from the St Louis Fed

— this post authored by Ray Boshara

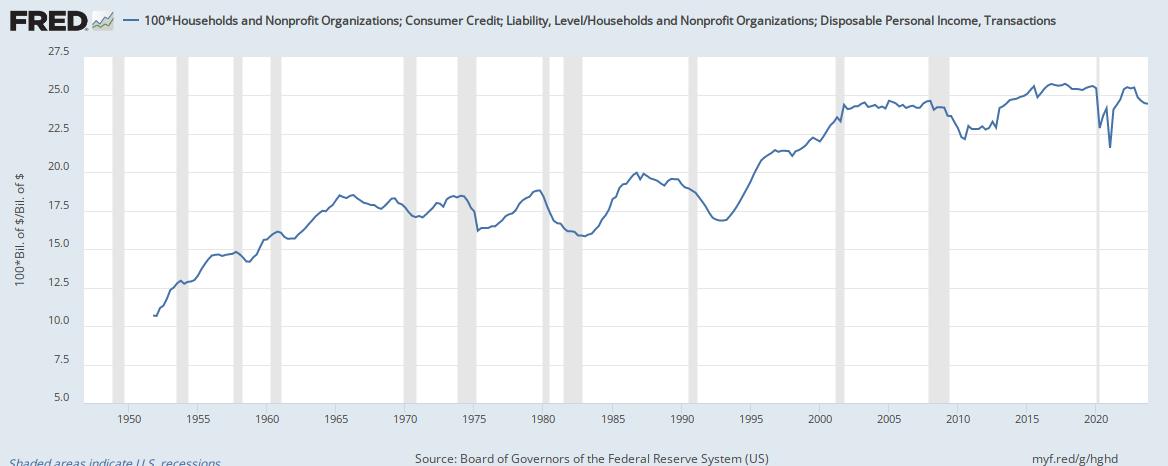

Amidst of lot of captivating headlines over the last few months, one may have missed the news that consumer debt has hit an all-time high of 26 percent of disposable income, as seen in the chart below.

In just the past five years, consumer debt (all household debts, excluding mortgages and home equity loans) has grown at about twice the pace of household income. This has largely been driven by strong growth in both auto and student lending.

But what does this say about the economy? Is it a sign of optimism or a cause for concern?

Increasing Debt Levels

Rising household debt levels could mean that:

- More Americans are optimistic about the U.S. economy.

- More people are making investments in assets that generally build wealth, like higher education and homes.

- Consumers have paid off their loans to qualify for new ones.

At the same time, higher debt levels could reveal financial stress as families use debt to finance consumption of necessities. It could portend new waves of delinquencies and, eventually, defaults that displace these kinds of investments. And rising family debts could slow economic growth and, of course, even lead to a recession.

Three Key Themes

This dual nature of household debt is precisely why the Center for Household Financial Stability organized our second Tipping Points research symposium on household debts. We did so this past June in New York, in partnership with the Private Debt Project

We recently released the symposium papers, which were authored by my colleagues William R. Emmons and Lowell R. Ricketts and several leading economists, such as Karen Dynan and Atif Mian. They offer fascinating insights about how, when and the extent to which household debt impacts economic growth.

Looking at all the papers and symposium discussions together, a few key themes emerged.

No. 1: Short-Term vs. Long-Term Debt

Despite an incomplete understanding of the drivers and mechanism of household debt, we learned that increases in household debts can boost consumption and GDP growth in the shorter term (within a year or two) but suppress them beyond that.

Whether and how household debt affects economic growth over the longer term depends on three things:

- Whether family debts improve labor productivity or boost local demand for goods and services

- The extent of leverage concurrently in the banking sector, which is much less evident today than a decade ago

- The stability of the assets, such as housing, being purchased with those debts

No. 2: Magnitude of Risk

Even with record-high levels of consumer debts, most symposium participants did not see household debts posing a systemic risk to the economy at the moment, though trends in student borrowing, auto loans and (perhaps) credit card debts are troubling to those borrowers and in those sectors.

Moreover, rising debt can be a drag on economic growth even if not a systemic risk, and longer-term reliance on debt to sustain consumption remains highly concerning as well.

No. 3: Public Policy

Public policy responses should also be considered. Factors that could further burden indebted families and impede economic growth include:

- Low productivity growth

- Higher interest rates

- New banking and financial sector regulations

- Rising higher-education costs

Indeed, levels of household debt have often served as a reflection of larger, structural, technological, demographic and policy forces that help or harm consumers. It only makes sense, then, that policy and institutional measures must be considered to ameliorate debt levels and their impact on families and the economy.

After all, what’s good for families is good for the economy, and vice versa.

Additional Resources

- Household Financial Stability: Tipping Points Research Symposia

- On the Economy: Are Consumers Finding it Harder to Repay Debt?

- On the Economy: To Borrow, or not to Borrow?

- In the Balance: Cash on Hand is Critical for Avoiding Hardship

Source

https://www.stlouisfed.org/on-the-economy/2017/december/consumer-debt-boon-bane

Disclaimer

Views expressed are not necessarily those of the Federal Reserve Bank of St. Louis or of the Federal Reserve System.