wells, we’ll continue to report them as they’re published, just as they’re watched & believed to be accurate by most everyone in the industry….(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,322,000 barrels per day last week, which was 5.9% less than the 6,721,000 barrel per day average that we were importing over the same four-week period last year… the 1,178,000 barrel per day net withdrawal from our crude inventories included a 1,051,000 barrel per day withdrawal from our commercially available stocks of crude oil, and a 127,000 barrel per day withdrawal from our Strategic Petroleum Reserve, space in which has been leased for commercial purposes…this week’s crude oil production was reported to be 200,000 barrels per day higher at 11,200,000 barrels per day because the rounded estimate of the output from wells in the lower 48 states was 200,000 barrels per day higher at 10,800,000 barrels per day, while an 3,000 barrel per day increase in Alaska’s oil production to 446,000 barrels per day had no impact on the rounded national total….US crude oil production was at a pre-pandemic record high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 14.5% below that of our production peak, yet still 32.9% above the interim low of 8,428,000 barrels per day that US oil production fell to during the last week of June of 2016…

Meanwhile, US oil refineries were operating at 92.6% of their capacity while using those 16,337,000 barrels of crude per day during the week ending June 4th, up from 91.3% of capacity the prior week, and the highest refinery utilization since January 3rd of last year…while the 16,337,000 barrels per day of oil that were refined this week were the most since January 17, 2020 and 20.1% higher than the 13,600,000 barrels of crude that were being processed daily during the pandemic impacted week ending June 12th of last year, they were still 5.4% below the 17,264,000 barrels of crude that were being processed daily during the week ending June 14th, 2019, when US refineries were operating at a close to summertime normal 93.9% of capacity…

With this week’s increase in the amount of oil being refined, the gasoline output from our refineries increased by 495,000 barrels per day to a 15 month high of 9,926,000 barrels per day during the week ending June 11th, after our gasoline output had decreased by 136,000 barrels per day over the prior week…while this week’s gasoline production was 18.8% higher than the 8,356,000 barrels of gasoline that were being produced daily over the same week of last year, it was still half a percent lower than the March 13th 2020 pre-pandemic high of 9,974,000 barrels per day, and 4.8% below the gasoline production of 10,423,000 barrels per day during the week ending June 14th, 2019….meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 135,000 barrels per day to 5,056,000 barrels per day, after our distillates output had increased by 111,000 barrels per day over the prior week…while this week’s distillates output was 12.4% more than the 4,498,000 barrels of distillates that were being produced daily during the week ending June 12th, 2020, it was still 5.9% below the 5,371,000 barrels of distillates that were being produced daily during the week ending June 14th, 2019..,…

With the increase in our gasoline production, our supply of gasoline in storage at the end of the week increased for the ninth time in eleven weeks, and for the 23rd time in thirty-one weeks, rising by 1,954,000 barrels to 242,980,000 barrels during the week ending June 11th, after our gasoline inventories had increased by 7,046,000 barrels over the prior week...our gasoline supplies increased by less this week because the amount of gasoline supplied to US users increased by 880,000 barrels per day to 9,360,000 barrels per day, even as our exports of gasoline fell by 122,000 barrels per day to 835,000 barrels per day, while our imports of gasoline remained unchanged at 1,050,000 barrels per day…and even after this week’s inventory increase, our gasoline supplies were 5.5% lower than last June 12th’s gasoline inventories of 256,995,000 barrels, but remained close to the five year average of our gasoline supplies for this time of the year…

Meanwhile, despite the increase in our distillates production, our supplies of distillate fuels decreased for the eighth time in ten weeks and for the 14th time in 26 weeks, falling by 1,023,000 barrels to 136,191,000 barrels during the week ending June 11th, after our distillates supplies had increased by 4,412,000 barrels during the prior week….our distillates supplies fell this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, rose by 923,000 barrels per day to 4,336,000 barrels per day, even as our imports of distillates rose by 182,000 barrels per day to 371,000 barrels per day while our exports of distillates rose by 174,000 barrels per day to a 37 week high of 1,237,000 barrels per day….after eight inventory decreases over the past ten weeks, our distillate supplies at the end of the week were 21.9% below the 174,471,000 barrels of distillates that we had in storage on June 12th, 2020, and about 6% below the five year average of distillates stocks for this time of the year…

Finally, with the jump in our oil exports and the ongoing increase in our oil refining, our commercial supplies of crude oil in storage fell for ninth time in the past seventeen weeks and for the 26th time in the past year, decreasing by 7,355,000 barrels, from 474,029,000 barrels on June 4th to 466,674,000 barrels on June 11th, after our crude supplies had decreased by 5,241,000 barrels the prior week….after this week’s decrease, our commercial crude oil inventories fell to about 5% below the most recent five-year average of crude oil supplies for this time of year, but were still 32.0% above the average of our crude oil stocks as of the the second week of June over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels….since our crude oil inventories had jumped to record highs during the Covid lockdowns of last spring, our commercial crude oil supplies as of this June 11th were 13.5% less than the 539,280,000 barrels of oil we had in commercial storage on June 12th of 2020, and are now 3.3% less than the 482,364,000 barrels of oil that we had in storage on June 14th of 2019, but are still 9.4% more than the 426,527,000 barrels of oil we had in commercial storage on June 15th of 2018…

This Week’s Rig Count

The US rig count rose for the 35th time over the past 40 weeks during the week ending June 18th, but it’s still down by 40.7% from the pre-pandemic rig count….Baker Hughes reported that the total count of rotary rigs running in the US was up by 9 to 470 rigs this past week, which was also up by 204 rigs from the pandemic hit 266 rigs that were in use as of the June 19th report of 2020, but was still 1,459 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, the week before OPEC began to flood the global oil market in an attempt to put US shale out of business….

The number of rigs drilling for oil was up by 8 to 373 oil rigs this week, after rising by 6 rigs the prior week, and that’s now 184 more oil rigs than were running a year ago, but it’s still just 23.2% of the recent high of 1609 rigs that were drilling for oil on October 10th, 2014….at the same time, the number of drilling rigs targeting natural gas bearing formations was up by 1 to 97 natural gas rigs, which was also up by 22 natural gas rigs from the 75 natural gas rigs that were drilling during the same week a year ago, and still just 6.0% of the modern era high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….

The Gulf of Mexico rig count was unchanged at 13 rigs this week, with all 13 of those rigs drilling for oil in Louisiana’s offshore waters….that was two more than the 11 rigs that were drilling in the Gulf a year ago, when again all 11 Gulf rigs were drilling for oil offshore from Louisiana….since there are no rigs operating off of other US shores at this time, nor were there a year ago, this week’s national offshore rig totals are equal to the Gulf rig count… however, in addition to those rigs offshore, a rig continued to drill through an inland lake in St Mary parish, Louisiana this week, whereas there were no such “inland waters” rigs running a year ago…

The count of active horizontal drilling rigs was up by 5 to 425 horizontal rigs this week, which was also up by 191 rigs from the 234 horizontal rigs that were in use in the US on June 19th of last year, but less than a third of the record of 1372 horizontal rigs that were deployed on November 21st of 2014….at the same time, the vertical rig count was up by three to 20 vertical rigs this week, and those were also up by 6 from the 14 vertical rigs that were operating during the same week a year ago….in addition, the directional rig count was up by 1 to 25 directional rigs this week, which was also up by 7 from the 18 directional rigs that were in use on June 19th of 2020….

