Of the three regional Federal Reserve surveys released to date, two show manufacturing expanding in March 2014.

Fifth District manufacturing activity remained soft in March, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments and the volume of new orders declined. Manufacturing employment remained flat, while the average workweek edged up and wages rose moderately.

Manufacturers’ expectations moved back in line with January’s expectations. A participant commented that weather has “wreaked havoc” on demand for the past two months, but he anticipated that his company will be very busy once the weather improves. Compared to last month’s outlook, shipments and new orders were expected to grow more quickly. Additionally, manufacturers looked for faster growth in backlogs and capacity utilization. Firms anticipated slightly longer vendor lead times in the six months ahead. Survey participants also expected faster growth in the number of employees along with strong growth in wages and a pickup in the average workweek.

Raw materials and finished goods prices rose at a slower pace in March compared to last month. Manufacturers expected faster growth in prices paid and prices received over the next six months, although their outlook was below February’s expectations.

Current Activity

The composite index of manufacturing dipped to a reading of −7 following last month’s reading of −6. The index for shipments slipped three points to −9, while the index for new orders remained at an indicator of −9. Manufacturing employment remained flat the past two months.

The index for backlog of orders slowed four points from last month’s reading. The capacity utilization index also slipped, ending at −14. Vendor lead time lengthened, moving the index to 6 from a reading of 0. Finished goods inventories built up at nearly the same rate as a month ago. Raw materials inventories grew more slowly compared to last month.

As weather improved slightly, a participant stated that his company was trying to catch up from weather-related plant shutdowns by adding employees and increasing capacity utilization.

Read entire source document from Richmond Fed

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

/images/z richmond_man.PNG

Kansas Fed (hyperlink to reports):

/images/z kansas_man.PNG

Dallas Fed (hyperlink to reports):

/images/z dallas_man.PNG

Philly Fed (hyperlink to reports):

/images/z philly fed1.PNG

New York Fed (hyperlink to reports):

/images/z empire1.PNG

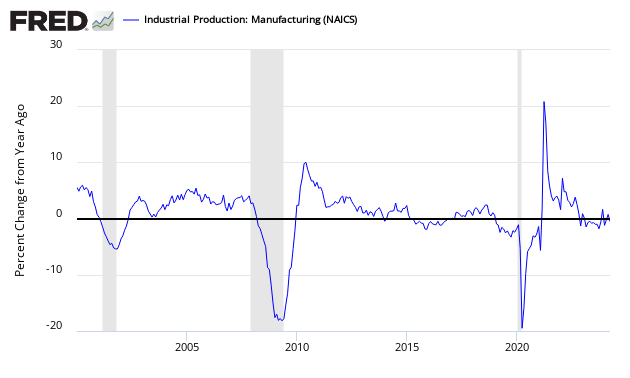

Federal Reserve Industrial Production – Actual Data (hyperlink to report)

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Richmond Fed Survey (dark green bar).

Comparing Surveys to Hard Data

![]()

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.