Written by Gary

U.S. stock index futures were higher this morning, a day after the S&P 500 snapped a three-day losing streak as a selloff in the equities market took a breather. Short-term indicators show markets will open higher and post a green close, but is likely to be a temporary pause. Crude oil inventories posting at 10 am could be a serious fly in the ointment if they come in high.

Here is the current market situation from CNN Money | |

| European markets are broadly higher today with shares in Germany leading the region. The DAX is up 1.07% while France’s CAC 40 is up 0.79% and London’s FTSE 100 is up 0.38%. |

What Is Moving the Markets

| Here are the headlines moving the markets. | |

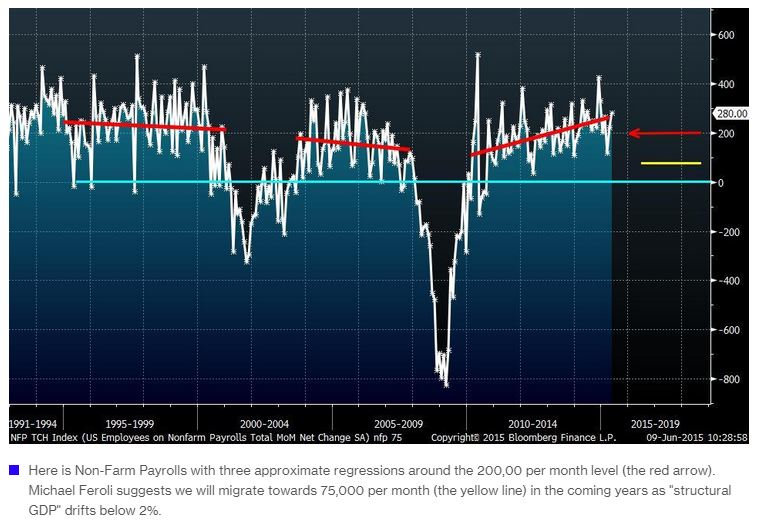

| The Job Market Will Get Much Worse, JPMorgan WarnsSubmitted by Daniel Drew via Dark-Bid.com, As Zero Hedge reports every month, the labor force participation rate is at multi-decade lows. Michael Feroli, a JPMorgan economist, said the economy will produce even fewer jobs in the future. In the last ten years, the U.S. saw 68,000 new jobs per month. Meanwhile, the population grew by over 200,000 per month. The last decade’s data was marred by severe job losses in 2008. From 1995 – 2005, it was normal to see 300,000 new jobs per month in good years, and the bad years didn’t come close to the 2008 horror show. Job creation is on a slight uptrend now, but it still hasn’t kept up with population growth. Even worse, Feroli says he expects monthly job creation to drop to around 75,000 in the near future. In other words, there will be no recovery. With a population that is still growing, this job shortage is nothing less than a ticking time bomb for |

| Spotify raises $115 million in share sale STOCKHOLM (Reuters) – Swedish telecom operator TeliaSonera is buying into music streamer Spotify for a slice of the fast growth and speedy innovation typical of online companies, just as competition heats up further in Spotify’s industry. |

| Pressing for Greek concessions, Merkel and Hollande keep Tsipras waiting BRUSSELS/ATHENS (Reuters) – Greece and its international lenders moved closer to the brink on Wednesday with the leaders of Germany and France holding off on an expected meeting with Prime Minister Alexis Tsipras to press for more concessions from the Greek side. |

| Futures rise after S&P 500 snaps three-day decline (Reuters) – U.S. stock index futures were higher on Wednesday, a day after the S&P 500 snapped a three-day losing streak as a selloff in the equities market took a breather. |

| Bund yield hits 1 percent as stock markets halt sell-off LONDON (Reuters) – German bond yields hit 1 percent for the first time since September on Wednesday as long-term inflation expectations rose, luring investors back into equities despite lingering jitters over the size of recent market swings. |

| Apple Music faces antitrust scrutiny in NY, Connecticut (Reuters) – The attorneys general of New York and Connecticut are investigating Apple Inc’s negotiations with music companies to look for signs of potential antitrust violations. |

| German Lawmakers To Vote Against Greek Bailout Saying Athens “Not Serious At All”“What they are delivering at the moment is not serious at all.” That’s Michael Fuchs, a senior lawmaker for German Chancellor Angela Merkel’s Christian Democratic bloc and it seems to accurately reflect the sentiments of Greece’s creditors with regard to the latest set of “proposals” submitted by Athens. Indeed, some have suggested that Greek PM Alexis Tsipras’ latest ‘effort’ represents more a step back than a step forward. As a reminder, Greece handed in two three-page documents on Tuesday, one of which focused on fiscal targets and the other amounted to a request to tap the ESM in order to repay the ECB, which would amount to a similar (if not quite as egregious) circular funding scheme as that which the Greeks employed in May when they drew down their IMF SDR reserves to just €30 million in order to make a €750 million payment to the Fund. On Tuesday, reports indicated that a rift between Merkel and German FinMin Wolfgang Schaeuble was growing wider, with many German lawmakers inclined to side with Schaeuble should it come to a decision between supporting Merkel’s inclinations towards concessions or the finance ministry’s less accommodative stance that implicitly sanctions cutting the Greeks loose. Now, it would appear tensions are rising in Berlin with a growing number of German lawmakers committed to voting against a third bailout for Athens. Bloomberg has more:

|

| Frontrunning: June 10Pressing for Greek concessions, Merkel and Hollande keep Tsipras waiting (Reuters) Treasuries Extend Slump as Pimco Dumps Two-Thirds of Holdings (BBG) U.S. prepares plans for more troops, new base in Iraq: officials (Reuters) Texas policeman resigns after video shows him toppling teen (Reuters) Kuroda Says Hard to See Yen Dropping More, Spurring Surge (BBG) Tech Startups Woo Investors With Unconventional Financial Terms — but Do Numbers Add Up? (WSJ) Putin is a ‘bully’, U.S. needs to respond resolutely: Jeb Bush (Reuters) Target announces share buyback, dividend boost after disclosure snafu (Reuters) Gen X Was Right: Reality Really Does Bite ( |

| Exclusive: Facebook earns 51 percent of ad revenue overseas NEW YORK (Reuters) – Overseas markets bring in more advertising revenue than the United States for Facebook Inc, amounting to 51 percent of global ad sales in the first quarter, with growth in Asia the fastest in the world at 57 percent, company executives told Reuters. |

| Alibaba’s Ma, visiting New York, says not in America to compete NEW YORK (Reuters) – Chinese e-commerce titan Alibaba Group Holding Ltd does not want to fight for U.S. market share but instead hopes to help small U.S. businesses sell more goods in China, Executive Chairman Jack Ma said. |

| U.S. Shifts Stance on Drug Pricing in Pacific Trade Pact Talks, Document Reveals A newly leaked Trans-Pacific Trade Partnership annex dated December 2014 reveals the Obama administration is no longer demanding protection for pharmaceutical prices. |

| Tokio Marine to buy HCC Insurance for $7.5 billion TOKYO (Reuters) – Tokio Marine Holdings Inc said on Wednesday it had agreed to buy U.S. specialty insurer HCC Insurance Holdings Inc for $7.5 billion, in what would be the biggest M&A deal this year by a Japanese company. |

| Bond Rout Continues: Bunds Rise Above 1%; 30Y “Golden Crossed”; Kuroda Sends Yen SoaringAfter a Chinese session which following the MSCI failure to include Chinese stocks in its EM index, if only for the time being, was largely a dud with Shanghai stocks actually dropping by 0.1% after a late day selloff, eyes turned to Europe, which once again did not disappoint and where the bond rout continued apace, with the 10Y Bund yield spiking just after the European open, and rising above 1.05%, the widest level since September 19, before recouping some losses and trading just around 1.00% at last check.

