Written by Steven Hansen

I can “prove”, using sources on the internet, almost anything. Gold going up, gold declining. Market momentum increasing, market crashing. Even studies and research conflicts, and much of it out of date and based on flawed sampling.

In fact, most of what I read is simply extrapolated opinion. People tend to believe in something, look ONLY at data points which support that opinion – and make the world and its events conform to this view. If you are a perma-bull, the market only moves in one general direction. With the manipulation and regulation going on right now, it is dangerous to view things in black and white.

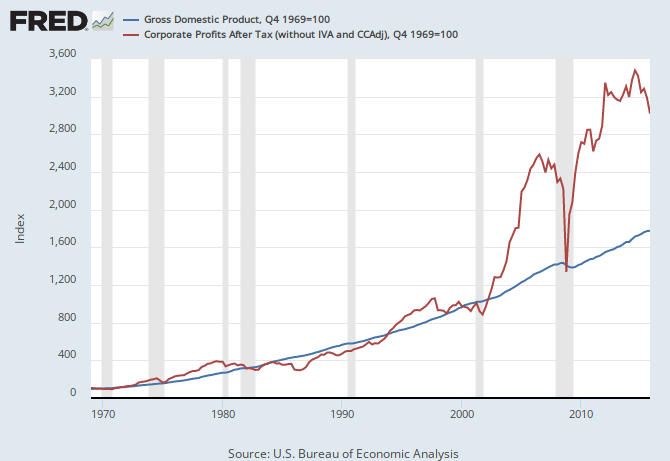

If I were starting my working life again, I have significant doubt I could have amassed my “fortune” in the markets to have been able to retire at 45 – and set sail on the seven seas. I refuse to breath the smoke which allows you to believe corporate profits will continue to outpace economic growth.

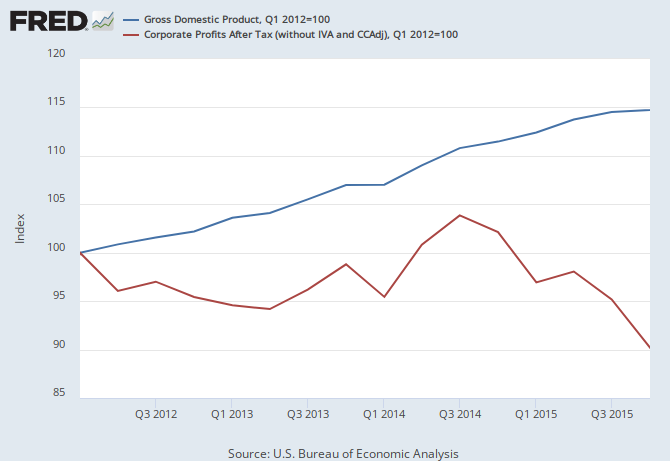

I was lucky enough to be caught in the updrafts where profits grew faster than GDP. But investors should have awakened that things began to change in 2012 when the markets changed to a trader’s market.

There is more to investing than just looking at profit growth. But for both investors and traders, your life is easier if the market’s general direction is skyward. There was a 20 year period in the 1960’s to the 1980’s where the market went nowhere.

I am at the point in my life where I have seen the impossible, and been crushed when certainty did not occur.

My OPINION is that the markets have outrun the economy – and we are in for a period of no market growth (maybe like the 1970’s). This does not mean I am putting my cash under the mattress, but I do have lower expectations – and am less inclined to accept much risk.

Most people cannot be traders as they have to work at unrelated jobs during the day – and investing is the only real option. Investors have to be careful where to put money, and the mattress is a poor option. Retirement may be out of the question for those who need the market to “manufacture” some relatively quick money. Investors are flying by the seat of their pants to find their way.

Other Economic News this Week:

The Econintersect Economic Index for March 2016 marginally improved but remains relatively weak. The index continues at one of the lowest values since the end of the Great Recession. It remains to be seen if this improvement is a reversal of the long term decline of our index since late 2014.

Current ECRI WLI Growth Index

The market expectations (from Bloomberg) were 270,000 to 278,000 (consensus 272,000), and the Department of Labor reported 259,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 270,000 (reported last week as 270,250) to 267,500. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held Buffets, Aspect Software Parent, Red Mountain Resources (Parent Time)