by John Mauldin, Thoughts from the Frontline

“Forget the past. The future will give you plenty to worry about.”– George Allen, Sr.

“I try not to worry about the future, so I take each day just one anxiety attack at a time.”– Tom Wilson

Please share this article – Go to very top of page, right hand side for social media buttons.

The middle ground can be uncomfortable. As someone now widely known as the “muddle-through guy,” I have learned this the hard way. My bullish friends call me a worrywart, and the bearish ones think I am Pollyanna incarnate.

The irony here is that I’ve never claimed to be a great trader or a short-term forecaster. I think I have a pretty good record of calling major turning points. Next week or next month is another matter. Anything can happen, and it probably will.

That said, the fact that my forecast may be wrong doesn’t prevent me from making one. So, with all the usual disclaimers, today I will review some recent analysis from my reliable sources and let you take a peek into my worry closet.

One point we all agree on: We live in unusual times.

Sell to Whom?

Last week Doug Kass sent around an e-mail comparing today’s markets to Queen’s classic “Bohemian Rhapsody.” I know that seems odd, but it was actually a good fit. I shared Doug’s full message with my Over My Shoulder subscribers. For everyone else, the point is that, like the song says, “Nothing really matters” to whoever is buying stocks these days. They just keep buying and pushing prices higher. As Jared Dillian says, “It’s a bull market, dude!” Stock prices do go higher in a bull market; and sometimes, as the end approaches, they make value investors very uncomfortable.

Neither Doug nor I quite understand the “Nothing really matters” attitude, though we have some theories. Doug is probably more bearish than I am. He has a long list of open questions. I zeroed in on the last one, which is critical: “When ETFs sell, who will buy?”

The stratospheric ascent of passive indexing is having side effects that I suspect will make markets sick at some point. Passive investing is perverting the financial markets’ core economic function, i.e., efficient capital allocation. In terms of stimulating buying interest, a company’s fundamental business prospects are now much less important than its presence in (or absence from) popular indexes.

We’ve created this environment in which badly managed companies can still see their stock prices rise along with those of well-managed companies. The actual facts about a company don’t mean all that much in a passive-investing world. Capitalization-weighted indexes aggravate this already problematic phenomenon. Money is pouring into stocks like Apple (AAPL) and Amazon (AMZN) simply because they are big. The resulting higher prices make them bigger still, and they pull in yet more capital. Here’s a look at the five largest stocks in the S&P 500.

What about the QQQ or the NDX? The five stocks above represent 42% of the NDX and 13% of the S&P 500. That means every time you buy an index based on the NASDAQ, 42% of your money goes into just five stocks, leaving 58% for the remaining 95. By the time you get past the largest 25, you are under 1% per stock. Apple alone is 12% of the NASDAQ 100 Index and 4% of the S&P 500. That explains, in part, why the NASDAQ has outperformed the S&P 500.

For the record, Goldman Sachs researchers recently released a paper with a strong fundamental forecast for those stocks. That is, they expect them to continue to go up, absent a recession or something else that triggers a bear market. I keep scanning the horizons in every direction, and I just can’t see anything that would trigger more than a minor correction today. Of course, a minor correction could deliver outsized impacts, given the heavy weighting of a few stocks and passive index investing. Be careful out there.

Doug asks, “When ETFs sell, who will buy?” The ETFs of the world may quickly begin trading below their actual net asset values (NAV). This is called price discovery, and the arbitrageurs will not be slow to take advantage of that difference. This means the indexes will drop much faster than they have gone up. I am neither a fortune teller nor the son of a fortune teller, but there are a few things I’ve picked up along the way. One of them is that, next time, stocks are going to go down breathtakingly fast once they begin to roll over.

This bull can’t end well, but it will end. At that point, Doug’s question becomes critical: Who will buy? I don’t know, but someone will. Prices for good and bad stocks will drop to whatever levels attract buyers. The indexes will eventually fall lower than any of us think likely right now. Whether that will happen next month, next year, or next decade is anyone’s guess.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Sidebar: You should think of cash as an option on your ability to buy the stocks that will lose 50% of their value and suddenly become the value stocks of the future. The option value on your cash today is not that much. You don’t make much on it, but you don’t lose much holding it. The time is going to come when you will be glad you have a little cash to put to work. Think March 2009.

(Almost) Everything Is Awesome

While Doug was musing about Queen, Louis Gave was thinking about rugby. Should one go where the ball is now, or try to figure out where the ball will be?

Louis asks that question while noting that it has been extremely difficult to lose money this year. Almost every tradable asset class has been climbing. You are probably making good returns this year unless you have been:

Overweight energy and materials, and/or

Overweight financials.

Those have been the primary weak spots. Investors in everything from technology to emerging markets, to Europe and even utilities have done well. All you had to do was avoid energy, materials, and financials.

