by Philip Pilkington

I’m currently reading Robert Solow’s paper A Contribution to the Theory of Economic Growth in which he lays out his famous Solow growth model. I don’t want to get into the actual model laid out here but instead ask what exactly this paper is trying to address. As readers of this blog will probably know I find so-called ‘long-run’ models to be about as useful for understanding the economy as toy train sets are for understanding the operations of an actual train. But in many instances the reasoning they are based on is poisonous and somewhat dangerous.

Please share this article – Go to very top of page, right hand side for social media buttons.

Solow starts out the paper by criticising the Harrod-Domar growth model (for an excellent overview of the Harrod-Domar model which is one of the most suggestive in macroeconomics see the following three blogs by Bill Mitchell: I, II, III). He complains that Harrod (and Domar) had assumed that there was no substitution between capital and labour. Speaking of the so-called ‘knife-edge’ assumption of the Harrod-Domar model he writes,

But this fundamental opposition of the warranted and natural rates turns out in the end to flow from the crucial assumption that production takes place under conditions of fixed proportions. There is no possibility of substituting labor for capital in production. If this assumption is abandoned, the knife-edge notion of unstable balance seems to go with it. Indeed it is hardly surprising that such a gross rigidity in one part of the system should entail lack of flexibility in another. (pp65-66)

Solow’s argument is that Harrod’s analysis is all very nice in the so-called ‘short-run’ when there is probably no substitution between capital and labour. But in the long-run there is surely substitution.

But what does Solow mean by the ‘long-run’ here? That is never actually addressed. So far as I can see it is an analytical device — perhaps even a rhetorical device — appealed to on the basis of dogma. Solow says that in the long-run labour and capital will be substituted as a matter of fact. But this is never justified.

By my reading the whole idea behind the Harrod-Domar model was to provide a basis for dynamic analysis. This has a very real means of application. We can do calculations based on this model to see what level of investment is needed to keep the economy at full employment (see a nice example here). Sure, this is a thought experiment, but it has some use. It allows us to conceptualise how a given rate of savings and a given capital-output ratio requires a certain amount of investment to keep the economy in balance. This strikes me as applying, in some way, to the real world where we do indeed encounter such problems.

Solow’s model, on the other hand, appears not to have any application to the real-world at all. The only conclusion one can draw from the model itself is that everything should be kept as flexible as possible so that the economy can tend toward a sort of ‘natural’ equilibrium position. In that way, the Solow model is a sort of moral judgement:

“this is how the world should be and if it deviates in some perverse manner then bad things will happen”.

The ‘long-run’ in this model is really a prescriptive norm that the economy is chastised for not living up to.

But Solow thinks himself a Keynesian so he doesn’t want to admit this. The last few paragraphs in the paper are among the most disingenuous ever written. In them Solow addresses what happens in the case of various ‘rigidities’ such as sticky wages or liquidity preference. And lo and behold, unemployment appears! Solow’s prescription is that Keynesian measures should be used to keep the economy on a stable growth path at full employment.

Why is this so disingenuous? Because as I have just said: Solow has thrown out a model that might tell us something about how we might keep the economy at full employment and replaced it with a model that tells us absolutely nothing about this! Then he turns around and starts to talk about issues that could have been addressed by the model he rejects but which cannot be dealt with by the model he has put forward.

Harrod and Domar said to us:

“here is a dynamic model that assumes we should take short-term problems very seriously; it will give us some insights into how we might overcome these problems to promote stable long-term growth.”

While Solow has said to us:

“pay no attention to that silly short-run model by Harrod and Domar; here is an equilibrium model that brushes over short-term problems completely and presents us with a teleological Utopia… but in all honesty the short-term problems probably exist and should be taken seriously, unfortunately given that I have ignored them I cannot really tell you anything of interest about how to manage them.”

Yes, Solow may get a Nobel Prize for his thought experiment but how he has poisoned the well! The implications an honest reader who ignores the extremely weak final section of the paper (as they should, for they get nothing out of it!) should draw from the paper is that rigidities should be removed from the economy so that the teleological Utopia is reached. Labour and capital will substitute automatically when imbalances threaten to build so there is no real need for management. Just make sure those wages stay nice and flexible and everything should be fine!

