Written by Gary

Markets opened mixed, moved to positive territory then started to trend down even after new orders for U.S. factory goods rebounded strongly in June. Coach jumped 6 percent after it reported earnings that beat analysts’ estimates, while Allstate sank 7 percent after its results came up short. Apple is now down 15% from record highs as “no brainer” investors begin to question their faith in its China prospects.

WTI oil has stalled in its upward climb and the U.S. averages look weak going into the afternoon session.

Here is the current market situation from CNN Money | |

| North and South American markets are mixed. The IPC is higher by 0.49%, while the Bovespa is leading the S&P 500 lower. They are down 1.57% and 0.16% respectively. |

Traders Corner – Health of the Market

| Index | Description | Current Value |

| Investors.com Members Sentiment: | % Bullish (the balance is Bearish) | 62% |

| CNN’s Fear & Greed Index | Above 50 = greed, below 50 = fear | 22% |

| Investors Intelligence sets the breath | Above 50 bullish | 43.2% |

| StockChart.com Overbought / Oversold Index ($NYMO) | anything below -30 / -40 is a concern of going deeper. Oversold conditions on the NYSE McClellan Oscillator usually bounce back at anything over -50 and reverse after reaching +40 oversold. | +7.08 |

| StockChart.com NYSE % of stocks above 200 DMA Index ($NYA200R) | $NYA200R chart below is the percentage of stocks above the 200 DMA and is always a good statistic to follow. It can depict a trend of declining equities which is always troubling, especially when it drops below 60% – 55%. Dropping below 40%-35% signals serious continuing weakness and falling averages. | 41.91% |

| StockChart.com NYSE Bullish Percent Index ($BPNYA) | Next stop down is ~57, then ~44, below that is where we will most likely see the markets crash. | 49.15% |

| StockChart.com S&P 500 Bullish Percent Index ($BPSPX) | In support zone and rising. ~62, ~57, ~45 at which the markets are in a full-blown correction. | 52.60% |

| StockChart.com 10 Year Treasury Note Yield Index ($TNX) | ten year note index value | 21.50 |

| StockChart.com Consumer Discretionary ETF (XLY) | As long as the consumer discretionary holds above [66.88], all things being equal, it is a good sign for stocks and the U.S. economy | 79.95 |

| StockChart.com NYSE Composite (Liquidity) Index ($NYA) | Markets move inverse to institutional selling and this NYA Index is followed by Institutional Investors | 10,841 |

What Is Moving the Markets

| Here are the headlines moving the markets. | |

| Greece upbeat about bailout deal, sees one within two weeks ATHENS (Reuters) – Greece expects to conclude a multi-billion-euro deal with international lenders within two weeks, officials said on Tuesday, and its finance minister said talks were going better than expected. |

| Laszlo Birinyi Projects S&P 3,200 Within 2 Years, Squeaks “It’s All Noise, Don’t Worry”“It’s all noise,” squeaks Laszlo Birinyi, deflecting concerns about revenues, earnings, Europe, China, commodities, and rates as he unleashes his latest extrapolation. “If we continue to grow at 11 bps per day, the S&P will be at 3,200 within 2 years,” adding “you can dismiss 40% of the S&P”, supposedly the 40% that is not going up, he warbles as he hopes his ruler – which missed its 2013 projection by 1100 points or 40% – is is more accurate at forecasting this time. Good luck with the ruler this time Laszlo.

This would represent a 24x multiple on Goldman Sachs’ already exuberant $134 estimate for 2017 earnings, which in turn assumes oil soars back to $100 or higher, and S&P earnings grow by almost 20% over the next two years. Dare we suggest that in order for the S&P to reach 3,200 within 2 years, the dollar will have to collapse in a Venezuela-esque hyperinflation. By then, the real question will be not if 3,200 but whether 32,000 or 320,000… Finally, his 2013 “forecast” aside, here is what he said would happen entering the biggest economic and market collapse in US history:

|

| Drugmaker Shire bids $30 billion for Baxter spin-off Baxalta LONDON (Reuters) – Drugmaker Shire said on Tuesday it was seeking to buy Baxalta , a company spun-off by Baxter International last month, for $30 billion to forge the leading global specialist in rare diseases. |

| U.S. judge rejects American Express class action settlement NEW YORK (Reuters) – A U.S. judge on Tuesday rejected a proposed class action settlement between American Express Co and merchants who sued the company over swipe fees, ruling that a lawyer for the merchants compromised the fairness of the agreement. |

