Of the five Federal Reserve districts which have released their April manufacturing surveys, all are forecasting growth. A complete summary follows.

Texas factory activity increased for the 12th month in a row in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 17.1 to 24.7, reaching its highest level in four years and indicating stronger output growth.

Some other measures of current manufacturing activity also reflected more robust growth. The new orders index posted a four-year high, rising to 21.3. The capacity utilization index rose to a multiyear high as well, climbing from 13.1 to 18.7, with a third of manufacturers noting an increase. The shipments index fell 7 points to 12.4, indicating the volume of shipments grew but at a slower pace than in March.

Perceptions of broader business conditions were markedly more optimistic in April. The general business activity index rose for a second consecutive month, increasing from 4.9 to 11.7. The company outlook index jumped nearly 15 points to a four-year high of 23.4, reflecting a sharp rise in optimism among manufacturers.

Labor market indicators reflected stronger employment growth and longer workweeks. The April employment index rose to 19.7, its highest reading in more than two years. Twenty-eight percent of firms reported net hiring compared with 8 percent reporting net layoffs. The hours worked index spiked from 5.3 to 13.9, indicating a sizeable increase in workweek length.

Upward pressure on input prices eased somewhat in April, while pressure ticked up for selling prices and wages. The raw materials price index declined sharply from 23.1 to 10.2, reaching an 8-month low. Meanwhile, the finished goods price index edged up to a reading of 8. Looking ahead, 36 percent of respondents anticipate further increases in raw materials prices over the next six months, while 25 percent expect higher finished goods prices. The wages and benefits index increased slightly to 21.3. This index has been consistently elevated since December, suggesting strong upward pressure on compensation costs for five months.

Expectations regarding future business conditions remained optimistic in April. The index of future general business activity rose 7 points to 24.5, while the index of future company outlook was largely unchanged at 26.9. Indexes for future manufacturing activity pushed further into positive territory.

Source: Dallas Fed

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

/images/z richmond_man.PNG

Kansas Fed (hyperlink to reports):

/images/z kansas_man.PNG

Dallas Fed (hyperlink to reports):

/images/z dallas_man.PNG

Philly Fed (hyperlink to reports):

/images/z philly fed1.PNG

New York Fed (hyperlink to reports):

/images/z empire1.PNG

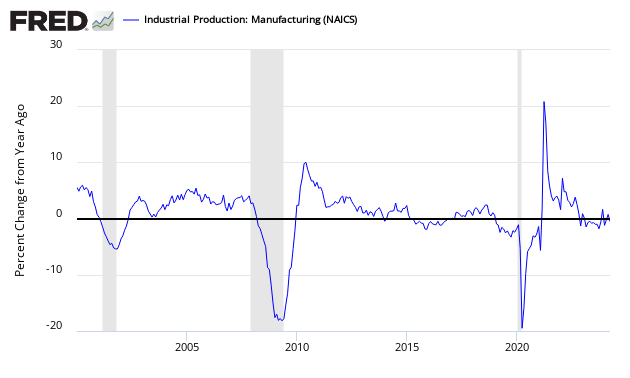

Federal Reserve Industrial Production – Actual Data (hyperlink to report)

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

Comparing Surveys to Hard Data

![]()

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.