Written by Steven Hansen

Written by Steven Hansen

ADP reported non-farm private jobs growth at 749,000 which was within expectations. A quote from the ADP authors:

The labor market continues to recover gradually.

Analyst Opinion of ADP Employment Situation

Last month’s employment gain was revised upward. It will be interesting to see what the BLS says is jobs growth.

ADP employment has not been a good predictor of BLS non-farm private job growth.

- The market expected from Econoday 400,000 to 1,000,000) – consensus 650,000. These numbers are all seasonally adjusted.

- In Econintersect‘s September 2020 economic forecast released in late August 2020, we estimated non-farm private payroll growth at -460,000 (based on economic potential) and -2,100.000 (fudged based on current overrun / under-run of economic potential).

- This month, ADP’s analysis is that small and medium-sized businesses contributed 60.2% of the job gains.

- Manufacturing jobs increased by 130,000

- The service sector had 73.7 % of the job gains

- The current employment level is 7.5 % below the level one year ago.

- The August ADP report (last month), which reported job gain of 428,000 was revised to a job gain of 481,000

ADP changed its methodology starting with its October 2012 report, and ADP’s real-time estimates are currently worse than the BLS.

Per Ahu Yildirmaz, VP and head of the ADP Research Institute.

The labor market continues to recover gradually. In September, the majority of sectors and company sizes experienced gains with trade, transportation and utilities; and manufacturing leading the way. However, small businesses continued to demonstrate slower growth.”

Jobs’ growth of 150,000 or more is calculated by Econintersect to the minimum job growth to support population growth (see caveats below). The graph below shows ADP employment gains by month.

Employment is a rearview indicator, and looking at this ADP data – the overall trend for the year-over-year rate of growth has been disrupted by the coronavirus. (red line in the graph below).

ADP Non-Farm Private Employment – Total (blue line) and Year-over-Year Change (red line)

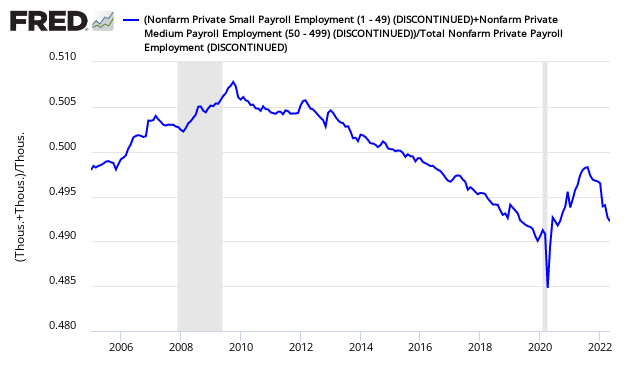

Small and medium-sized businesses historically create most of the new jobs (analysis here) when using the ADP data.

The ratio of ADP Under 500 person Business Growth to Total Business Growth

The relative strength is in the service sector which has driven the jobs growth post-Great Recession.

z adp3.png

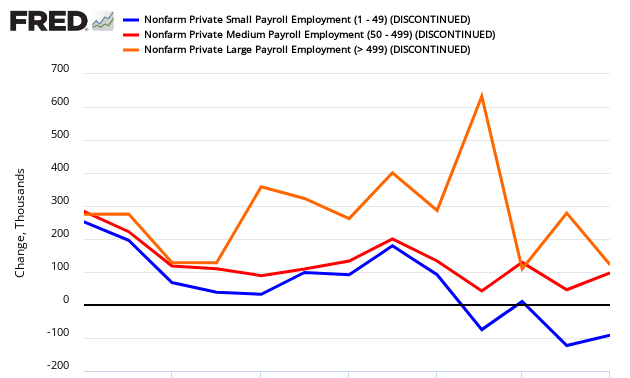

The graph below breaks down employment growth by the size of the company.

ADP Non-Farm Private Jobs Growth Per Month – Under 50 employees (blue line), under 500 employees (red line), 500 and up employees (orange line)

Change in Total Nonfarm Private Employment by Company Size

Caveats on the Use of ADP Employment Data

For the last two years, ADP’s estimates of the final BLS employment numbers have not shown to be accurate. Econintersect does not place much importance on the ADP’s numbers since revising their methodology in 2012.

Historically employment is the confirmation that real economic growth is occurring. As background, many economic factors impact jobs growth. How many jobs businesses create in any one month is not directly dependent on these economic factors but on individual decisions. The impact of all the economic factors is averaged out over many months.

Here is the revised methodology beginning with the October 2012 data:

Working in close collaboration with Moody’s Analytics, Inc. and its experienced team of labor market researchers, the ADP Research Institute has further enhanced the monthly ADP National Employment Report® in order to more closely align it with the final print of the U.S. Bureau of Labor Statistics (BLS) numbers.

Beginning with its November 1, 2012 report, the ADP National Employment Report’s new methodology now utilizes ADP payroll data, U.S. BLS employment data, and the Philadelphia Federal Reserve Bank’s Aruoba-Diebold-Scotti Business Conditions Index.