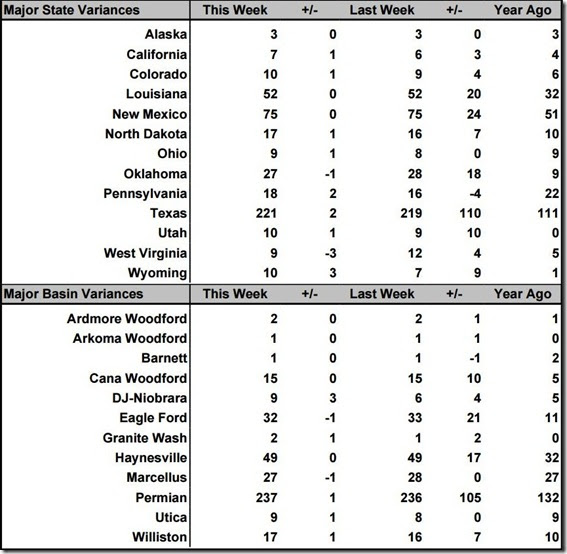

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of June 18th, the second column shows the change in the number of working rigs between last week’s count (June 11th) and this week’s (June 18th) count, the third column shows last week’s June 11th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 19th of June, 2020..

As you can see, rig additions were quite widespread this week, suggesting that higher prices are contributing to new drilling activity in areas that have long been stable….checking first for the details on the Permian basin in Texas from the Rigs by State file at Baker Hughes, we find that five oil rigs were added in Texas Oil District 8, which is the core Permian Delaware, while four rigs were pulled out from Texas Oil District 7C, which encompasses the southern counties of the Permian Midland, which thus gives us a net increase of just one rig in the Texas Permian…elsewhere in Texas, we find that three rigs were added in Texas Oil District 2, while three rigs were pulled out of Texas Oil District 1, at least one but possibly all of which account for the decrease in the Eagle Ford shale, depending on how many of the District 2 additions were targeting that basin….Texas also had an oil rig added in Texas Oil District 10 in the panhandle, which accounts for this week’s Granite Wash basin addition…elsewhere, the three rigs added in the Denver-Julesburg Niobrara chalk of the Rockies’ front range account for the Colorado rig addition and two of new Wyoming rigs, while the other new Wyoming rig was set up in a basin that Baker Hughes doesn’t track…Baker Hughes also doesn’t account for changes in the basins of California or Utah, two other states where rigs were added this week…likewise, the rig pulled out in Oklahoma was also from a basin that Baker Hughes does keep counts on…however, the oil rig addition in North Dakota was in the Bakken shale of the Williston basin….meanwhile, for rigs targeting natural gas, there was a rig addition in Ohio’s Utica shale, and two rigs added in Pennsylvania’s Marcellus, while three rigs were pulled out of the Marcellus in West Virginia at the same time….natural gas rigs were still up by one, however, because a natural gas rig was added in one of those aforementioned basins that Baker Hughes doesn’t track, which would include at least one of the rig additions in Texas Oil District 2…

DUC well report for May

Monday of this past week saw the release of the EIA’s Drilling Productivity Report for June, which includes the EIA’s May data for drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions….that data showed a decrease in uncompleted wells nationally for the 12th month in a row, as both completions of drilled wells and drilling of new wells increased, but remained below the pre-pandemic levels…for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 247 wells, falling from a revised 6,768 DUC wells in April to 6,521 DUC wells in May, which was also 26.1% fewer DUCs than the 8,822 wells that had been drilled but remained uncompleted as of the end of May of a year ago…this month’s DUC decrease occurred as 532 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during May, up from the 511 wells that were drilled in April, while 779 wells were completed and brought into production by fracking, up from the 765 completions seen in April, and up from the pandemic hit 253 completions seen in May of last year, but down by 40% from the 1,298 completions of May 2019….at the May completion rate, the 6,521 drilled but uncompleted wells left at the end of the month represents a 8.4 month backlog of wells that have been drilled but are not yet fracked, down from the 9.1 month DUC well backlog of a month ago, with the understanding that this normally indicative backlog ratio is being skewed by a completion rate that is still around 50% below the pre-pandemic norm…

Both oil producing regions and natural gas producing regions saw DUC well decreases in May, and none of the major basins reported DUC well increases….the number of uncompleted wells remaining in the Permian basin of west Texas and New Mexico decreased by 115, from 2,731 DUC wells at the end of April to 2,616 DUCs at the end of May, as 258 new wells were drilled into the Permian during May, while 373 wells in the region were completed…at the same time, DUC wells in the Niobrara chalk of the Rockies’ front range fell by 41, decreasing from 448 at the end of April to 407 DUC wells at the end of May, as 44 wells were drilled into the Niobrara chalk during May, while 85 Niobrara wells were being fracked….in addition, DUCs in the Eagle Ford of south Texas decreased by 31, from 1,071 DUC wells at the end of April to 1,040 DUCs at the end of May, as 53 wells were drilled in the Eagle Ford during May, while 84 already drilled Eagle Ford wells were completed…. at the same time, there was also a decrease of 27 DUC wells in the Bakken of North Dakota, where DUC wells fell from 663 at the end of April to 636 DUCs at the end of May, as 29 wells were drilled into the Bakken during April, while 56 of the drilled wells in the Bakken were being fracked….. meanwhile, the number of uncompleted wells remaining in Oklahoma’s Anadarko decreased by 19, falling from 880 at the end of April to 861 DUC wells at the end of May, as 27 wells were drilled into the Anadarko basin during May, while 46 Anadarko wells were being fracked….

Among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, fell by 13 wells, from 590 DUCs at the end of April to 577 DUCs at the end of May, as 72 wells were drilled into the Marcellus and Utica shales during the month, while 85 of the already drilled wells in the region were fracked….in addition, the natural gas producing Haynesville shale of the northern Louisiana-Texas border region saw their uncompleted well inventory decrease by 1 to 384, as 49 wells were drilled into the Haynesville during May, while 50 of the already drilled Haynesville wells were fracked during the same period….thus, for the month of May, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) decreased by a total of 233 wells to 5,560 wells, while the uncompleted well count in the natural gas basins (the Marcellus, the Utica, and the Haynesville) decreased by 14 wells to 961 wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas…

Senate committee eyes vote to shield natural gas from cities’ bans – An Ohio Senate committee could vote out legislation Tuesday that would shield the natural gas industry from the potential of cities seeking to crack down on fossil fuel emissions. If passed, House Bill 201 would block any city or county from issuing any law or zoning code that “limits, prohibits, or prevents” people and businesses from obtaining natural gas or propane service. At least 14 states have passed similar preemption bills this year, according to a runningcount from the National Resources Defense Council, with similar efforts underway in another five.A small but growing list of progressive cities around the U.S. have passed legislation banning new buildings from obtaining natural gas hookups, an effort to cut down on greenhouse gas emissions that contribute to climate change.No Ohio cities have joined in, although some (including Cincinnati, Lakewood, and Cleveland) have passed resolutions establishing goals of becoming carbon neutral in the coming years.About two in three Ohio households use natural gas for heat, far more than electricity (25%), propane (5%), or other sources, according to U.S. Census data compiled by the Legislative Service Commission, which conducts policy analysis for lawmakers. The House passed the bill in mid-May on a 65-32 vote, with all Republicans and two Democrats in support. Supporters say the legislation preserves consumers’ rights of choice as to the energy they purchase. Also, they say allowing cities or counties to restrict natural gas development would create a labyrinth of local regulations for the industry to work around. Update: The Senate Energy and Public Utilities Committee passed House Bill 201 at 10 a.m. Tuesday.

