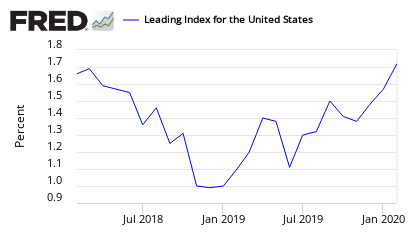

Econintersect: A positive index number projects positive economic growth for the next 6 months. The May 2013 forecast growth is 1.5. A positive number indicates growth.

The Federal Reserve Bank of Philadelphia has released the leading indexes for the 50 states for May 2013. The indexes are a six-month forecast of the state coincident indexes (also released by the Bank). Forty-one state coincident indexes are projected to grow over the next six months, while nine are projected to decrease. For comparison purposes, the Philadelphia Fed has also developed a similar leading index for its U.S. coincident index, which is projected to grow 1.5 percent over the next six months.

This index has been noisy, but remains above 1%.

United States from the Philadelphia Fed – This index is the super index for all the state indices.

The leading index for each state predicts the six-month growth rate of the state’s coincident index. In addition to the coincident index, the models include other variables that lead the economy: state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.

This index is subject to backward revision.

The Other Leading Indicators

The leading indicators are to a large extent monetary based. Econintersect‘s primary worry in using monetary based methodologies to forecast the economy is the current extraordinary monetary policy which may (or may not) be affecting historical relationships. This will only be known at some point in the future. Econintersect does not use any portion of the leading indicators in its economic index. All leading indices in this post look ahead six months – and are all subject to backward revision. This index has been on an improving trend for one year.

Current ECRI WLI Index

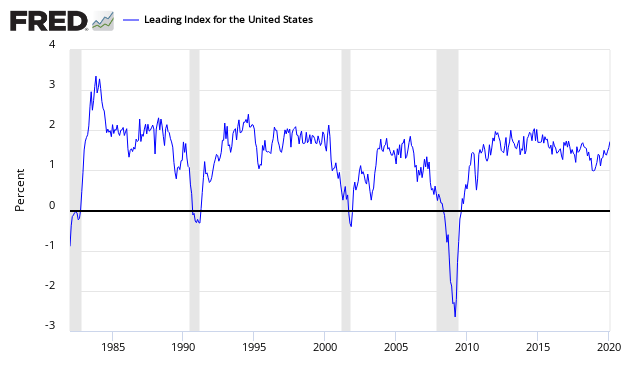

The Conference Board’s Leading Economic Indicator (LEI) – Looking at the historical relationships, this index’s 3 month rate of change must be in negative territory many months (6 or more) before a recession occurred. Ths index is in positive territory and improving – implying any recession is months away.