In addition, the sample size of the ADP data set from which the newly enhanced ADP National Employment Report is derived has been expanded from 344,000 U.S. companies to 406,000, and from 21 million employees to 23 million, which accounts for more than 20 percent of all U.S. private sector employees. This larger data set is expected to help enable the ADP National Employment Report to more closely match the final print of the BLS numbers.

According to the new methodology, Moody’s Analytics’ monthly analysis for the ADP National Employment Report begins with processing ADP data according to the following steps:

- Classification by industry and size class based on the North American Industrial Classification system (NAICS)

- Creation of matched pairs for employment during the pay period including the 12th of the month

- Seasonal adjustment

- Removal of outliers

- Adjustments are made to match the industry and size distribution to the Quarterly Census of Employment and Wages (QCEW) industry and size data reported each March

- Regressions are run to predict the current month’s BLS number by industry

- These are then aggregated to derive the growth in total nonfarm private employment

- Industry, size and total growth rate estimates are then converted into differences.

Additional information about Moody’s Analytics’ methodology can be found at ADPEmploymentReport.com.

Basically this employment index is designed to mimic BLS private non-farm employment – which does not include government employment. The headline BLS Employment Report includes government employment.

The graph below shows ADP’s monthly change (blue line) versus BLS non-farm private change (red line).

ADP (blue line) versus BLS (red line) – Monthly Jobs Growth Comparison

There is now a known disconnect between BLS and ADP on the breakdown of jobs growth between small, medium and large business – as the graphs below illustrate. Basically, the BLS sees large business as the employment driver, while ADP sees small and medium size business as the employment driver. For full details please read BLS Experiments With New Data Series: Now I Am Confused.

Comparing Jobs Growth Per Month – ADP vs BLS

There is the proverbial question on what is minimal jobs growth each month required to allow for new entrants to the market. Depending on mindset, this answer varies. According to Investopdia, the number is between 100,000 and 150,000. The Wall Street Journal is citing 125K. Mark Zandi said 150K. Econintersect is going with Mark Zandi’s number:

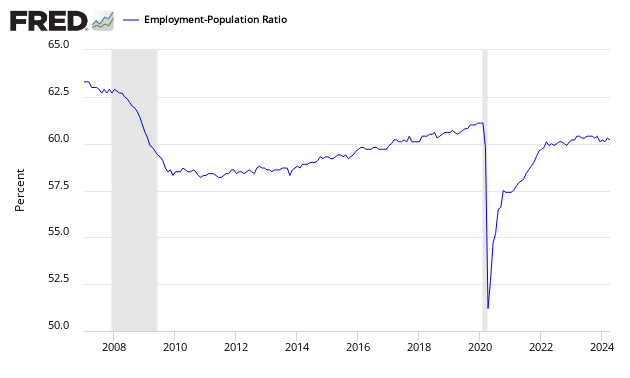

- If Econintersect used employment/population ratios to determine the number, the exact number seems to be between 140,000 and 160,000. The graph below uses the historical employment-population ratios to show jobs growth per month if the population was 300 million.

Historical Monthly Jobs Growth Comparison if Population was 300 Million

- If Econintersect uses employment-population ratios, the correct number would be the number where this ratio improved. Using the graph below, the ratio began to improve starting a little after mid-year. This corresponds to the period where the 12 months rolling average of job gains hit 150,000.

Employment to Population Ratio

Note: The ratio could be fine-tuned by adjusting to the ratio of employment to working-age population rather than the total population. However, this would not change the big picture that an increase of somewhere around 150,000 (+/-) is needed for the growing population numbers. We have estimated 140k – 160k. The number might possibly be within the range 125k – 175k. Econintersect cannot find a reason to support the estimates below 125k.

The question of how changing demographics impact the employment numbers is at the margins of analysis. Econintersect will publish more on this fine-tuning going forward, both in-house research and the work of others.

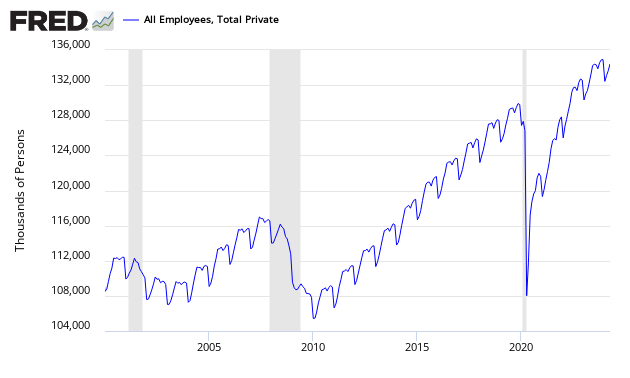

The following graph (not seasonally adjusted non-farm private payroll) shows that most of the employment growth is in the first half of the year, and there is little real growth of employment in the second half of the year. Therefore seasonal adjustment algorithms understate employment growth in the first half of the year and overstate growth in the second half of the year.

Non-Seasonally Adjusted Employment – Private Sector

include(“/home/aleta/public_html/files/ad_openx.htm”); ?>