Ohio’s HB No. 152 Sponsors Amend Forced-Pooling Bill, But Gateway Royalty Says Not Enough — After sounding the alarm, in a press release dated May 25, 2021, concerning an industry backed bill before the Ohio House Energy and Natural Resources Committee that would have required forced-pooled mineral owners to accept large cost deductions from their monthly royalties, These cost deductions, which are sometimes paid to affiliates of the oil and gas producers, “are as much as 95% of the sale price and can reduce the royalty payments to almost nothing,” says Chris Oldham, the president of Gateway Royalty LLC, a company that invests in oil and gas by buying a portion of mineral owners’ royalty interests.Facing public outrage over forcing out-sized costs on mineral owners, oil and gas producers have backed away from the bill, and Ohio’s sponsors of H.B. No. 152 have put forward a substitute bill that requires the royalties to be paid on the gross proceeds of the sale of the oil and gas.Gateway Royalty has been advised on very short notice that there will be a hearing on the substitute bill this week before the House Energy and Natural Resources Committee on Wednesday, June 16, 2021, at 10:30 AM, in Room 116 of the Ohio State House.”The new bill is certainly better than the original,” says Oldham, “but unleased mineral owners can still get stuck with huge cost deductions because operators have figured out clever ways to deduct costs, even if the lease says the royalties will be paid on the gross proceeds.”One way, Oldham says, is by selling the oil and gas to a marketing affiliate. “The operator sells the oil and gas to the affiliate at the well, the affiliate processes the oil and gas and sells it downstream of the well, and then the affiliate pays the operator the price it receives less all costs between the well and the downstream point of sale.” Oldham says. “This two-step marketing gambit allows the operator to say it deducted no costs,” Oldham says, “when in fact costs were netted out of the true gross sale price by the affiliate.”Another ploy used by operators, Oldham says, is to add a “market enhancement” clause to a gross proceeds lease. “The lease will say the royalty will be on the gross proceeds and list all the costs that can’t be deducted but will then have a clause that says costs can be deducted if they enhance the value of an already marketable product,” Oldham explains. “The operator then says that the oil and gas was in marketable condition the moment it left the ground, meaning that all costs between the well and the point of sale can be deducted, including the long list of costs the lease just said would not be deducted.”

Pennsylvania’s gas-well revenue down as price, drilling drop – Pennsylvania’s counties and municipal governments will see the lowest level of annual fee revenue they get from Marcellus Shale gas wells, as drilling slowed and prices sank during the pandemic, the Pennsylvania Public Utility Commission said Monday. Impact fee revenue from Marcellus Shale wells sank to $146 million from drilling activity in 2020, down $54 million from the year before, the commission said. Lawmakers authorized the fee in 2012, pinning it to new wells and the price of natural gas. But the average price of natural gas in 2020 was $2.08 per million British thermal units, down from $2.63 in 2019. Pennsylvania also saw the fewest number of new wells drilled than in any year since the law was enacted, the commission said. Most of the money, about $71.5 million, goes to county and municipal governments, while smaller amounts are earmarked for environmental improvement programs, roadway repairs and water and sewer infrastructure upgrades.

Impact fee payments shrink as natural gas price, drilling declined in 2020 -Low natural gas prices and scant new drilling sent Pennsylvania’s impact fee revenue from shale gas wells plummeting to the lowest level on record for the 2020 reporting year, according to Pennsylvania Public Utility Commission data released this week.Companies operating Marcellus and Utica shale wells paid $146 million – about $54 million less than the year before. The annual fee was driven down by the lowest average annual price of natural gas and the fewest number of new wells drilled since the impact fee was established in 2012, the PUC said.Impact fees are collected in April and distributed in July.County and municipal governments that host shale wells will receive $71 million of the total revenue, while state agencies will get $24 million and the Marcellus Legacy Fund, which pays for environmental, highway and water projects throughout the state, will get $51 million.In a sharp reversal prompted by the pandemic and a mild winter, the local share of impact fee revenue was nearly cut in half from the 2018 reporting year, when the levy hit a record high.About $33 million of the fees will go to Southwestern Pennsylvania counties and municipalities, according to an analysis by the Marcellus Shale Coalition, with Washington and Greene county communities receiving $21 million of the region’s share.The impact fee is charged per well to compensate the state and local communities for the industry’s demands on roads, public services and the environment. Most gas-producing states implement severance taxes on natural gas that are based on price and production volumes, but those are secondary factors in calculating Pennsylvania’s impact fees.According to a report last week from the Independent Fiscal Office, the total impact fee revenue relative to the market value of the gas produced in 2020 amounted to an annual average effective tax rate of 3.3%.Companies pay lower impact fees for wells as they age, so the revenue relies on new drilling. This was the first year that fees from new wells were not enough to fully offset lost fees from aging wells, the fiscal office said. There were only 475 new wells subject to the fee in 2020. The previous record low collection was $173 million for the 2016 reporting year. The impact fee has raised $2 billion over the last decade.

Who pays for the care of “orphaned” oil and gas wells? You do — When oil and gas wells end their useful life, one of two things happens: 1) They are plugged and capped to prevent further flows or 2) they are simply abandoned.When they fall into the second category, they are called “orphaned” wells and they become the responsibility of the government to secure. But that’s if the government actually knows about them. Records of well placements are not always so carefully maintained and can get lost during bankruptcies and changes in ownership or due to sheer carelessness. As a result, there appear to be far more abandoned wells than the orphaned ones that governments know about.Companies are required to post bonds to pay for the plugging and capping of wells by the state if the companies fail to plug and cap them. However, these bonds are entirely inadequate. According to Grist, in Texas the bonds covered just 16 percent of the costs incurred by the state in 2015. In New Mexico the number was 18 percent.The pattern here is a familiar one. The profits of oil and gas production get privatized and the costs – in this case, environmental and health costs – get socialized, that is, members of the public get saddled with the costs either through clean-up or damage to health and property.The environmental costs include damage to soil, air and water. But perhaps the most enduring damage is to aquifers as briny water from brackish aquifers, chemicals used in well operations, and hydrocarbons migrate upward to poison drinkable groundwater wherever well casings are cracked and leaking. This is something that proper plugging can prevent. Such pollution of aquifers can render groundwater unfit for human or animal consumption for any time frame relevant to human societies.And there is the leakage of methane, a potent greenhouse gas, from abandoned gas wells and wells that produced both oil and what is called associated gas.There have been millions of oil and gas wells drilled in the United States since the beginning of the oil age and millions more drilled throughout the world. The carelessness of those who drilled and prospered by them is now turning into an ugly and persistent legacy of the industrial age.

