by Seth Mason, ECOMINOES.com

Here’s some compelling evidence that the Federal Reserve–one of the primary culprits of the collapse of the economy–is looking out for Wall Street investors rather than the Main Street economy: the S&P and GDP expectations have been inversely proportional since the Fed announced “Operation Twist” (a bond buying scheme) in October, 2011.

As you can clearly see on this chart from Bloomberg (and labeled by Zero Hedge), Operation Twist has greatly benefited those whose incomes are strongly tied to the market. But, for the tens of millions of middle class Americans who were unfortunate enough to lose their financial standing during Fed’s Great Recession, economic prospects aren’t looking so good. (Article continues after chart.)

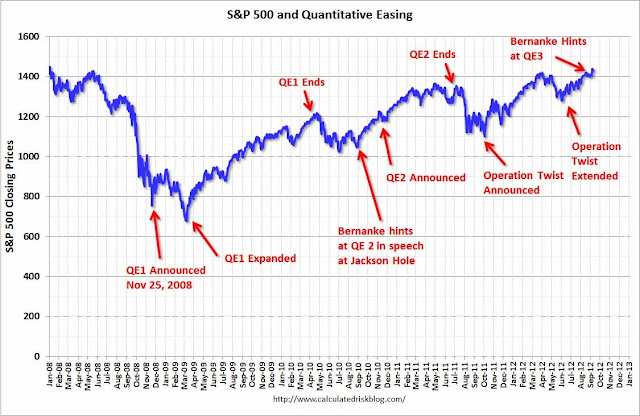

See, the Fed didn’t create its money printing and interest rate crushing schemes to benefit the Main Street economy. No, it created them to keep Wall Street fat cats happy. Whatever residual “wealth effect” the middle class has experienced from the stock market’s artificial “boom” is merely icing on the cake for the Fed. Need more evidence? Look how the Fed’s liquidity pumping has affected the stock market throughout this economic depression. (Article continues after chart.)

Every time the Fed has “made a move”, the market has risen. Every time one of the Fed’s liquidity pumping schemes has ended, the market has declined. And, recall that the Fed’s monkeying will result in significant inflation. The Fed clearly favors Wall Street over you and me. And it’ll continue to inflate bubbles until 2008 2.0, just a couple of years away by my watch.

You think the Yellin Fed is going to be different? Not!