by Bill Bonner, Daily Reckoning

As metals prices boomed during the last decade, small explorers and big miners spent billions of shareholder dollars seeking new deposits. Investors wanted the high rewards of a discovery as metals soared in price. At $1,900 per ounce of gold, even mediocre finds could make money.

Richard Schodde, of MinEx Consulting, has studied past exploration cycles in detail. He says we are seeing a tightening of the sector, as the availability of capital has plummeted. Costs of exploration are coming down as companies cut back on high-salaried employees and reduce operating costs.

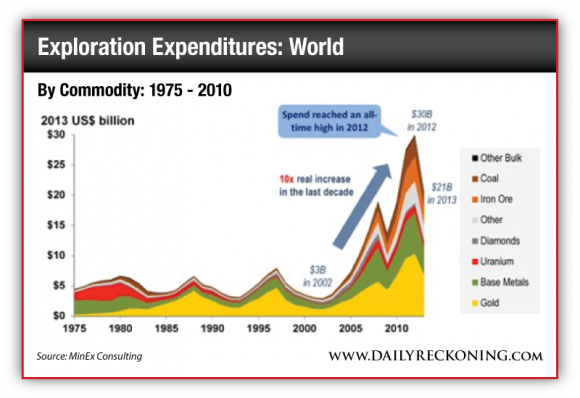

The following chart from MinEx shows exploration expenditures rising quickly during the boom years:

The amount of money spent exploring rose during the last decade from $2.9 in 2002 to $29.4 billion in 2012, before falling back to $21 billion in 2013 says Mr. Schodde. Over the time-frame 2002-12 $136 billion was spent world-wide on non-bulk exploration, resulting in 647 significant new discoveries, of which only 18 are considered to be ‘top tier.’

Despite a 10-fold increase in the amount of money spent on exploration over the last decade, the amount of new discoveries was relatively unchanged – meaning that more money was spent per new discovery. Mr. Schodde explains that as more money went into the sector, expenses related to exploring went up. Geologists and engineers demanded higher salaries. Drilling equipment and operators became more expensive, and money was spent liberally on general and administrative expenses.

As an ebullient market sentiment took hold, money was also wasted on projects with negligible odds of success or likelihood of development and often incompetent management. So despite high expenditures of capital, the pace of discoveries remained relatively tame.

Mr. Schodde notes that today, salaries and G&A expenses have come down since 2012, and he believes that this trend will continue as capital remains scarce.

Adding to the challenge, finding new deposits will become much tougher for the exploration industry, he says, because most ‘easy-to-find’ deposits have already been discovered. Explorers will have to drill deeper in known mineral-rich locations, such as Western Australia, or look in problematic jurisdictions, such as Central Africa. Making discoveries should become more costly for these reasons.

Already, new discoveries are barely keeping pace with depletion, says Mr. Schodde.

What is the Income Play Rich Investors Love? (Hint: It’s Tax-Free)

As he explains, only about half of new decently-sized deposits will later become a mine. Depending on the commodity and location it will take 10-15 years on average for a discovery to become a mine. So we must discover about twice as much metal today as we will be using in a decade from now in order to maintain supply.

Looking ahead to expected production rates in 2020, gold is being discovered at 1.5 times the expected depletion rate. New copper deposits are being discovered at 1.7 times the projected consumption rate in 2020, which is also below the ‘replacement rate’ for the metal.

The exploration sector is contracting – spending less money and pursuing fewer projects – and is being forced to be more efficient, Mr. Schodde explains.

While exploration expenses have come down, the need for new deposits is strong. The exploration industry will need to make more new discoveries, despite decreasing capital available, or the supply of mined metals is likely to decline in coming years.