Clean-up continues at Brookhaven spill site as residents worry about long-term effects – The clean-up of a fuel spill that killed numerous aquatic creatures and forced Coebourn Elementary School to go virtual continues as officials work to determine the extent of the damage and cause. Borough officials were out along the 2300 block of Mt. Vernon Avenue Monday, talking with neighbors and checking the sanitary sewers Monday for any additional contamination. “The clean-up is ongoing and we are trying to reassure the residents that everything is okay and if they have any questions or concerns to contact the borough,” Crews were busy using a giant vacuum truck to remove the petroleum from a marshy retention pond next to the school as well as soiled and debris from behind the gas station where the spill began. Borough engineers along with the county hazmat team were performing a smoke test of the sanitary sewer lines to check for any infiltration of water getting in and going back to the water treatment plant, Montella said. “Our home values just went down,” said Ginny McKee, a resident along Mt. Vernon Avenue which backs up directly behind the school. “You’re also talking about the environment. We run our dogs back here, the kids play back here.” McKee said the stench from the gas irritated her eyes and throat and neighbor Fred Lincoln agreed. “It actually gave me a headache Saturday afternoon,” said Lincoln, who was out walking his dog, Buttercup, when he got a whiff of the fumes. Montella said a company will also test the tightness of the tanks and lines at the gas station to rule out the possibility of a leak. He said the tanks at the station have not been drained and the monitoring system indicates the levels are stable. An overflow alarm first sounded at 10:53 p.m. Friday; however, first responders didn’t get a call until 6:15 Saturday morning which came from a resident some distance away on Brookhaven Road who reported an odor of gas. Firefighters quickly tracked the smell back to the Gas-N-Go station at 4612 Edgmont Ave. They also found much of the fuel ponding in the retention basin on the other side of the elementary school. Schultz said fish and waterways officials said the damage was contained to two small creeks Shepherds run and Coebourn run. “We’re trying to prevent it from getting into the large creek.” Mondella said. As to pinpointing the source of the spill, officials are still investigating and cautious to lay blame. “We don’t know if the release was related to the delivery of the product, we know there was a truck delivering product at roughly the time the alarm went off,” Montella said. “The gas station is tight and the lines are tight but we lost a lot of product. We’re trying to determine why that happened. Was it a catastrophic failure, was it negligence on the driver? We just don’t know. We’re investigating all ends.”

Sewer contractor demands $13M from O&R utility for putting it between rock and hard place – A New Jersey contractor is demanding $13 million from Orange and Rockland Utilities Inc. for allegedly blocking completion of a sewer project. Metra Industries Inc. of Little Falls accused the electric and gas utility of fraud, defamation and tortious interference, in a complaint filed June 11 in U.S. District Court, White Plains. The utility caused “massive delays and cost overruns,” Metra claims, “due to O&R’s failure to … relocate its gas mains.” The Rockland County Sewer District awarded Metra a $14.7 million contract in 2014 to extend a sewer line three miles from a wastewater treatment plant in Hillburn to homes in Sloatsburg. Time was of the essence, according to the Route 17 Project specifications. The job had to be completed in 365 days. Parts of the sewer line had to be installed under 15 to 25 feet of ledge rock in a public right-of-way that O&R used for gas lines. Rock had to be blasted and removed. Plans allowed for low peak particle velocity explosions – a measure of movement or vibration within the ground – so as to prevent damage to existing pipes. The contract also allowed for the possibility of moving the gas lines, the lawsuit states, and New York law requires utilities to relocate pipes at their own expense when required for public health and safety or convenience. Metra states it had installed about 74% of the pipes by February 2016, all in places with little rock. But when it came time to break rock, the project ground to a near standstill. Metra claims it was not possible to break the rock with low velocity blasts, and O&R refused to move its gas lines.

Pipeline moves forward, Longmeadow Select Board approves MSBA requests – Michelle Marantz, chair of the Longmeadow Pipeline Awareness Group, informed the Longmeadow Select Board of movement in the gas pipeline issue. “Eversource recently told me that they will move forward with the old Columbia Gas plan to build a high-pressure pipeline starting at a proposed metering station on [Longmeadow Country Club (LCC)] property and ending in Springfield.” She said that Eversource plans to announce the pipeline route and get feedback from the town beginning in July. Eversource confirmed to Reminder Publishing that it is “evaluating options for a Western Massachusetts Reliability Project,” which includes the pipeline through Longmeadow. The project seeks to serve 58,000 customers in Agawam, West Springfield, Southwick, Springfield, Longmeadow, East Longmeadow and Chicopee by replacing the existing pipeline, which Eversource Spokesperson Priscilla Ress described as “aged” and “a significant risk” of future outages. She said the company is exploring safe service to customers “while balancing environmental impacts and cost.” Marantz stated that Eversource’s plans ignore the state’s 2021 climate bill, “An Act Creating a Next Generation Roadmap for Massachusetts Climate Policy,” which sets an emissions reduction mandate of 50 percent by the year 2030. She also balked at the company’s declaration that it is working toward a “clean-energy future.” She emphasized the potential danger of pipelines by citing the Marshfield Pipeline Fire and held up Easthampton as a model the town should aspire toward. Its municipal buildings are scheduled to run on 40 percent solar power by August.

Flooding effects of Mountain Valley Pipeline under scrutiny after weekend damage in central WV— Long beleaguered by erosion concerns, the Mountain Valley Pipeline is facing complaints that it exacerbated adverse effects from flooding that hit central West Virginia this weekend. Environmental control devices installed along the route were overwhelmed by a large amount of rain in a short period of time, said Natalie Cox, spokeswoman for Equitrans Midstream Corp., the Canonsburg, Pennsylvania-based developer of the pipeline. Cox noted that rainfall averaged 4 to 6 inches across all areas of the route from Monday through Sunday. Mountain Valley Pipeline reported to the West Virginia Department of Environmental Protection’s state spill line that it lost timber mats because of high water and crossed a creek in Braxton County. It lists Clover Fork as the affected stream. Monroe County resident and pipeline opponent Maury Johnson notified the DEP of reports he received of sediment control issues in Lewis, Braxton and Webster counties, sending state environmental regulators photos of damage near U.S. 19, in Braxton County. “They’re trying to build across these steep, slip-prone soils that we have,” Johnson said. A Lewis County landowner reported to environmental regulators that extreme flash-flooding exceeded 6 feet near Second Big Run, destroying the pipeline’s silt barriers and fencing, washing out the base of timber mats and suggesting that the area is unstable because of deforestation and saturated soil increasing the risk for mass flooding in the valley. Johnson contended that erosion issues with the pipeline will persist until the pipeline is removed from steep slopes and trees are reestablished on them. Cox said the pipeline has paused construction to focus on environmental compliance and right-of-way stabilization. Each specific location along the route will resume full activities as permitted, once erosion and sediment control measures are evaluated and found to be meeting or exceeding compliance requirements, she added. Fines and concerns over lack of erosion controls have dogged the Mountain Valley Pipeline project. An analysis that the anti-pipeline group Mountain Valley Watch submitted to federal regulators in February argued that an increased risk of landslides along the project route in Lewis County remains, despite efforts to stabilize slide areas. The filing cites topographic and rainfall studies, past filings with federal regulators and aerial photographs of the pipeline to make a case that highly erodible soils, above average annual precipitation rates and steep mountain slopes have produced an ideal situation for landslides to occur.

