Article of the Week from Fixing the Economists

by Philip Pilkington

As part of the research for one of the chapters of my recently published book, I was reading Keynes’ Treatise on Money. The book, while fundamentally flawed due to its Wicksellian (perhaps even New Keynesian!) framework, has a lot of interesting material that the General Theory lacks (not least a theory of profits). It is also cast, as GLS Shackle never tired of noting, in an explicitly dynamic framework rather than the inferior comparative statics framework of the General Theory.

Please share this article – Go to very top of page, right hand side, for social media buttons.

Anyway, in reading the book one of the Fundamental Equations caught my eye as being particularly relevant to the present moment. The Equation is the following and can be found on page 137:

Where P is the price-level, W are wages, e is the productivity coefficient, I and S are investment and savings respectively and O is total output.

For Keynes this equation said that the price-level “is made up, therefore, of two terms, the first of which is the level of efficiency-earnings… and the second of which is positive, zero or negative, according as the cost of new investment exceeds, equals or falls short of the volume of current savings” (p136).

We can easily translate the early Wicksellian Keynes into the later Keynes of the General Theory by converting this equation into an equation laying out the components of effective demand rather than a price equation. We can do this simply by assuming that it is quantities rather than prices that may adjust due to a change in any of the terms.

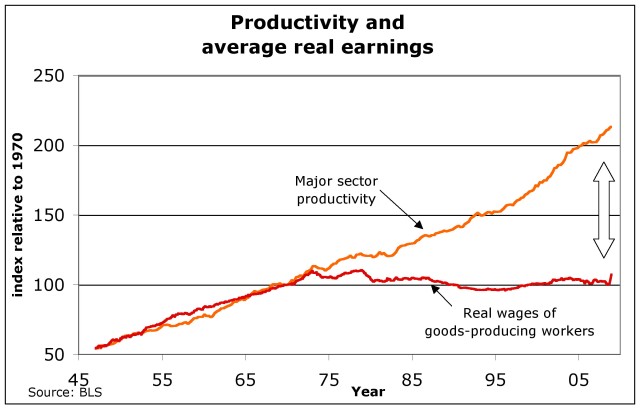

Now, what does this tell us about our present moment. Well, in order to contemplate this take a look at this well-known graph for the US:

That chart maps out the ‘efficiency earnings’ variable of Keynes’ equation. And as we can see real wages in relation to productivity — i.e. Keynes’ ‘efficiency earnings’ — have been falling since the mid-1970s. In Keynes’ discussion in the Treatise on Money this would, ceteris paribus, entail a fall in the price-level. And if we read the equation in terms of quantity adjustments it would entail, again ceteris paribus, a fall in employment and output.

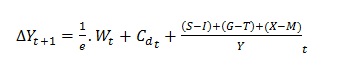

But then why hasn’t there been stagnation since the mid-1970s in the US. Well, if we take Keynes’ equation at face value then net investment must have been picking up the slack left by the fall-off in real wages. Keynes’ framework, however, ignore that the economy is open, has a government sector and that, crucially, money can be spent on final goods and services by a net change in debt. We can thus rewrite the equation as such:

We have made some fairly substantial changes here that we should probably explain. For one, we have replaced the term O with the more conventional term Y. We have also added time periods to highlight the dynamic nature of Keynes’ system in the Treatise. This was particularly important because (obviously) now that we have converted the price equation into a quantity equation we have the variable for output (Y) on both sides. Thus we must distinguish between them to show that they refer to output in different periods and thus cannot “cancel each other out”. Finally, we have opened up the equation to include a government and a foreign sector and added a variable, Cd, which denotes debt-fueled consumption.

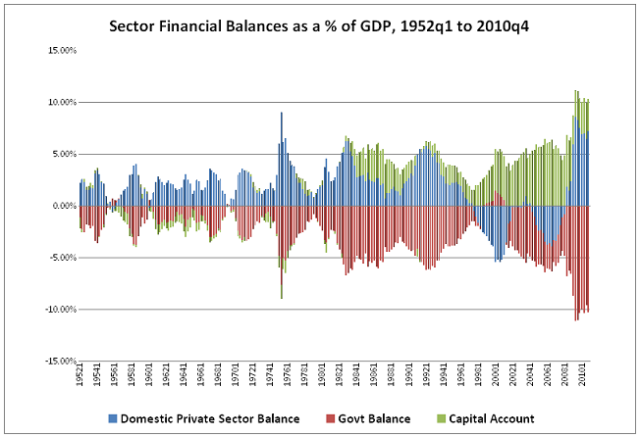

Now we can speculate that the fall in efficiency earnings was probably counteracted by some combination of government deficit spending and debt-based consumption. (Note we also have to account for the US trade deficits in this year which produce a further drag on national income; thus we must assume high private sector debt levels and high government deficits or some combination thereof). When we turn to the statistics we do indeed see something quite like this. First, here are the sectoral balances of this period:

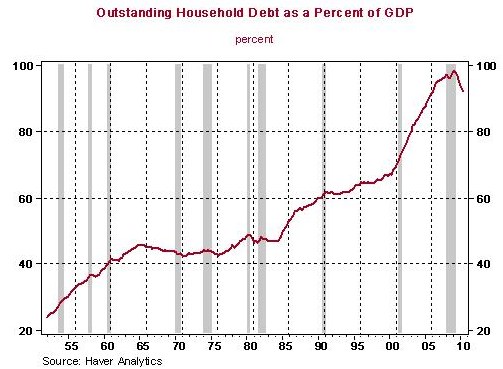

As we can see, it was mainly large government deficits in this period that propped up demand. But at the same time we also see the household debt burden rise relative to GDP. Here is a graph:

So there you have it! With a bit of modification Keynes’ old Fundamental Equations can be used to provide quite a nice account of the current stagnation in the US, which is basically a result of households pulling back on their debt-fueled consumption spending (and the reaction of investment to this loss of effective demand).