Written by Gary

Opening Market Commentary For 10-21-2014

Premarkets were up this morning 0.7% and rose to over one percent within a few minutes on moderate to heavy volume. No particular news, just euphoria from a lot of investors that believe the dip is over and the party has started once again.

By 10 am the US existing home sales came in higher at 2.4% beating the 1% expected and the averages continued climbing. We are definitely in an upswing but a lot of investors are not so sure it is going to continue.

Our medium term indicators are leaning towards sell portfolio of non-performers at the opening and the short-term market direction meter is bullish. We remain mostly, at best, negative and conservatively bullish. The important DMA’s, volume and a host of other studies have now turned and may be enough for some to start shorting. Right now now I am getting very concerned the current downtrend will get more aggressive in the short-term and volatility may promote sudden reversals. The SP500 MACD has turned up, but remains below zero at -24.02. I would advise caution in taking any position during this uncertain period and I hope you have returned your ‘dogs’ to the pound. Having some cash on hand now is not a bad strategy.

Investing.com members’ sentiments are 36 % Bearish (falling from 70%) and it seems to be a good sign for being bearish. The ‘Sheeples’ always seem to get it wrong.

Investors Intelligence sets the breath at 38.6 % bullish with the status at Bear Confirmed. (Chart Here ) I expect a market reversal at or before ~25.0.

StockChart.com NYSE Bullish Percent Index ($BPNYA) is at 40.52. (Chart Here) Below support zone but rising. Next stop was ~57, then ~44, below that is where we will most likely see the markets crash. We are seriously below 44 and need a reversal pronto as it looks like there is nothing to stop the fall until 25 and taking the markets with it.

StockChart.com S&P 500 Bullish Percent Index ($BPSPX) is at 43.00. (Chart Here) In support zone and rising. ~62, ~57, ~45 at which the markets are in a full-blown correction. The next stop now is ~37.00.

StockChart.com 10 Year Treasury Note Yield Index ($TNX) is at 22.18. (Chart Here) Treasury Yield Curve Approaches Flattest Since 2009.

StockChart.com Overbought / Oversold Index ($NYMO) is at +35.77. (Chart Here) But anything below -30 / -40 is a concern of going deeper. Oversold conditions on the NYSE McClellan Oscillator usually bounce back at anything over -50 and reverse after reaching +40 oversold. (Now were in good shape to descend again – watch out!)

StockChart.com Consumer Discretionary ETF (XLY) is at 65.54. (Chart Here)

Chris Ciovacco says, “As long as the consumer discretionary ETF (NYSEARCA:XLY) holds above [66.88], all things being equal, it is a good sign for stocks and the U.S. economy.” This chart clearly shows that dropping below 65.00 / 62.75 (and staying there) should be of a great concern to bullish investors.

This $NYA200R chart below is the percentage of stocks above the 200 DMA and is always a good statistic to follow. It can depict a trend of declining equities which is always troubling, especially when it drops below 60% – 55%. Dropping below 40%-35% signals serious continuing weakness and falling averages.

Today it represents the lowest levels seen since the beginning of the October, 2011 rally. Eric Parnell says, ‘ If nothing else, given that relatively fewer stocks are trading above their 200-day moving average at a time when the market is just off of its all-time highs suggests that an increasingly narrowing group of stocks is driving the rally at this stage, which does not bode well for the future sustainability of the uptrend.” It also strongly suggests there has been a ‘stealth bear market’ underway in recent months.

StockChart.com NYSE % of stocks above 200 DMA Index ($NYA200R) is at 38.55 %. (Chart Here) The downside decent has reversed, but will it continue to rise? The next support is ~37.00, ~25.00 and ~15.00 below that. December, 2012 was the last time we saw numbers this low.

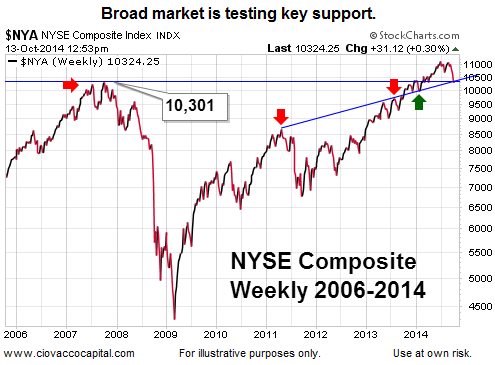

The Most Important Chart On Wall Street (NYA)

The arrows in the chart below show levels that have acted as support and resistance since 2006. The two blue lines intersect near 10,301. As long as 10,301 holds, the odds of a rally taking place will be higher. If 10,301 fails to attract support from buyers, then the bullish push higher in early 2014 could be classified as a “failed breakout”, which would increase the odds of bad things happening in the weeks ahead.

StockChart.com NYSE Composite (Liquidity) Index ($NYA) is at 10416. (Chart Here) Next stop is 9750, then 9250, and 8500.

Eric Parnell, in his timely article below points out the obvious and we may very well see the starting of it right now.

The Slow And Perilous Death Of Bull Markets

Summary

A primary worry among many stock investors today is that the long running bull market may soon come to an end.

At the heart of their concern is the worry that the subsequent decline into the next bear market could quickly become swift and severe.

History has shown that the transition from a bull market to a bear market is a process filled with rallies and correction that plays out over an extended period of time.

Bull markets die long slow deaths, and it is this prolonged dying process that causes so many investors to find themselves unwittingly trapped in the next bear market.

A primary worry among many stock investors today is that the long running bull market may soon come to an end. At the heart of their concern is exactly what lies beyond the bull market peak, as many worry that the subsequent decline into the next bear market could quickly become swift and severe.

But history has shown that the transition from a bull market to a bear market is often a gradual and drawn out process filled with rallies and correction that plays out over an extended period of time. In short, bull markets die long slow deaths, and it is this prolonged dying process that causes so many investors to find themselves unwittingly trapped in the next bear market long before they even realize it.

It is still possible that Mr. Market is not through playing with the averages and even newer historical highs are a distinct possibility. Historically, accordingly to Eric Parnell, “major bull markets have almost never reached their final peak in a sideways grinding pattern. Instead, they have almost always peaked with flourish including one final crescendo toward a new all-time high before finally rolling over and succumbing to the forces of the new bear market”.

The longer 6 month outlook is now 30–70 sell (probably should be 20-80 sell) and will remain bearish until we can see what the effects are in the Fed’s game plan. Sooner or later brighter skies will return over the market. Until then, investors should employ the first thing one learns while in a foxhole; keep their head down.

The DOW at 10:15 is at 16467 up 67 or 0.41%.

The SP500 is at 1923 up 19 or 1.01%.

SPY is at 192.25 up 2 or 1.02%.

The $RUT is at 1105 up 10 or 0.96%.

NASDAQ is at 4371 up 56 or 1.29%.

NASDAQ 100 is at 3922 up 52 or 1.35%.

How the Popular ‘VIX’ Gauge Works

$VIX ‘Fear Index’ is at 16.87 down 1.70 or -9.21%. Bullish Movement

(Follow Real Time Market Averages at end of this article)

The longer trend is up, the past months trend is down, the past 5 sessions have been up and the current bias is positive.

Saudi Arabia has reportedly been telling oil-market investors and analysts that it is ready to accept oil prices below $90 per barrel, and even as low as $80, for up to a year or two. If true, it would represent a major change in policy for Riyadh, which may be looking to slow the expansion of rivals such as the U.S.

WTI oil is trading between 83.24 (resistance) and 81.76 (support) today. The session bias is positive and is currently trading down at 82.65. (Chart Here)

Brent Crude is trading between 86.47 (resistance) and 85.20 (support) today. The session bias is neutral, volatile and is currently trading down at 85.78. (Chart Here)

Monday, October 20, 2014 For those traders who really take a long view of market trends, looking at the monthly continuation chart for Gold futures, we notice that the bull market that began back in 2001 when Gold prices were… Read More…

– and –

The general consensus is that gold prices will actually fall in the next twelve months (Sept to Aug. 2015). Goldman Sachs estimates that gold will fall to $1,050 an ounce, a drop of nearly 19%.

Gold rose from 1246.05 earlier to 1255.57 and is currently trading up at 1252.80. The current intra-session trend is trending higher and volatile. (Chart Here)

Currency Corruption Weighs on Copper

Dr. Copper is at 3.026 rising from 2.974 earlier. (Chart Here)

The US dollar is trading between 85.41 and 84.79 and is currently trading down at 85.35, the bias is currently positive and volatile. (Chart Here) Resistance made in Aug., 2013 (~85.00) has been broken and now is support. (Which has been tested and failed 2 times.)

The markets are still susceptible to climbing on ‘Bernankellen’ vapor, use caution!

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation inequities, they should try to be fearful when others are greedy and greedy only when others are fearful.” – Warren Buffett

If you would like to get advanced buy/sell tweets, sign-up in the column to the right of this post by clicking on the ‘Follow‘ button. Write me with suggestions and I promise not to bite.

Real Time Market Numbers

To contact me with questions, comments or constructive criticism is always encouraged and appreciated:

Written by Gary