The reasons for this are pretty simple. Inflation remains low to nonexistent in most places, which hurts commodity prices along with companies in the energy and materials sectors. The widespread belief that inflation will stay low is keeping long-term bond yields low, which reduces the net interest margin for lenders, particularly banks. Hence, we see underperformance in financial services stocks, too. Further complicating the energy story is the continued expansion of unconventional shale oil production in the United States. Eventually the technology will spread to the rest of the world. Countries that depend on high oil prices are hurting. (And not just Saudi Arabia and Russia but a whole host of Middle Eastern countries).

The conditions that will change this pattern aren’t complicated: higher inflation expectations and rising long-term bond yields. That combination would push energy and metals prices up and steepen the yield curve. But the problem there is that the Federal Reserve remains intent on raising short-term rates. If they tighten another notch next week, as everyone expects, the current trends seem likely to continue. Here’s Louis’s conclusion:

In sum, it is hard to foresee what will disturb the current Goldilocks scenario. So, investors who liken themselves to Rugby forwards (aka “piggies”) [an actual rugby term that is a double-play pun on investors getting greedy and hungry – JM] will want to continue dining at the trough of the current bull market. Meanwhile, investors who like to get their hair blow-dried before games (backs, or princesses), and prefer to run where the ball is going to be rather than where it is, may want to look at reducing their underweights in financials. After all, at current global fixed income valuations, it wouldn’t take much – central bank hawkishness, upside surprises to core CPI – to trigger a mild fixed income sell-off. And any steepening of the yield curve would lead to a very different investment environment.

The shape of the yield curve is clearly critical in assessing markets right now. I agree with Louis that any steepening would lead to big changes. I wonder if we might get a steepening the other way: An inverted yield curve – when short-term rates are higher than long-term rates – is a classic recession indicator. It’s something the US hasn’t seen lately but can’t avoid forever.

How can we get an inverted yield curve with short-term rates so low? The Federal Reserve just slowly and surely raises rates; the weight of debt begins to slow economic growth even more; and long-term rates drop. Voilà, inverted yield curve. That is at least classically what is supposed to happen. So let’s think about that for a few paragraphs.

Bending the Yield Curve

The other much-anticipated news from next week’s FOMC meeting is how/when the Fed intends to start reducing the massive bond portfolio it accumulated during the QE years. The initial move may be simply to stop reinvesting the proceeds when bonds mature. That is still billions of dollars each month – enough for even the very deep Treasury bond market to notice. (Then again, maybe they just let their mortgage bonds roll off and keep buying the Treasuries. They have so many options, and they haven’t bothered to tell us which ones they are seriously considering.)

A little-discussed aspect of this situation is, who will buy the Treasury bonds once the Fed backs out? That part is beyond the Fed’s control. The federal government won’t stop borrowing just because the Fed stops “lending.” The Treasury will have to find other buyers for its paper and will likely pay higher rates to attract them. Maybe. That is what is supposed to happen. In a world where the unthinkable keeps happening, we’ll just have to wait and see.

Brevan Howard’s chief US economist, my friend Jason Cummins (a past SIC speaker, I should note) wrote a fascinating guest column in the Financial Times on this topic. He points out something quite obvious that hasn’t occurred to many. The Treasury Department must borrow enough cash to pay the government’s bills, but it has huge discretion as to how it structures federal debt.

That means Treasury Secretary Steve Mnuchin can choose to replace the Fed’s purchases by issuing new debt at any point on the yield curve. It doesn’t have to be of the same term as the maturing paper it replaces. He can issue thirty-year bonds, three-month bills, or anything in between, in whatever combinations he thinks best.

The implication, as Jason gently explains, is that Steve Mnuchin can essentially rebuild the yield curve into whatever shape he wishes – presuming he can find buyers. He always will, of course, at some price.

The Treasury is such a massive borrower that its entry at any given maturity level can crowd out other borrowers and force rates higher. I am sure the Treasury people who manage this process try to reduce interest expense as much as possible, but they can only do so much. The government has bills to pay.

If Mnuchin decides to concentrate new borrowing at the long end, it will drive up those yields and steepen the yield curve. That’s exactly what banks would like to see. That would enhance their profit margins – but with the possible outcome of raising mortgage and other long-term rates. Not good for the housing sector.

Or, Mnuchin could do more borrowing at the short-term end. That would be a bit of a gamble because there’s no way to know what rates will be when the debt matures in the relatively near future. The strategy would also flatten and possibly even invert the yield curve.

Just to make all this more suspenseful, the government is also bumping up against its statutory debt ceiling. Congress might have to approve an increase as soon as August, and some in the House want to use the opportunity to exact spending cuts. The odds are low, but we can’t rule out the possibility of another government shutdown scenario, as we saw in 2011 and 2013.

As Cummins noted,

“As the clock ticks down and investors get increasingly skittish, the last thing the Treasury needs is to have to find more private sector buyers of its debt.”

Agreed. That is why I expect the Fed to delay implementing its balance sheet reductions until after the debt ceiling is raised – or maybe longer, if employment growth and/or inflation weaken over the summer and fall.

The Dangers of Passive Investing

Before we end, I want to come back to a few charts that illustrate some of the problems that are building up in the passive index world. It is not just ETFs, but also index mutual funds and the enormous amount of pension and insurance funds, along with many trust funds, that are passively invested directly in stocks. They simply duplicate indexes.

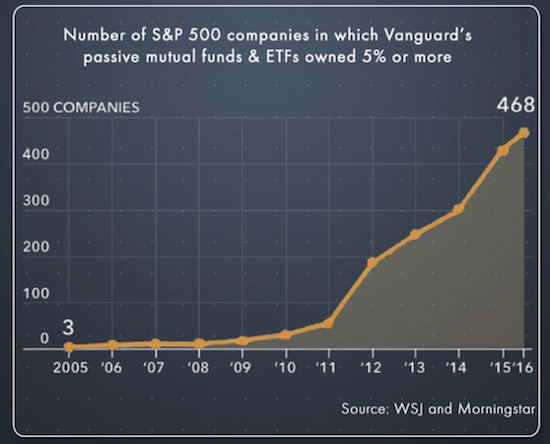

First, let’s note that Vanguard now owns more than 5% of 468 stocks in the S&P 500. That’s one fund company.

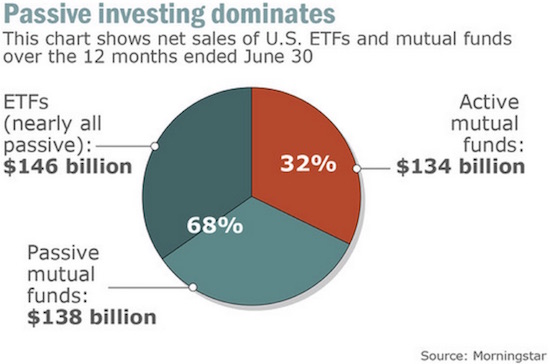

Here’s the picture for fund flows last year:

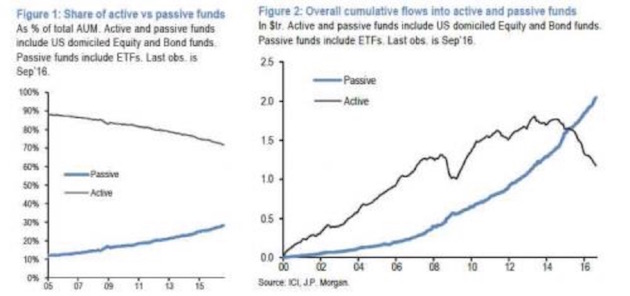

The number of hedge funds is at its lowest level since 2000. Passive funds are eating away at the assets under management by active funds:

This trend goes back to a point I made a few weeks ago but that needs to be repeated again and again. When the market obscures distinctions between good stocks and bad stocks because it buys all of them at the same time, there is no way for an active manager to take advantage of his skill in determining value. That ability to look at a company’s balance sheet and determine something close to true value is what gives active managers their edge. If you don’t have the chance to do this, you cannot add any alpha, and you are going to underperform the simple passive indexes – even though you charge higher fees. Money will leave you for the seemingly more plentiful pastures of passive indexing. One day you will be vindicated, and the money will come back (think Jeremy Grantham); but because investors will lose a great deal of their money in a bear market, you won’t get as much back in the short term as left you over the past few years. If you are an active manager, this just sucks.

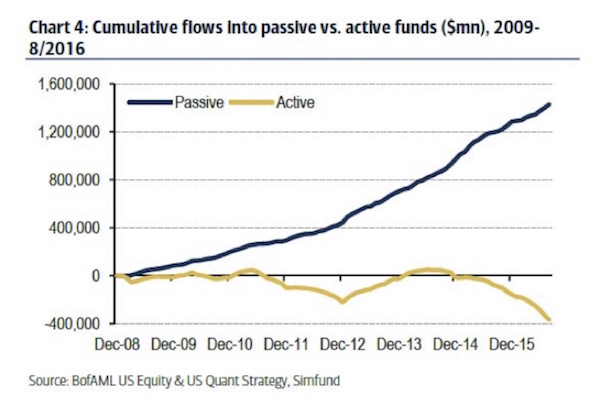

The next two charts show the difference between active and passive investing in the retail fund space. It’s a huge contrast:

The chart below traces the widening imbalance since 2008.

As I stated above, this imbalance will eventually be corrected. But the correction will not be pretty, though it may be swift.

If I’m going to keep my pledge to be shorter, more thoughtful, and faster, then I’d better close on that note.