The German bond move continues to reverberate in the US, where the 30 Year bond just experienced a yield “Golden Cross” after the 50-DMA touched 2.826%, exceeding the 200-DMA at 2.824%, for the first time since March 2014. Back then the 30Y yield was about 3.60% when its 50-DMA crossed below its 200-DMA in March 2014; it declined by more than 100bps from that level, reaching record low 2.219% on Jan. 30, 2015. Not helping matters was Pimco, which as reported last night on its website, slashed its US government-related debt holdings by two-thirds, from 23.4% to 8.5%. Cited by Bloomberg, Allan von Mehren, chief analyst at Danske Bank A/S in Copenhagen said that “we are seeing a bearish sentiment in the market and we are heading for higher yields as we approach the first” Federal Reserve interest-rate increase. “All of the fundamentals are pointing in a bearish direction for … |

| Tokio Marine of Japan Agrees to Acquire HCC Insurance for $7.5 Billion The deal would expand Tokio Marine’s business in the United States and broaden its specialty product lines. |

| Missing The Point — Austerity Was Not The Biggest Mistake In GreeceAs Greece teeters on the brink once again the back and forth between the two sides has become increasingly hostile, as has some of the commentary around the negotiations. Much of this has focused on ‘austerity’, which has now become a four letter word. But I believe that many people are missing the point. Austerity was not the biggest mistake in Greece – it was the lack of a proper debt restructuring (the context in which austerity was carried out). This has important implications for the path forward. |

| Tesla CFO Ahuja to retire; electric car maker sees growth spurt DETROIT (Reuters) – Tesla Motors Chief Financial Officer Deepak Ahuja will retire this year, but will stay on to help search for a successor at the fast-growing electric car maker, Chief Executive Officer Elon Musk told shareholders on Tuesday. |

| Bank of Japan’s Sato warns of diminishing returns from monetary easing program KOFU, Japan (Reuters) – Bank of Japan board member Takehiro Sato on Wednesday warned of diminishing returns and potential drawbacks of maintaining the bank’s massive stimulus program for too long, such as delaying government efforts to fix Japan’s tattered finances. |

| Diagnosis for America (Version 3)Written by Frank Li

|

| Disappearing Bakken oil discount adds to output slowdown signs NEW YORK (Reuters) – Oil traders scrambling to secure crude in the U.S. Midwest have pushed North Dakota’s Bakken to a near premium for the first time in two years, a rally stoked by record refinery runs and an unprecedented slump in Canadian imports. |

| Target announces share buyback, dividend boost after disclosure snafu (Reuters) – Target Corp said it would double its share buyback program to $10 billion and boost its quarterly dividend by 7.7 percent, confirming the contents of a statement it published inadvertently and took off its website earlier on Tuesday. |

| The PetroYuan Is Born: Gazprom Now Settling All Crude Sales To China In RenminbiTwo topics we’ve deemed critically important to a thorough understanding of both global finance and the shifting geopolitical landscape are the death of the petrodollar and the idea of yuan hegemony. Last November, in “How The Petrodollar Quietly Died And No One Noticed,” we said the following about the slow motion demise of the system that has served to perpetuate decades of dollar dominance:

|

| DoubleLine’s Gundlach sees odds of Fed hike by December under 50 percent NEW YORK (Reuters) – Jeffrey Gundlach, chief executive of investment firm DoubleLine Capital, said on Tuesday he still believes the U.S. Federal Reserve will probably not raise interest rates this year, in part because of a lack of wage inflation. |

Earnings Summary for Today

leading Stock Positions

Current Commodity Prices

Commodities are powered by Investing.com

Current Currency Crosses

The Forex Quotes are powered by Investing.com.

To contact me with questions, comments or constructive criticism is always encouraged and appreciated: