Three regional surveys released to date for January show manufacturing expansion.

TENTH DISTRICT MANUFACTURING SURVEY REBOUNDED MODERATELY

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity rebounded moderately in January, and factories’ production expectations continued to climb higher.

“We were encouraged to see overall regional factory activity grow in January after dropping last month, said Wilkerson. Production fell slightly in January, which many firms again attributed to weather-related delays, but orders rose and optimism about the future increased.”

TENTH DISTRICT MANUFACTURING SUMMARY

Tenth District manufacturing activity rebounded moderately in January, and factories’ production expectations continued to climb higher. Many contacts blamed winter weather issues for the slowdown in December, citing lost production days, delays in supply shipments, and lower customer demand. Production also declined slightly in January, for similar reasons, but was expected to rise strongly heading forward. Price indexes rose in January, particularly expectations for raw materials prices.

The month-over-month composite index was 5 in January, up from -3 December and similar to the reading of 6 in November (Tables 1 & 2, Chart). The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased at both durable and nondurable goods-producing plants, with the exception of food, beverage, and aerospace products. Most other month-over-month indexes also rose in January. The production index edged higher from -13 to -8, and the shipments, new orders, and order backlog indexes all rebounded from last month. The employment index jumped from 0 to 11–its highest level since October 2011–and the new orders for exports index moved into positive territory for the first time in five months. The raw materials inventory index increased from -1 to 6, and the finished goods inventory index also inched higher.

Most year-over-year factory indexes increased after falling last month. The composite year-over-year index rose from 3 to 8, and the production, shipments, and new orders indexes also improved moderately. The capital spending index posted its highest level since March, and the new orders for exports index edged up from -3 to 3. The employment and order backlog indexes were relatively unchanged. Both inventory indexes increased for the second straight month.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

/images/z richmond_man.PNG

Kansas Fed (hyperlink to reports):

/images/z kansas_man.PNG

Dallas Fed (hyperlink to reports):

/images/z dallas_man.PNG

Philly Fed (hyperlink to reports):

/images/z philly fed1.PNG

New York Fed (hyperlink to reports):

/images/z empire1.PNG

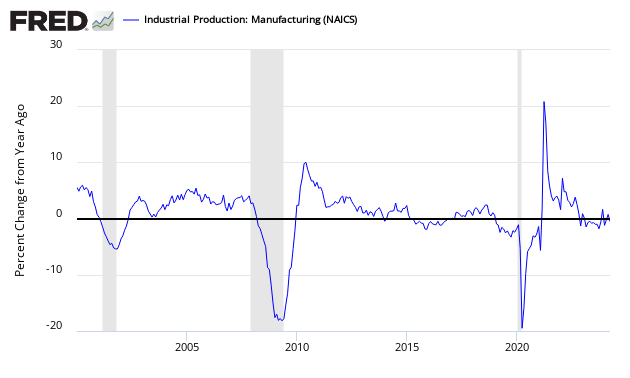

Federal Reserve Industrial Production – Actual Data (hyperlink to report)

Holding this and other survey’s Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Kansas City Survey (pea-green bar).

Comparing Surveys to Hard Data

![]()

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.