| Charting the U.S. markets’ technical cross currentsFocus: Apple’s breakdown, Crude oil’s new low, 10-year note yield signals weakness, Rate-sensitive sectors come to life CINCINNATI (MarketWatch) — Technical cross currents remain in play across the major U.S. benchmarks. Broadly speaking, the market backdrop is bending, though the S&P 500’s sluggishly-bullish bias hasn’t cracked just yet. Read More >>> |

| U.S. appeals court revives lawsuits against Visa, Mastercard NEW YORK (Reuters) – A federal appeals court has revived litigation against Visa Inc , Mastercard Inc and several U.S. banks accusing them of conspiring to inflate the prices of ATM access fees in violation of antitrust law. |

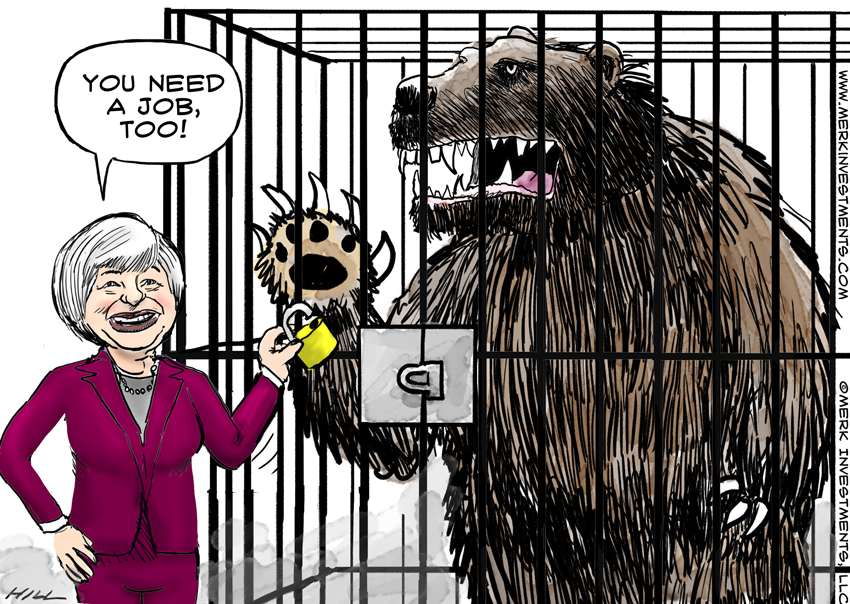

| Axel Merk Comes Out… As A BearVia Axel Merk of Merk Investments, Increasingly concerned about the markets, I’ve taken more aggressive action than in 2007, the last time I soured on the equity markets. Let me explain why and what I’m doing to try to profit from what may lie ahead.

I started to get concerned about the markets in 2014, when I heard of a couple of investment advisers that increased their allocation to the stock market because they were losing clients for not keeping up with the averages. Earlier this year, as the market kept marching upward, I decided that buying put options on equities wouldn’t give me the kind of protection I was looking for. So I liquidated most of my equity holdings. We also shut down our equity strategy for the firm. Of late, I’ve taken it a step further, starting to build an outright short position on the market. In the long-run, this may be losing proposition, but right now, I am rather concerned about traditional asset allocation. Fallacy of traditional asset allocation |

| China Is Spending 11.6 Million Annual Incomes Per Day Propping Up StocksFor years now China has been heralded as an economic miracle that will drive the global economy towards growth and eventually eclipse the US as THE superpower in the world. This theme was driven by the view that somehow China had obtained the magic balance between free-market capitalism and Central Planning. Globally analysts breathlessly talked about China’s insatiable demand for commodities as its economy grew by double digits for three decades straight. Unfortunately all of this overlooked basic common sense… that China was actually just one giant debt-fueled fraud in which the politically connected got rich skimming off the top of an endless sea of loose money funneled into dodgy investments and projects. For example, let’s say that China built a city. Regardless of whether any of the buildings are ever purchased or leased, China will count the entire city in its GDP growth. As one can imagine, this has highly incentivized China’s government to build “bridges to nowhere” or economic projects that are never actually used. Indeed, at one point Chinese bureaucrats even resorted to detonating buildings for the express purpose of then building another one… all in the name of generating that magic GDP growth… and generating additional bribes and under the table deals for the officials who signed off on the projects. Throughout this period, Chinese officials who were “on the take” fled the country with their bribes and Indeed, between 1991-2011, it’s estimated that between 16,000-18,000 Chinese officials fled China taking 800 BILLION RMB (roughly $125 BILLION) with them. Bear in mind China’s entire GDP was just 2.1 trillion RMB in 1991. As the Chinese economic miracle inc … |