TETCO Pipe Throttling 40% of MU Southbound Gas to Last All Summer –Traders are crediting news from Enbridge’s Texas Eastern Transmission (TETCO) pipeline that a recent flow restriction enforced by the Pipeline and Hazardous Material Safety Administration (PHMSA) will continue through the end of summer with helping to spike the Henry Hub futures price of natgas, up 4.5% on Friday to close at $3.30/MMBtu. Last week MDN brought you the news that TETCO was denied permission to continue operating its pipeline system (three pipelines, actually) at full pressure (see PHMSA Forces TETCO Pipe to Throttle 40% of M-U Southbound Gas). The 20% reduction in pressure translates to some 40% of the gas that was flowing from the Marcellus/Utica to the Gulf Coast via TETCO disappearing. At least until “late in the third quarter” of this year, meaning the end of summer.PHMSA ordered the reduction in pressure after TETCO found “an anomaly” during a recent inspection that the agency wants to investigate. Since TETCO has had three explosions in various locations since 2016, it’s probably a good idea to back off on the pressure for now. However, reduced flows mean higher prices at the Henry Hub and (gulp) lower spot prices in the M-U region. We can’t get our gas out to other markets willing to pay more.Enbridge Inc’s ENB.TO Texas Eastern Transmission (TETCO) unit said late Thursday it anticipated the earliest its 30-inch natural gas pipe from Pennsylvania to Mississippi could return to full pressure was late in the third quarter of 2021.TETCO declared a force majeure on May 28 after the U.S. Pipeline and Hazardous Material Safety Administration (PHMSA) required the company to reinstate a 20% pressure restriction on two of three lines (Lines 10 and 15) that make up the 30-inch system between its Kosciusko, Mississippi, and Uniontown, Pennsylvania, compressor stations effective June 1.That reduction cut flows from Appalachia to the Gulf Coast on the 30-inch system at the Owningsville compressor station in Kentucky to 1.0 billion cubic feet per day(bcfd) so far in June from an average of 1.9 bcfd in May, according to Refinitiv data.Even though analysts said most of that gas could travel on other pipes, the premium of next-day gas at the Henry Hub NG-W-HH-SNL benchmark in Louisiana over the Dominion South hub NG-PCN-APP-SNL in Pennsylvania rose to $1.08 per million British thermal units so far in June from an average of 66 cents in May.Traders said that wider spread was a sign that at least some lower-cost gas from Appalachia was no longer reaching the Gulf Coast.PHMSA’s order came as part of the agency’s increased monitoring of TETCO after three recent explosions. The first was in January 2019 in Ohio, the second in August 2019 in Kentucky, which was fatal, and the third in May 2020 in Kentucky.PHMSA ordered the reduction after TETCO found “an anomaly” during a recent inspection that the agency wants to investigate. (1) Reuters/Nasdaq (Jun 11, 2021) – Enbridge U.S. TETCO natgas pipe likely to remain reduced until Q3

Solution to TETCO (& Other) Southbound Pipes? New NE Refineries – As we report today, Enbridge’s Texas Eastern Transmission (TETCO) pipeline will not be back to full pressure flowing Marcellus/Utica gas south (some of it to the Gulf Coast) until the end of summer. Last week MDN brought you the news that TETCO was denied permission to continue operating its pipeline system (three pipelines, actually) at full pressure (see PHMSA Forces TETCO Pipe to Throttle 40% of M-U Southbound Gas). The reduced pressure of 20% means some 40% of the gas that was flowing from the Marcellus/Utica to the Gulf Coast via TETCO is now gone. Following that post, we received an email from one of our favorite industry observers, Garland Thompson, who proposes the ultimate solution to the problem of decreased flows on TETCO (and other pipelines) to the Gulf Coast.Garland’s solution? Quit sending our gas south! Instead, let’s build refineries and new export facilities in the northeast to process and use that gas. Let’s build petrochemical plants here, in our own neighborhood, to use the natural gas that has been feeding petchem plants and LNG facilities along the Gulf Coast. We think Garland’s suggestion makes eminent good sense.mHere’s the note we received from Garland last week, reproduced here with his permission:The true problem this story illustrates, painfully, is that TETCO, the former “Little Big Inch” constructed in Jig-Time during World War II and repurposed for natural-gas delivery after the war, is old technology, as far as pipeline construction goes. Metal fatigue in a transport vessel never intended to contain the pressures now experienced due to the Gulf Coast’s increased demand for Appalachian Mountain gas thus could be expected to produce failures.What’s really needed here is a wide recognition that the U.S. Gulf Coast is truthfully not the ideal place from which to export Appalachia’s gas. It just happens that the Gulf Coast has good facilities to do so, because for the last 100 years the Oil Patch was the main U.S. source of petroleum and its associated natural gas, emerging as the headquarters of the world oil industry. What’s really needed badly in the U.S. petroleum and gas industry is a Northern alternative terminal capacity: Not decreased oil refining, such as occurred when the plants along the Hudson River and the Delaware shut down, but increased refining capacity. Look what’s happened: * At the end of the day, what’s urgently needed is a new appreciation for the opportunities opened to Eastern business leaders – and the workers they could employ – by the advantageous development of newly recoverable gas and oil reserves from the Marcellus and Utica shales, less than a quarter of the distance away from the Delaware River ports than their distance to the U.S. Gulf Coast. Those gas and NGL exports – bigger from the Gulf Coast ports than from Marcus Hook or even from Cove Point, Maryland, on the Chesapeake – could be exported in bigger volumes with lowered pipe-transport costs from the Delaware. But pipeline opponents, “activist investors” seeking capitalist rents from solar and wind-power development growth, and other environmental activists continue to fight the building of East Coast transmission lines while they also blithely continue their everyday use of the products made from petroleum, natural gas, and natural gas liquids. Just as long as the plants making those products are located elsewhere – preferably foreign elsewhere – the activists pretend not to know the origins of their favorate consumer products while they stay focused on fighting U.S. production.

July Natural Gas Futures, Cash Prices Soar Amid Blistering Heat — Natural gas futures on Monday rallied for a fifth consecutive day as simmering summer heat, a recovery in liquefied natural gas (LNG) levels and supply pressures collectively provided further price support. The July Nymex contract settled at $3.352/MMBtu, up 5.6 cents day/day. August rose 5.6 cents to $3.367. Strong near-term weather demand also boosted cash prices. NGI’s Spot Gas National Avg. soared 26.5 cents to $3.325. The prompt month gain followed a nearly 15-cent surge last Friday, boosted by weather demand and festering worries associated with potentially prolonged restrictions on the Texas Eastern Transmission Co. (Tetco) system. Tetco said a 20% pressure reduction that began this month on part of its 30-inch diameter system could last until late in the third quarter. This developed after Tetco reported an anomaly that was identified during recent inspections. “We believe the market may still be underestimating the impact of the anomaly discovered on Tetco’s 30-inch pipeline,” analysts at EBW Analytics Group said Monday. EBW is watching to see if “it is found to extend into other segments of the line or takes many more months to repair than the time frame specified in the Tetco notice, as we believe is likely to occur.” “It may take weeks or even months before the gas market fully recognizes the extent of the impact,” the EBW analysts added. Meanwhile, hotter-than-normal conditions could persist for the rest of June over parts of the West, Midwest and Southeast, bolstering natural gas demand, while production is holding steady at around 91-92 Bcf/d. Bespoke Weather Services expects a “hotter overall base state” over the next two weeks. “Best heat in the near term remains in the western half of the nation, where some records likely fall this week, though as we move closer to the end of the month, some modest above normal temperatures can return to the eastern U.S.,” Bespoke said.

U.S. natgas falls from 7-month high on lower power generator gas use (Reuters) – U.S. natural gas futures fell over 3% on Tuesday from a seven-month high in the prior session as Monday’s high prices prompted power generators to burn more coal and less gas to keep air conditioners humming. Traders noted the decline in futures came even though next-day power and gas prices in Texas and California spiked to multimonth highs as homes and businesses cranked up their air conditioners to escape brutal heat waves. Front-month gas futures NGc1 fell 11.2 cents, or 3.3%, to settle at $3.240 per million British thermal units (mmBtu). On Monday, the contract closed at $3.352, its highest since October 2020. Data provider Refinitiv said gas output in the Lower 48 U.S. states averaged 91.7 billion cubic feet per day (bcfd) so far in June, up from 91.0 bcfd in May but still well below the monthly record high of 95.4 bcfd recorded in November 2019. With warmer weather on the horizon, Refinitiv projected average gas demand, including exports, would rise from 89.1 bcfd this week to 89.6 bcfd next week. Those demand forecasts were lower than Refinitiv projected on Monday on expectations of lower power generator demand. The amount of gas flowing to U.S. LNG export plants slid to an average of 9.7 bcfd so far in June, down from 10.8 bcfd in May and an all-time high of 11.5 bcfd in April. Traders noted LNG feedgas was down due to short-term maintenance at the Sabine Pass and Cameron export plants in Louisiana and some of the pipelines that provide them with fuel. But with European and Asian gas prices both trading over $10 per mmBtu, analysts said they expect buyers around the world to keep purchasing all the LNG the United States can produce.

US working natural gas net build drops on reclassification to base gas: EIA Due to a massive reclassification of working natural gas to base gas in the Pacific storage region, the US Energy Information Administration reported a paltry 16 Bcf net injection to inventories for the week ended June 11 as below-average builds ahead look to drive up the deficit further. Storage inventories increased by an implied flow of 67 Bcf for the week ended June 11, according to EIA data released June 17. However, due to the 51 Bcf reclassification in Pacific Gas & Electric’s storage system in California, the net change resulted in a 16 Bcf injection for the week. This proved well below the five-year average of 87 Bcf. Storage volumes now stand 453 Bcf, or 16%, less than the year-ago level of 2.88 Tcf and 126 Bcf, or 5%, less than the five-year average of 2.553 Tcf. The NYMEX Henry Hub July contract dipped 2 cents to $3.23/MMBtu in trading following the release of the weekly storage report. Prices through balance of summer were trading roughly 3 cents lower on the day, bringing the July-October Henry Hub contract strip down to an average $3.24/MMBtu. This extends the volatility that has marked the gas markets over the last week. Prices rose from $3.16/MMBtu to $3.30/MMBtu June 11 following news from Texas Eastern Pipelines that its 30-inch system would be operating at a reduced pressure through the end of Q3, limiting supplies from reaching the Gulf Coast region. The upward pressure continued to mount in the days that followed, culminating in a settlement of $3.36/MMBtu on June 14 before falling sharply in the following days. Overall, prices are up roughly 5 cents from where they were a week ago, but they are down nearly 15 cents from where they were only a few days ago. Platts Analytics’ supply and demand model currently forecasts a 58 Bcf injection for the week ending June 18, which would measure 25 Bcf less than the five-year average and 57 Bcf below last year.

July Natural Gas Futures Falter After EIA Posts Light Storage Injection – The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 16 Bcf into natural gas storage for the week ended June 11. Natural gas futures dived lower after the report. The result was skewed by a one-time adjustment in the Pacific that resulted in a steep decrease in working gas stocks in that region. EIA announced an implied build of 67 Bcf for the week, a few below median estimates. However, the large reclassification in the West made the actual storage change only 16 Bcf. Pacific Gas and Electric Co. (PG&E) said it reclassified 51 Bcf from working gas to cushion gas, effectively removing that amount from the available inventory. PG&E initially reported that the change would take effect with next week’s storage report, but EIA pushed up the timeline. The PG&E adjustment reflected a change in the company’s accounting methodology.Analysts on The Desk’s online energy platform Enelyst said the magnitude and accelerated timing of the adjustment likely caused some traders to pause to digest the change. It marked the largest reclassification in any one region to date.“The scale of this is preposterous,” said one participant on The Desk. Ahead of the EIA report, the July contract was down 3.2 cents at $3.219/MMBtu. The prompt month picked up a cent when the EIA data was released at 10:30 ET. Within a half an hour, though, it was down 6.0 cents to $3.191.

U.S. natural gas flat as small storage build offsets milder forecasts – U.S. natural gas futures were little changed on Thursday as a smaller than expected storage build offset forecasts for less hot weather over the next two weeks following heatwaves in Texas and California this week. Those heatwaves caused some power prices in the U.S. West to hit multiyear highs and boosted power demand in Texas to a June record as homes and businesses cranked up their air conditioners. The U.S. Energy Information Administration (EIA) said utilities added 67 billion cubic feet (bcf) of gas into storage during the week ended June 11. Analysts said that was smaller than usual because the weather last week was warmer than normal and exports to Mexico were at record highs. That was lower than the 72-bcf build analysts projected in a Reuters poll and compares with an increase of 87 bcf in the same week last year and a five-year (2016-2020) average increase of 86 bcf. Last week’s injection, which included a reclassification of 51 bcf of working gas (gas that can be used) into base gas (gas left in storage to maintain pressure) by PG&E Corp in California, boosted stockpiles to 2.427 trillion cubic feet (tcf). That is 4.9% below the five-year average of 2.553 tcf for this time of year. Front-month gas futures rose 0.2 cents, or 0.1%, to settle at $3.253 per million British thermal units. Data provider Refinitiv said gas output in the Lower 48 U.S. states averaged 91.6 billion cubic feet per day (bcfd) so far in June, up from 91.0 bcfd in May but still well below the monthly record high of 95.4 bcfd recorded in November 2019. Despite forecasts for a gradual increase in average nationwide temperatures in coming weeks, Refinitiv projected average gas demand, including exports, would slip from 89.5 bcfd this week to 87.8 bcfd next week as power generators burn more coal and less gas to keep air conditioners humming. The amount of gas flowing to U.S. LNG export plants slid to an average of 9.7 bcfd so far in June, down from 10.8 bcfd in May and an all-time high of 11.5 bcfd in April.

Weekly Natural Gas Prices Advance Amid Sweltering Western Heat – Natural Gas Intelligence – Weekly cash prices gained ground amid scorching temperatures and strong cooling demand across much of the western Lower 48, highlighted by whopping surges in California. NGI’s Weekly Spot Gas National Avg. for the June 14-18 period climbed 24.0 cents to $3.170.Blistering heat moved in early across the Plains, Mountain West, Southwest and California and hung around most of the week, driving up demand and prices. High temperatures ranged from the high 90s in the Dakotas to 120 in the deserts of the Southwest, baking Las Vegas, Phoenix and other major markets.It was hot over most of the South and Texas, as well, throughout the week. Citing sustained highs in the 90s and forced power outages, the Electric Reliability Council of Texas asked Texans during the week to conserve as much energy as possible to avoid blackouts.As the trading week closed in California, SoCal Citygate was up $2.550 to $6.330 and SoCal Border Avg. was ahead $1.725 to $4.835. In the Southwest, El Paso S. Mainline/N. Baja surged $2.560 to $5.745. The July Nymex futures contract, meanwhile, finished a bumpy trading week on a sour note. The prompt month settled at $3.215/MMBtu to close the trading week Friday, down 3.8 cents day/day.Futures stumbled as weather forecasts for the week ahead shifted cooler and a storm in the Gulf of Mexico (GOM) threatened to curb demand. A record reclassification that altered the latest government inventory report also weighed on markets.Pacific Gas and Electric Co. (PG&E) said it reclassified 51 Bcf from working gas to cushion gas, effectively removing that amount from the available inventory. The U.S. Energy Information Administration announced an implied build of 67 Bcf for the week ended June 11, but the PG&E accounting adjustment reduced totals in the Pacific region, and the official injection into storage fell to 16 Bcf.

TSA working on additional pipeline security regulations following Colonial Pipeline hack – The Transportation Security Administration (TSA) is working on an additional cybersecurity directive for pipeline companies in the wake of the ransomware attack on Colonial Pipeline. “We are continuing to develop additional measures for pipeline companies, and we are developing now a second security directive which would have the force of a regulation,” Sonya Proctor, the assistant administrator for Surface Operations at TSA, testified during a hearing held by two House Homeland Security Committee subcommittees on Tuesday. The new directive will be the second issued by TSA, with the agency rolling out a directive last month that required pipeline owners and operators to report cybersecurity incidents within 12 hours of discovery to the Cybersecurity and Infrastructure Security Agency (CISA). It also increased coordination between pipeline owners and both CISA and TSA. Proctor said Tuesday that the upcoming second directive would be classified as more sensitive in nature than the first directive due to “the nature of the mitigating measures that are going to be required.” She noted that the directive “will require more specific mitigation measures, and it will ultimately include more specific requirements with regard to assessments,” and that TSA inspectors trained in both pipeline operations and cybersecurity will be tasked with ensuring pipeline companies adhere to both directives. “As recently evidenced, cyber intrusions into pipeline computer networks have the potential to negatively impact our national security, economy, commerce, and wellbeing,” Proctor said as part of her prepared statement for the hearing. “For these reasons, TSA remains committed to securing our Nation’s pipelines against evolving and emerging risks.” Both directives are being put together by TSA in the wake of the ransomware attack on Colonial Pipeline last month. The company provides 45 percent of the East Coast’s fuel supply, and major gas shortages were seen in several states when Colonial was forced to shut down the entire pipeline for nearly a week to protect operational controls from attack. Colonial subsequently revealed that it had opted to pay the attackers around $4.4 million in Bitcoin demanded to regain control of its systems, though the Justice Department announced last week that it had been able to recover the majority of those funds. House lawmakers Tuesday stressed the need for both TSA and CISA to have more visibility and powers when it came to responding to a cyberattack on critical systems such as pipelines, and criticized Colonial for not accepting CISA’s assistance in investigating its networks following the attack. “Colonial still has not agreed to participate in the physical assessment, and only agreed to cooperate with TSA’s cybersecurity assessment three weeks after the ransomware attack occurred,” Rep. Bonnie Watson Coleman (D-N.J.), chair of the committee’s subcommittee on Transportation and Maritime Security, testified. “If this is at all indicative of how pipeline owners and operators view their regulators, we have a problem.”

Gulf County Exploratory Oil And Gas Well A Dry Hole – Oil and natural gas exploration in the Apalachicola River basin has encountered a setback. For the second time in three years, an exploratory well in the area has found nothing worth developing. Apalachicola Riverkeeper Georgia Ackerman said the latest attempt to find oil and natural gas in the area has been unsuccessful. “The Bear Creek well that Spooner Petroleum was drilling in Gulf County near the Wetappo Creek headwaters has come up dry.” Ackerman said the wellhead has now been permanently capped. Although that doesn’t mean exploration in the area has totally ceased. “Currently in Calhoun County, Cholla Petroleum of Dallas, Texas has 6 oil and gas permits that are active. Drilling has not begun. As we understand it, the buildout for some of those pads has begun. So we’ll continue to monitor to stay abreast of what’s happening out there.” Nearly three years ago, another exploratory well in Calhoun County also turned out nonproductive.

OIL AND GAS: Interior faults major drilling company on worker safety — Wednesday, June 16, 2021 —The Bureau of Safety and Environmental Enforcement yesterday faulted one of the world’s largest offshore drilling companies for trying to ride out a hurricane last year, risking workers and causing nearly $6 million in damages to equipment.

Oil Companies Evacuating U.S. Gulf of Mexico Platforms ahead of Storm –Chevron Corp and Occidental Petroleum Corp said on Thursday they were withdrawing staff and implementing storm precautions at their U.S. Gulf of Mexico offshore facilities ahead of a brewing tropical storm. A weather disturbance over the Gulf of Mexico could become a tropical storm by Friday and take aim at the Louisiana and Mississippi coasts, the U.S. National Weather Service said on Thursday. “All of our facilities have plans to prepare for weather-related events and are implementing those procedures,” Occidental said on its website. It did not comment on production. Chevron said it had removed non-essential staff from three U.S. Gulf of Mexico oil platforms and fully evacuated a fourth. Output remains at normal levels, the company said. “We will continue to closely monitor the storm and we remain focused on the safety of our workforce, the integrity of our facilities and the protection of the environment,” spokesperson Deena McMullen said. All workers were evacuated from Chevron’s Genesis facility, located about 150 miles (240 km) off the coast of Louisiana, and non-essential workers were removed from its Big Foot, Jack/St. Malo and Tahiti production platforms. BP and Shell said they were monitoring the situation. Tropical storm conditions could begin Friday along portions of the central Gulf Coast from Louisiana to the Alabama/Florida border. Rainfall of up to 12 inches in isolated areas could hit the Gulf Coast and the Southern Appalachians, the National Weather Service said.

Federal Judge Deals Major Blow To Biden’s “Green” Agenda, Orders Resumption In Federal Drilling Auctions A federal judge in Louisiana on Tuesday blocked the Biden administration’s pause on oil and gas leasing on public lands and waters, dealing a setback to a key White House effort to address climate change. The order granted a preliminary injunction to Louisiana and 12 other states that sued Democratic President Joe Biden and the Interior Department over the freeze on new drilling auctions. Louisiana is a major hub for offshore oil and gas production. Biden paused the government’s leasing auctions in January pending a review that is expected to be completed in the coming weeks. The move was part of a sweeping plan to rein in fossil-fuel extraction and combat the effects of climate change. The Interior Department said it would comply with the ruling, but did not say when auctions might resume. The nation’s top oil and gas trade group, the American Petroleum Institute, issued a statement urging the administration “to move expeditiously to follow the court’s order and lift the federal leasing pause.” The Center for Biological Diversity environmental group said in a statement the order “turns a blind eye to runaway climate pollution that’s devastating our planet.” The judge’s decision, which applies to onshore and offshore leasing nationwide, will remain in effect pending the final resolution of the case or orders from higher courts, according to a court document. In the ruling, Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana said the states had met the requirements to establish that they would suffer injury from the pause on new oil and gas leases. “Millions and possibly billions of dollars are at stake,” Doughty wrote.

Amid oil and gas buildout, Louisiana industry pushes for less oversight – When a natural gas pipeline fire in Paradis killed one worker and burned three others in 2017, the Louisiana State Police ordered Phillips 66 to pay a $22,000 fine for failing to immediately report the incident. The fire burned for four days before first responders could put it out. But the company ultimately didn’t pay any police fine, ending up with just a warning. That story is common, according to public records reviewed by the Louisiana Illuminator and Floodlight with The Guardian. The Louisiana State Police – which oversees pipeline safety – issued 34 fines and five warning letters in the past five years. A quarter of those penalties were reduced: three were lowered, five were replaced with warning letters, and two were dismissed. The fines that did stick were low, between $2,250 to $8,000. Aside from the obvious potential harms to workers, gas leaks pose fire risks and can cause respiratory problems for people in nearby communities. The company was separately fined $20,000 over the incident by the Department of Natural Resources. Despite the record of lax enforcement by the State Police, gas companies in the state say they are being treated unfairly and have lobbied for legislation to loosen requirements around reporting pipeline leaks. Louisiana has more gas pipelines than any other state except Texas, and more gas pipeline projects are planned in the state to support the growing demand for US natural gas exports. The proposal, House Bill 549 from state Rep. Danny McCormick (R-Oil City), was approved by the Legislature and has been sent to Gov. John Bel Edwards’ desk. It is one of many efforts by the influential oil and gas industry to avoid regulation and keep its tax rates low in the state. If signed into law,it would absolve companies from reporting natural gas leaks of less than 1,000 pounds, unless they cause hospitalization or death.

New plant proposals on the table as power outages threaten Texas again (Reuters) – A proposal to spend $8 billion on new power plants in Texas has stalled, Starwood Energy Group’s chief executive said on Monday, as the state’s grid operator called for conservation amid record demand. In April, the Connecticut investment firm proposed the construction of 11 natural-gas fired power plants, aiming to improve grid reliability during times of extreme demand. State grid operator, the Electric Reliability Council of Texas (ERCOT), on Monday asked residents to reduce electricity use “as much as possible” through Friday, citing plants supplying 11,000 megawatts that were offline as temperatures hit 98 degrees Fahrenheit (37 Celsius). Starwood’s proposal to build “peaker plants” for such outages was the second presented to Texas this year. A similar plan for 10 plants was submitted in March by Berkshire Hathaway Inc.The company has held early conversations with stakeholders, Saxena said, and lawmakers have looked at proposals submitted to ERCOT and state regulator the Public Utility Commission of Texas (PUCT), according to a spokesperson for the PUCT.

Exclusive-Shell weighs blockbuster sale of Texas shale assets – (Reuters) – Royal Dutch Shell is reviewing its holdings in the largest U.S. oil field for a potential sale, people familiar with the matter told Reuters, marking a key moment in its shift away from fossil fuels as it faces growing pressure to slash carbon emissions. The sale could be for part or all of Shell’s position in the U.S. Permian Basin, located mostly in Texas, which accounted for around 6% of the Anglo-Dutch company’s total oil and gas output last year. The holdings could be worth more than $10 billion, the people said. Shell declined to comment. There was no guarantee Shell would end up striking a deal for the assets, said the people, who spoke on condition of anonymity to discuss confidential information. Shell, the second largest western energy company, and its peers have come under investor pressure to increase profits and slash planet-warming greenhouse gas emissions, including by shedding assets. Any retreat from the Permian would mark a major shift from an area previously identified as one of nine core basins in its energy transition strategy to net-zero carbon emissions by 2050. For all the activity in the Permian, profits have remained elusive because of scale and constant drilling required to boost output.

Interest in Shell’s Permian assets seen as a bellwether for shale demand – (Reuters) – A cadre of oil companies, seeing continued profits in shale, are mulling Royal Dutch Shell’s holdings in the largest U.S. oil field as the European giant considers an exit from the Permian Basin, according to market experts. The potential sale of Shell’s Permian holdings, located in Texas, would be a litmus test of whether rivals are willing to bet on shale’s profitability through the energy transition to reduce carbon emissions. Shell would follow in the footsteps of other producers, including Equinor and Occidental Petroleum that have shed shale assets this year, looking to cut debt and reduce carbon output in the face of investor pressure. Shell, which declined to confirm on Reuters’ report on Sunday that it was weighing the blockbuster sale of its Texas shale assets, also did not comment for this story. To showcase its 260,000 acres (105,200 hectares) in the Permian, Shell has opened a data room, according to two people familiar with the matter. ConocoPhillips, Devon Energy, Chevron Corp , EOG Resources and some private energy houses are all potential bidders for some or all of Shell’s Permian assets, according to analysts. None of the four publicly-traded companies immediately responded to comment requests. U.S. oil output is still roughly 2 million barrels per day below its all-time record production of nearly 13 million bpd hit before the coronavirus pandemic, that made it the world’s top producer. Oil prices have rebounded in 2021 with fuel demand rising as the pandemic ebbs. Benchmark U.S. crude futures are up 49% this year to nearly $72 per barrel, more than double their 2020 lows. Against this backdrop, estimates for Shell’s acreage run from $7 billion to over $10 billion, the latter implying a valuation of almost $40,000 an acre. That would be in line with the per-acre price Pioneer Natural Resources paid for DoublePoint Energy in April, the most costly deal since a 2014-2016 rush by producers to grab positions in the Permian. Most Permian deals this year have closed between $7,000 and $12,000 per acre, said Andrew Dittmar, senior mergers and acquisitions analyst at data provider Enverus.