This is how we should view basically all so-called ‘long-run’ marginalist models. They provide Utopian visions that can never exist in the real world. And implicit in these Utopian visions are harsh moral lessons that make no sense in an imperfect world. When they are applied they cause chaos but this chaos is ignored because the Utopians can tell us that we will reach heaven soon.

This is the type of reasoning that Karl Popper deemed totalitarian. The philosopher and sociologist Ralf Dahrendorf summarised this nicely,

One of the basic assumptions of all utopian constructions is that conditions may be created under which conflicts become superfluous. Indeed, the resulting state of harmony is the theoretical basis of the persistence of the social structure of utopia. But in reality these conditions do not exist. In fact, with the terrible dialectics of the non-rational, it happens that utopia first requires and then glorifies suppression.

Solow may be a liberal in his politics and in his economic policy prescriptions, but he is a totalitarian in his reasoning and his writing. All the marginalists are. Those on the right will hide it behind silly cant about ‘liberty’ while those on the left, like Solow, will hide behind irony and disingenuous nods toward Keynesianism. Their reasoning is Utopian in the Popperian sense (i.e. totalitarian) and the prescriptions such reasoning organically leads to are suppressive and dangerous.

Professor Solow himself may be a good guy. Smart, able to appreciate nuance, a fine writer, even a good policy economist. But what are his writings used for today? They are used to train students to think in totalitarian modes of thought. They are used to teach Utopias that students then go out and seek out — in vain — in the real world. And as sorry as I am to say it, those totalitarian fantasies are already contained in Solow’s writings. They are contained in the very essence of the way in which he writes and thinks.

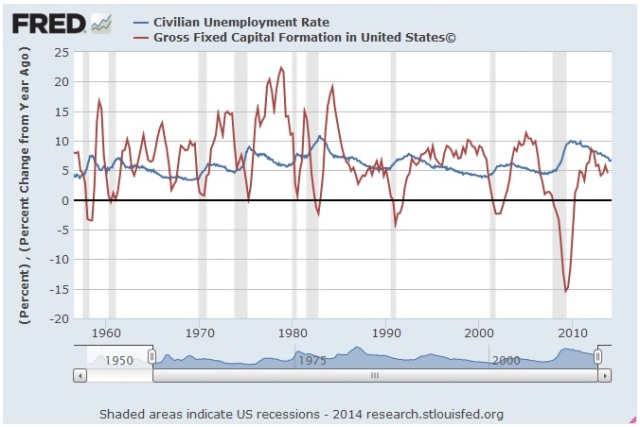

Addendum: I just wanted to clarify why I think that Solow’s construction is wholly unrealistic. Very generally speaking we would assume by Solow’s conception that when unemployment rises labour replaces capital as the wage falls. If we look at the data we would thus expect to see unemployment and capital formation move in opposite directions. That is, when unemployment rises then capital formation should fall and vice versa.

When we turn to the data we do see unemployment rise at the same time as capital formation declines. This, however, is due to the fact that unemployment rises at the start of a recession and capital formation tends to also fall at the start of a recession. I have laid out the data below.

Pick out particular periods in this data, however, and we see no evidence of substitution. In times with sustained high unemployment, for example, capital formation tends to pick up after its initial dip. I have laid out two separate periods of sustained high unemployment below.

Note how after the initial dip after a recession capital formation begins to pick up again despite the fact that there is unemployment. What this tells us is that even though many workers remain idle capitalists continue to build new plant and equipment. The reasons why this occurs are highly complex and do not concern us here. But the facts are clear: capitalists will build new plant and equipment even when workers lay idle.

We see the same dynamic at work in the opposite scenario. According to the idea of substitution we should expect that in times of low unemployment we should see a rise in capital formation. But we do not. Take a look at the graph below.

In the mid to late-1960s the unemployment rate was very, very low. According to the substitution hypothesis this should have led capitalists to greatly increase their capital formation to replace the expensive labourers. But we do not see this. Rather capital formation was growing at a lower rate in the later period when unemployment was lower than it was in the earlier period when unemployment was higher. Again, the evidence for substitution is very thin indeed.

When we appeal to the ‘long-run’ it is unclear that we are talking about the real world at all. Where is this ‘long-run’ in the data? Surely the ‘long-run’ is a series of short-run scenarios. But if substitution does not take place in the short-run then when do we conceptualise it taking place at all?