by Rodger Malcolm Mitchell, www.nofica.com

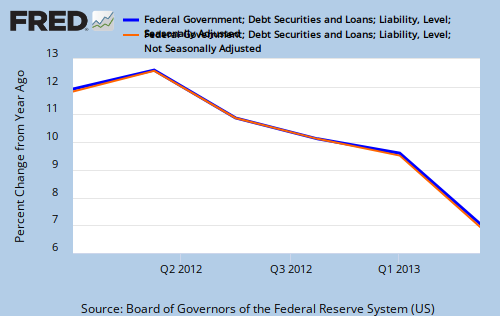

In the June 12, 2013 post titled, “This graph predicts the future. What does it tell you“, we showed you this graph:

Click on graph for larger image.

The FRED series, Total Credit Market Debt Owed by Domestic Nonfinancial Sectors – Federal Government, is now known as Federal Government; Credit Market Instruments; Liability.

And we asked four questions:

1. What does the federal government do in the years leading up to recessions? (Answer: Cut growth in deficit spending)

2. What does the government do that cures recessions? (Answer: Increase growth in deficit spending)

3. What is the government doing now? (For a clearer picture, the next graph is a closeup of the most recent past)

4. Why is the government cutting deficit spending growth, despite overwhelming evidence this causes recessions? (Because of the false premises that the federal government can run short of dollars, or by creating dollars, could cause inflation.)

——————————————————————————————-

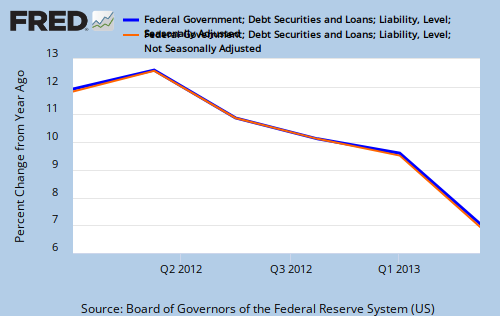

Now another quarter has been posted by the Fed, and the update looks like this:

Because growth in federal deficit spending continues to decline, the next recession draws closer.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.