| Pfizer wins EU approval for $15 billion Hospira buy BRUSSELS (Reuters) – U.S. drugmaker Pfizer gained European Union antitrust approval on Tuesday for its proposed $15 billion acquisition of U.S. rival Hospira after pledging to sell some drugs to allay competition concerns. |

| Wall St. falls as Apple slips to six-month low (Reuters) – U.S. stocks fell on Tuesday as Apple’s shares remained under pressure, hitting their lowest in more than six months, and investors digested earnings reports from a host of companies. |

| US stocks waver between small gains and losses; Allstate slumps on disappointing resultsNEW YORK (AP) — U.S. stocks moved between small gains and losses on Tuesday as investors assessed the latest company earnings reports and deal news. Allstate slumped after the insurance company reported earnings that missed analysts’ expectations. Pharmaceutical maker Baxalta jumped after rival Shire agreed to buy the company for about $30 billion. Apple fell sharply for a second day. KEEPING SCORE: The Standard & Poor’s 500 index was flat at 2,098 as of 12:17 a.m. Eastern. The Dow Jones industrial average dropped 9 points, less than 0.1 percent, to 17,582. The Nasdaq composite was little changed at 5,113. ALLSTATE SLUMP: Allstate was the biggest decliner in the S&P 500. The insurer dropped $8.24, or 11.9 percent, to $61.13 after reporting earnings that fell significantly short of analysts’ expectations. The company said its earnings dropped because of more frequent and more severe auto accidents. |

| AAPL Down 15% From Highs – Worst Drop In 30 MonthsApple is now down 15% from record highs as “no brainer” investors begin to question their faith in its China prospects. This is the biggest drop since January 2013 and overall AAPL is now almost unchanged on the year…AAPL has lost $27bn market cap today.. a TWTR or a LNKD Biggest drop since Jan 2013…

As investors pile out post-earnings…

leaving AAPL nearly unch YTD…

And as Nanex notes, it appears the market is about to break (again)…

Charts: Bloomberg |

| BMW says worsening Chinese market could hit forecast FRANKFURT (Reuters) – BMW , the world’s biggest luxury carmaker, warned on Tuesday that its financial forecasts for this year could be at risk from any further deterioration in the Chinese market, where its sales have begun to fall for the first time in a decade. |

| Russia Ready To Send Paratroopers To SyriaAs Syria’s civil war enters its fourth year, it’s become something of an open secret that ISIS, for all their bluster and Hollywood-level video editing capabilities, are at best an unhappy side effect of efforts to train and arm the Syrian resistance and at worst, are a “strategic asset” funded and supported by coalition governments. In other words, there is indeed a geopolitical chess match going on here that will have far-reaching consequences when the blood and dust settle, but it has nothing to do with ISIS’ far-fetched quest to establish a Medieval caliphate and everything to do with installing a government in Syria that will be more friendly to the interests of the West and its Middle Eastern allies. ISIS will remain in play as long as they are necessary, but once the time comes for the US to clean up the mess left by Syria’s three-front war once and for all, that will be all she wrote for this particular CIA asset. Until then, everyone apparently gets to use Islamic State as an excuse to pursue their own political agenda, as evidenced by Turkey’s new war on “terrorists.” Not wanting to miss an opportunity to justify what would otherwise be a rather brash declaration, Russia is reportedly ready to send in the paratroopers should Syria request Moscow’s help in battling terrorist elements. Here’s more via Tass:

|

| Paris-Tokyo in three hours: Airbus wins patent for hypersonic plane PARIS (Reuters) – Airbus has won a patent for a hypersonic plane, but Concorde’s hydrogen-powered successor is unlikely to leave the drawing board any time soon. |

| Greek stocks close down 1.2 percent, banks shed near 30 percent ATHENS (Reuters) – Greece’s main stock index unofficially closed down 1.2 percent on Tuesday, a day after a record fall of 16.2 percent, but most losses were in the banking sector which sank around 30 percent. |

Earnings Summary for Today

leading Stock Positions

Current Commodity Prices

Commodities are powered by Investing.com

Current Currency Crosses

The Forex Quotes are powered by Investing.com.

To contact me with questions, comments or constructive criticism is always encouraged and appreciated: